Pound Sterling Price News and Forecast: GBP/USD may target the immediate resistance at the five-month high

GBP/USD Price Forecast: Holds position above 1.3000 near five-month highs

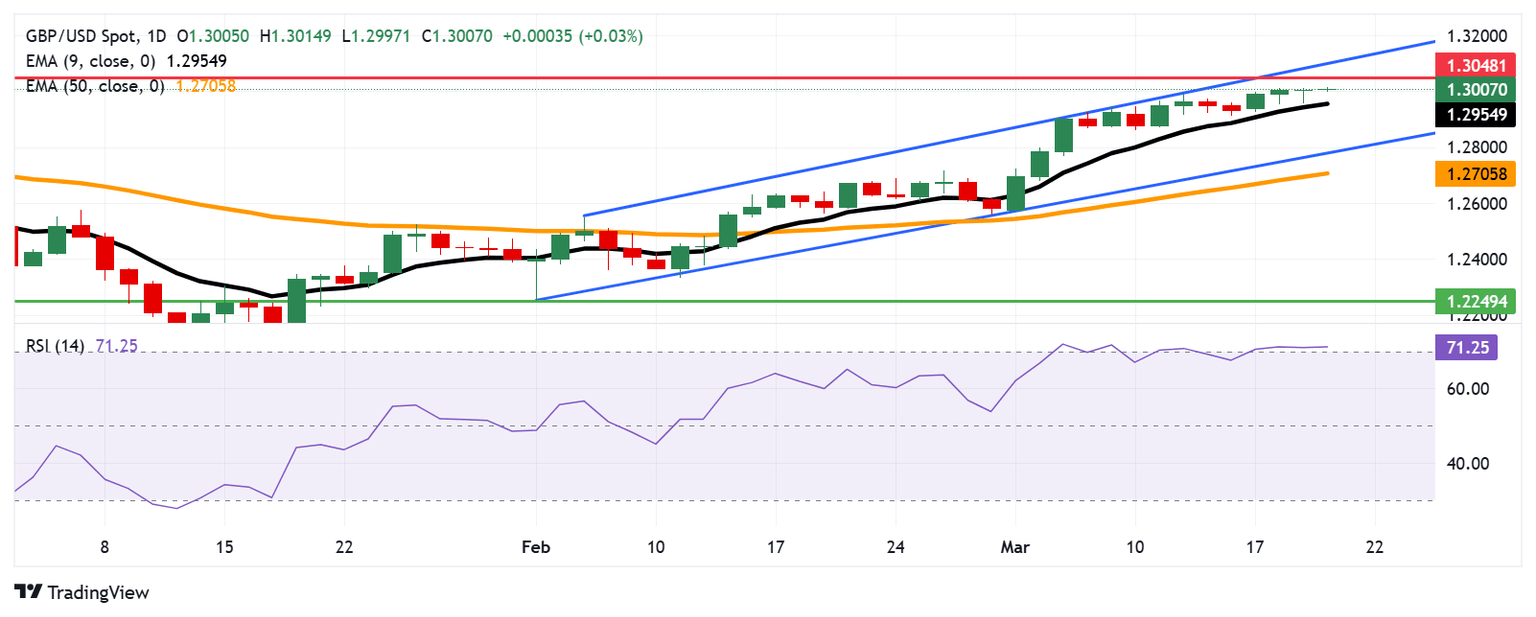

The GBP/USD pair remains in positive territory for the fourth successive session, trading around 1.3010 during the Asian hours on Thursday. Technical analysis of the daily chart indicates a continued bullish bias, with the pair moving upwards within an ascending channel pattern.

The 14-day Relative Strength Index (RSI) is slightly above 70, signaling strong bullish momentum but also suggesting that the GBP/USD pair is overbought, potentially leading to a downward correction. Read more...

