Pound Sterling Price News and Forecast: GBP/USD moves higher in Asia in a risk-on setting

GBP/USD bulls move in and look towards 1.2320

GBP/USD is bid in Asia printing fresh corrective highs to 1.2317 and up 0.2% at the time of writing. Investors sought clarity on the fallout from the recent collapse of two US lenders and the rescue of Credit Suisse while central bank sentiment simmers on the backburners.

The dollar index, DXY, which measures the currency against six rivals, was lower on the day and is extending the offer in Asia on Tuesday near the 7-week low of 101.91 touched on Thursday. Last week, the US Federal Reserve raised interest rates by 25 basis points, as expected, but took a cautious stance on the outlook because of the banking sector crisis. Markets are now pricing in around a 55% chance of the Fed standing pat on interest rates in its next meeting in May and anticipate a pivot as early as July. Read more...

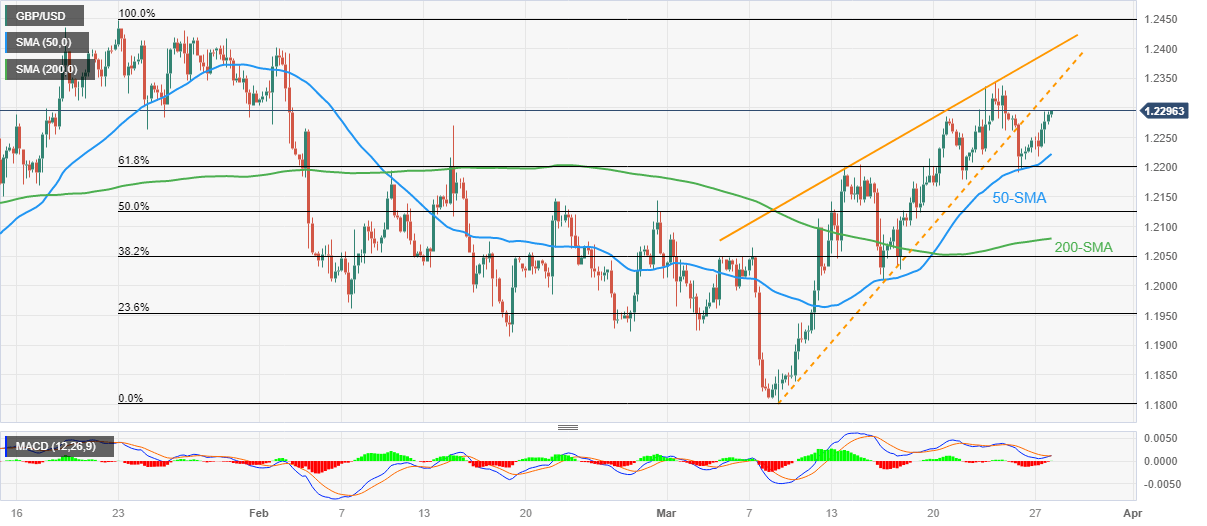

GBP/USD Price Analysis: Extends bounce off 50-SMA towards 1.2330 support-turned-resistance

GBP/USD remains on the front foot as bulls attack the 1.2300 mark during Tuesday’s Asian session, following an upbeat start of the week.

In doing so, the Cable pair stretches the previous run-up from the 50-bar Simple Moving Average (SMA) and the 61.8% Fibonacci retracement level of the quote’s January-March downside. Adding strength to the upside bias could be the impending bulls cross on the MACD. Read more..

Author

FXStreet Team

FXStreet