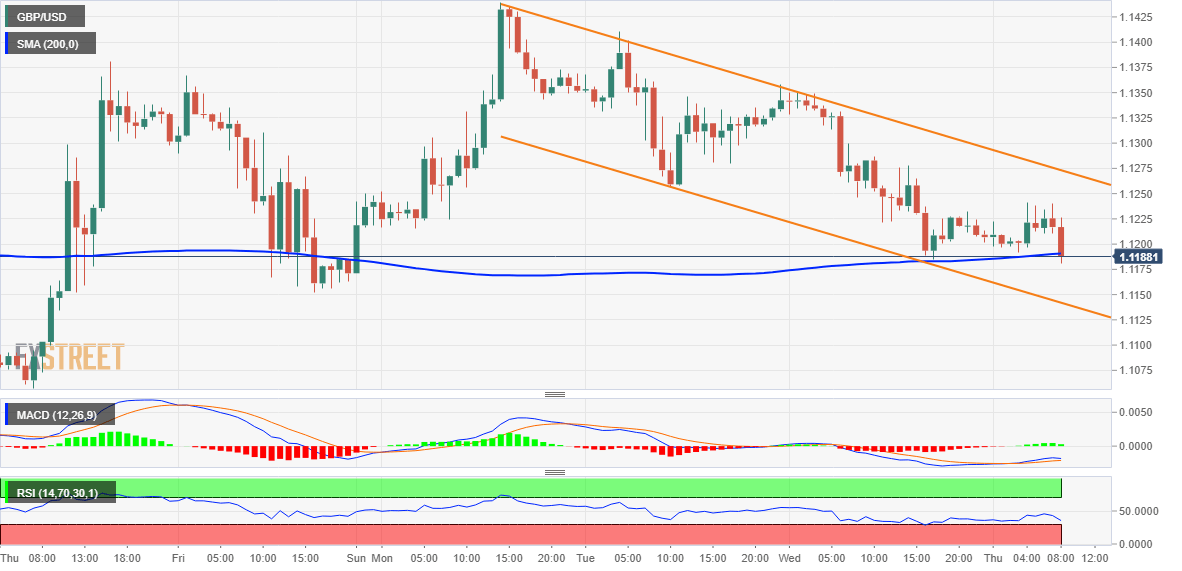

Pound Sterling Price News and Forecast: GBP/USD rejected at 1.1330 as Truss’s withdrawal enthusiasm ebbs

GBP/USD rejected at 1.1330 retreats to 1.1220 as Truss’s withdrawal enthusiasm ebbs

The pound has given away most of the ground taken after the announcement of Prime Minister Truss's resignation and remains practically unchanged on the daily chart. The pair rallied to session highs at 1.1330 with the market celebrating the departure of Truss’s controversial government, to lose steam shortly afterward and return to the lower ranges of 1.1200. Read more...

GBP/USD higher as Prime Minister Liz Truss resigns, USD/JPY climbs to highest level since 1990 [Video]

British Prime Minister Liz Truss was forced to resign on Thursday, as pressure on her rose, following a failed mini-budget. Today’s news follows on from Home Secretary Suella Braverman leaving her post on Wednesday, which many see as the nail on the PM’s coffin. She becomes the UK’s shortest serving PM. GBPUSD hit a high of $1.133 on the news. Read more...

GBP/USD Outlook: Bears look to seize control below 1.1200 amid UK political crisis

The GBP/USD pair remains depressed for the third straight day on Thursday and drops to the lower end of its weekly trading range despite a modest US dollar downtick. That said, the UK political crisis acts as a headwind for the British pound and keeps spot prices below mid-1.1200s through the first half of the European session. After being forced to resign, UK Home Secretary Suella Braverman launched a stinging attack on Prime Minister Liz Truss. Moreover, reports indicate that lawmakers will try to oust the recently-elected British Prime Minister in the wake of the recent tax cut fiasco. Read more...

Author

FXStreet Team

FXStreet