GBP/USD remains attached to 1.3000 after Fed rate hold

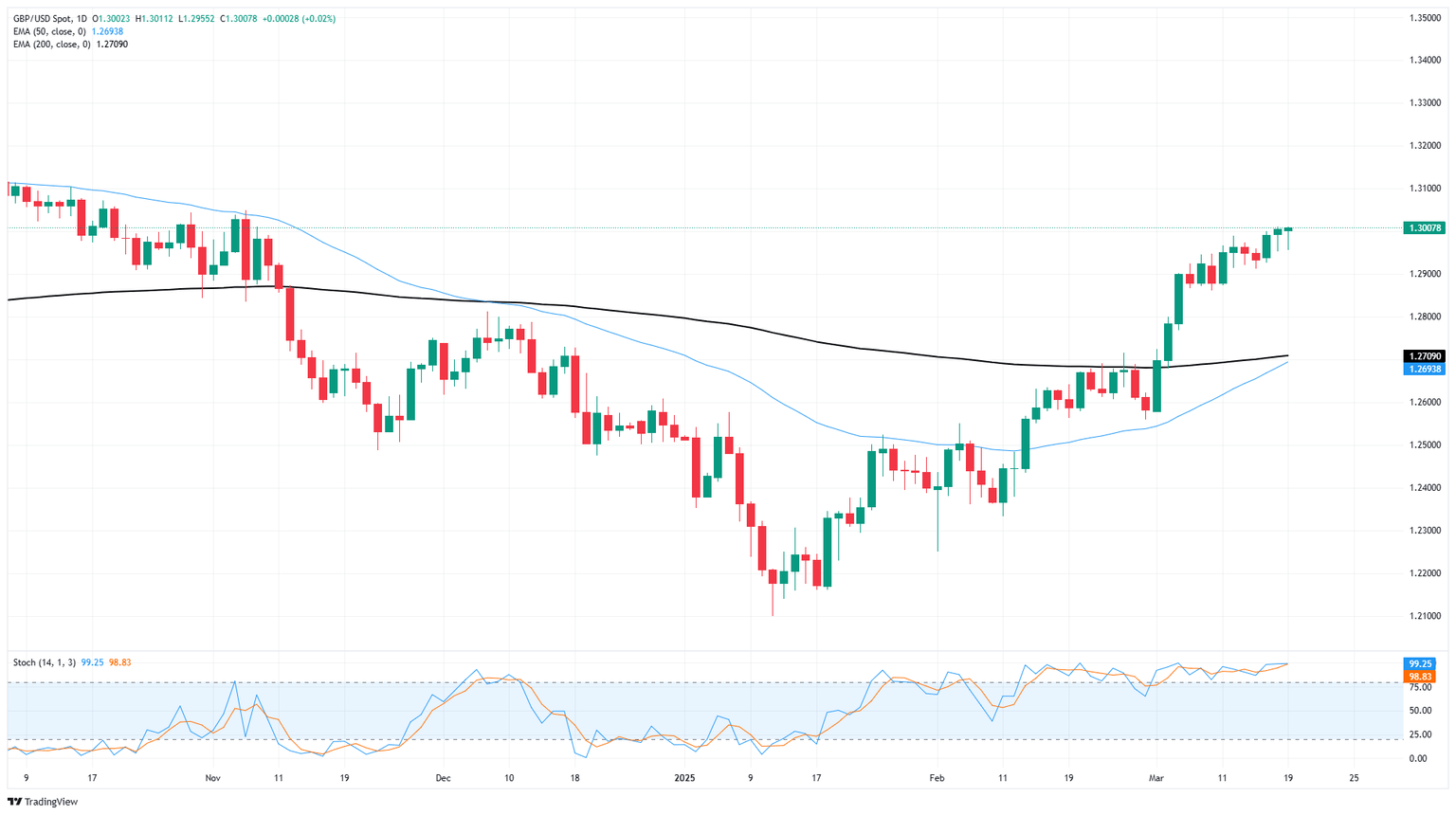

GBP/USD remained pinned to recent highs near the 1.3000 handle on Wednesday, with market sentiment bolstered into the high side after the Federal Reserve (Fed) held steady on its plans to deliver more rate cuts in 2025, albeit later in the year. Rate markets are still pricing in another quarter-point cut from the Fed at the US central bank’s June meeting, and Fed Chair Jerome Powell reiterated that the Fed still strong growth and a healthy labor market underpinning the US economy.

However, not all is rosy in the Fed’s outlook: Fed policymakers have trimmed their growth outlook for the year, with US Gross Domestic Product (GDP) growth to slow to just 1.7% through 2025, several points below December’s forecast of 2.1%. Fed Chair Powell also nodded a head at downside risks at the hands of the Trump administration’s trade policies, however the Fed thus far continues to bet that inflationary effects from global tariff-fueled trade wars will be mild and temporary. Read more...

Author

FXStreet Team

FXStreet