Pound Sterling Price News and Forecast: GBP/USD retreats from the daily highs

GBP/USD Price Analysis: Retreats from the daily highs, steadily around 1.2080

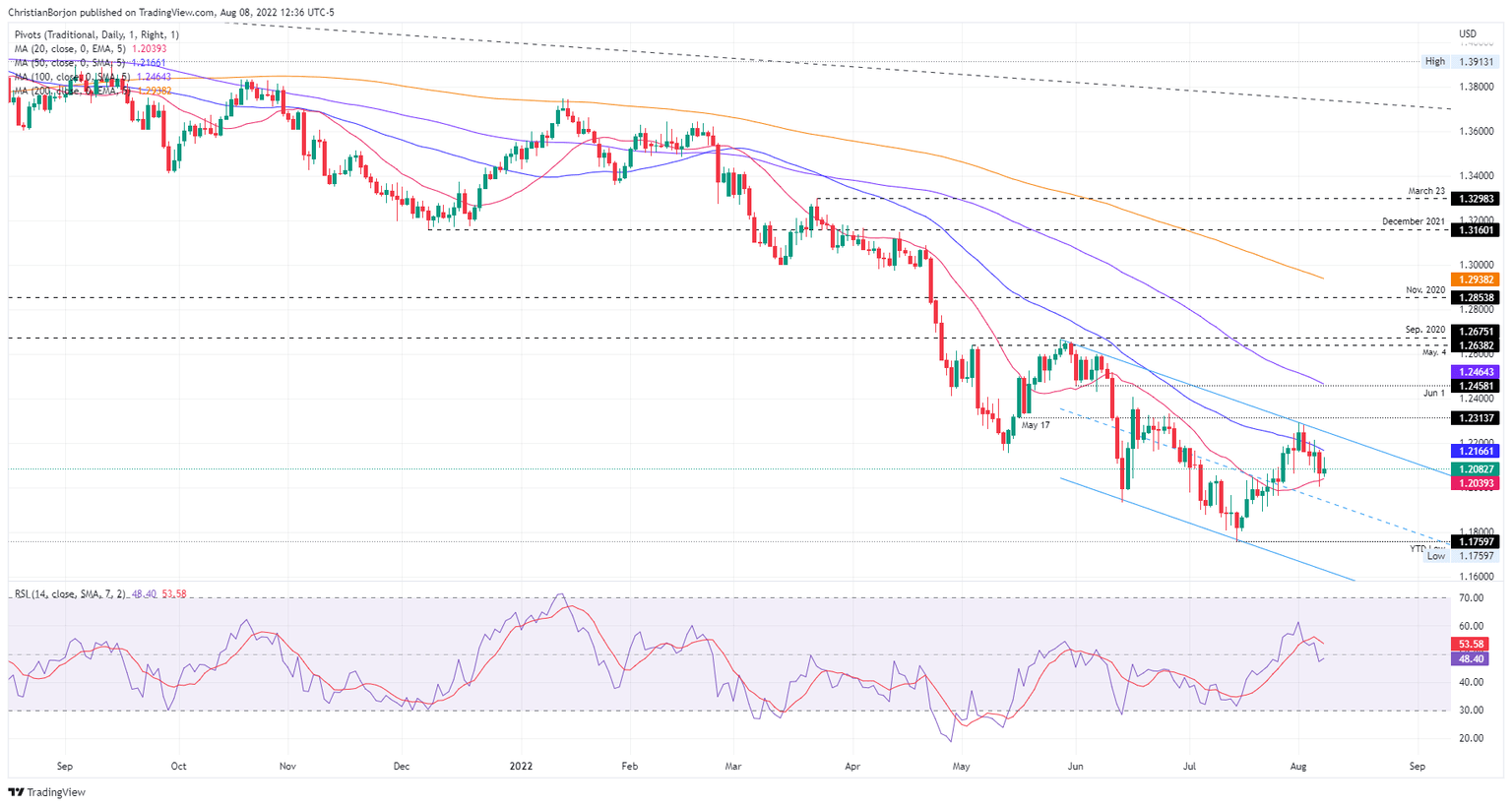

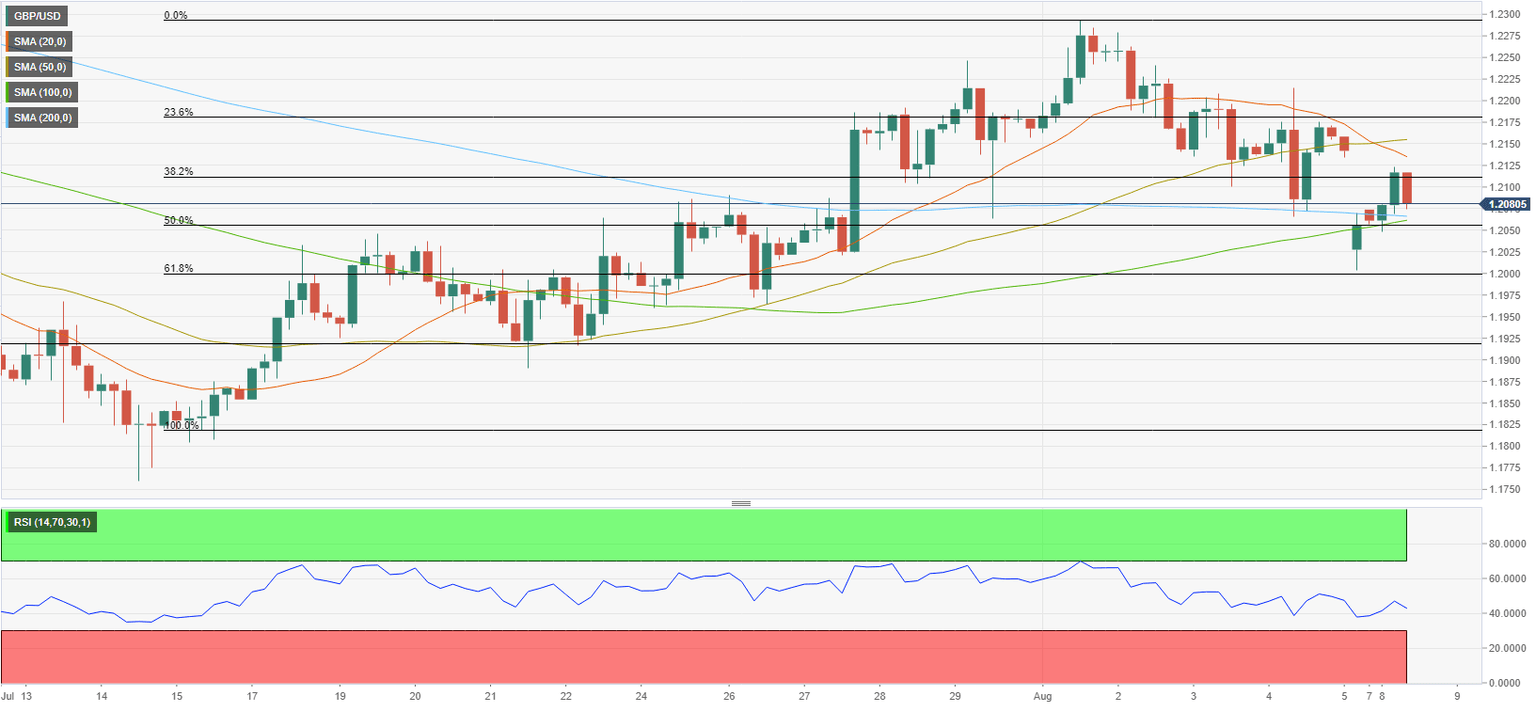

The GBP/USD records minimal gains after hitting a daily high at 1.2137, shy of the 50-day EMA at 1.2166, which has proven to be solid resistance in the last four days. However, the British pound retreated under 1.2100 but remained above the opening price, recording gains of 0.12%. At the time of writing, the GBP/USD is trading at 1.2081. Read more...

GBP/USD Forecast: Bears to take action with a drop below 1.2050

GBP/USD has lost its recovery momentum after having climbed above 1.2100 earlier in the day. The pair faces significant support at 1.2050 and sellers are likely to dominate the pricing action if that level fails. The upbeat July jobs report from the US allowed hawkish Fed bets to return and triggered a dollar rally ahead of the weekend. Nonfarm Payrolls in the US rose by 528,000, surpassing the market expectation of 250,000, and the Unemployment Rate edged lower to 3.5% from 3.6%. According to the CME Group FedWatch Tool, markets are now pricing in a nearly 70% probability of a 75 basis points rate increase in September. Read more...

GBP/USD surrenders modest intraday gains, flat-lining below 1.2100 mark

The GBP/USD pair struggles to preserve its modest intraday gains and retreats nearly 50 pips from the intraday peak touched during the early European session. The pair is currently trading just a few pips above the daily low, around the 1.2075-1.2070 region. The Bank of England offered a bleak outlook last week, which continues to act as a headwind for the British pound and turns out to be a key factor capping the GBP/USD. In fact, the UK central bank warned that a prolonged UK recession would start in the fourth quarter and indicated that the monetary policy is not on a pre-set path. This, in turn, suggests that the BoE is more likely to slow down the pace of its tightening cycle. Read more...

Author

FXStreet Team

FXStreet