GBP/USD Forecast: Bears to take action with a drop below 1.2050

- GBP/USD has failed to reclaim 1.2100 following the earlier recovery attempt.

- The pair could face further bearish pressure if 1.2050 support fails.

- The positive shift witnessed in risk sentiment helps the pound limit its losses.

GBP/USD has lost its recovery momentum after having climbed above 1.2100 earlier in the day. The pair faces significant support at 1.2050 and sellers are likely to dominate the pricing action if that level fails.

The upbeat July jobs report from the US allowed hawkish Fed bets to return and triggered a dollar rally ahead of the weekend. Nonfarm Payrolls in the US rose by 528,000, surpassing the market expectation of 250,000, and the Unemployment Rate edged lower to 3.5% from 3.6%. According to the CME Group FedWatch Tool, markets are now pricing in a nearly 70% probability of a 75 basis points rate increase in September.

During an appearance before the Kansas Bankers Association on Saturday, Fed Governor Michelle Bowman said that she strongly supports "super-sized" rate hikes to fight inflation.

The hawkish tilt in the Fed's rate outlook and the Bank of England's (BOE) gloomy outlook suggests that the policy gap could continue to widen and allow investors to continue to favour the dollar over the British pound.

There won't be any high-tier macroeconomic data releases on Monday and the risk perception could impact the pair's action in the short term. The UK's FTSE 100 Index is rising nearly 0.5% at the beginning of the week and US stock index futures are up between 0.2% and 0.45% during the European trading hours. In case the market environment remains risk-positive in the second half of the day, GBP/USD's downside could remain limited. Nevertheless, market participants are unlikely to bet on a steady rebound in the pair ahead of the highly-anticipated US inflation report on Wednesday.

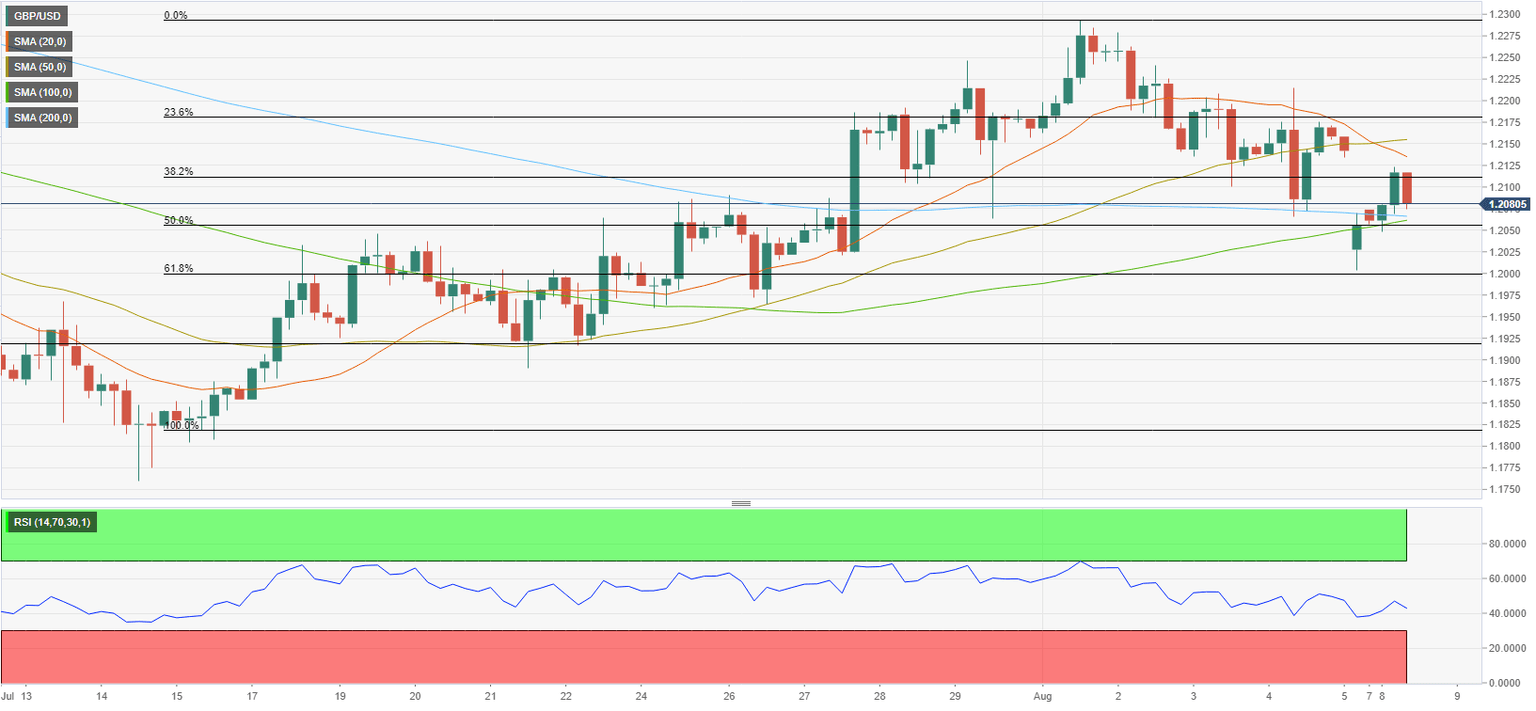

GBP/USD Technical Analysis

The Fibonacci 50% retracement level of the latest uptrend forms significant support at 1.2050. The 200-period and the 100-period SMAs on the four-hour chart reinforce that level as well. In case sellers drag the pair below that level, additional losses toward 1.2000 (psychological level, Fibonacci 50% retracement) and 1.1920 (static level) could be witnessed.

On the other hand, 1.2100 (psychological level, Fibonacci 38.2% retracement) aligns as significant resistance. If the pair starts using that level as support, technical recovery could stretch higher toward 1.2150 (50-period SMA) and 1.2175 (Fibonacci 23.6% retracement).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.