Pound Sterling Price News and Forecast: GBP/USD renews intraday high during three-day rebound from monthly low

GBP/USD: Cable buyers approach 1.2400 as upbeat sentiment weighs on US Dollar, UK inflation woes amplify

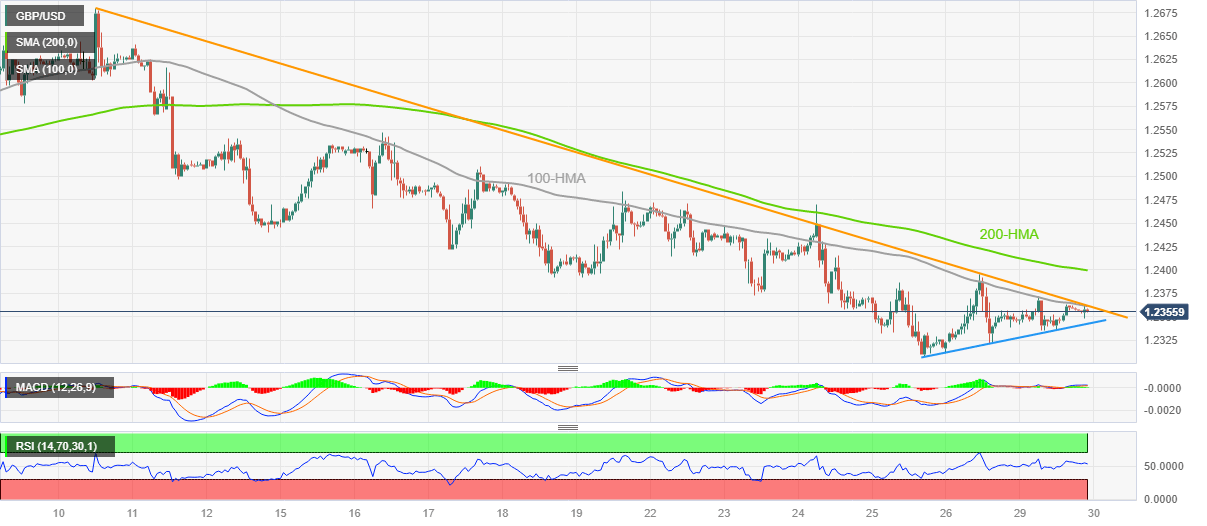

GBP/USD prints a three-day uptrend as bulls approach the 1.2400 resistance confluence during very early Tuesday morning in Europe, refreshing intraday high to around 1.2370 by the press time.

In doing so, the Cable pair not only cheers the US Dollar’s pullback amid the risk-on mood but also benefits from the hawkish hopes surrounding the Bank of England (BoE). It’s worth noting that the Pound Sterling pair dropped to the lowest levels in early April in the last week. Read more...

GBP/USD Price Analysis: Cable prods 1.2360 immediate hurdle in search of further recovery

GBP/USD grinds higher past 1.2350, making rounds to 1.2360 amid early Tuesday in Asia, as it struggles to extend the previous two-day rebound from the lowest levels since April.

In doing so, the Cable pair pokes a convergence of the 100-Hour Moving Average (HMA) and a falling trend line from May 10. Read more...

Author

FXStreet Team

FXStreet