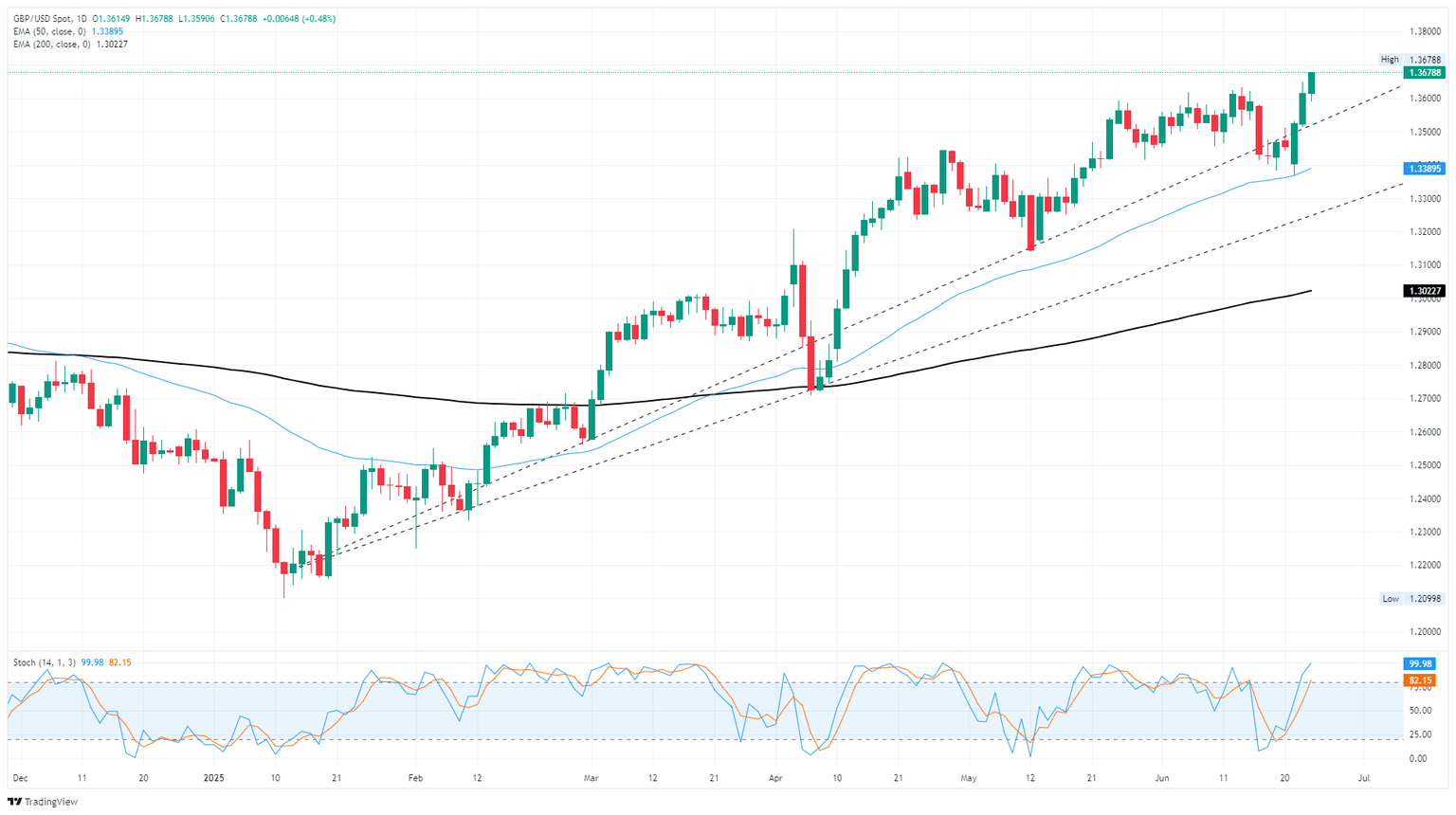

Pound Sterling Price News and Forecast: GBP/USD has reached 1.3724, a fresh high since January 2022

GBP/USD moves above 1.3700, marks fresh multi-year highs

GBP/USD extends its winning streak for the fourth successive session, trading around 1.3710 during the Asian hours on Thursday. The pair has marked 1.3724, a fresh high since January 2022, which was recorded on Thursday. The risk-sensitive GBP/USD pair receives support from the improved risk appetite, driven by a fragile US-brokered Israel-Iran ceasefire.

US President Donald Trump noted that the United States (US) and Iran would hold a meeting next week but questioned the need for a diplomatic solution on Iran's nuclear program, citing the damage that American bombing had done to key sites, per Bloomberg. Read more...

GBP/USD extends rally, clips fresh multi-year highs

GBP/USD gained more ground as the US Dollar waffles across the board, extending into a third straight day of firm gains and clipping its highest bids in four and a half years. Several central bank policymakers from both the Bank of England (BoE) and the Federal Reserve (Fed) made appearances through the first half of the week, and the trend is expected to continue through the remainder of it.

Fed Chair Jerome Powell wrapped up his two-day stretch of testimony before congressional and Senate financial committees on Wednesday, sticking close to the familiar Fed script and reiterating multiple times the Fed’s wait-and-see stance. The Fed has laid the broad unease about economic conditions at the Trump administration’s feet, and is avoiding making any adjustments to interest rates until the full effects of Donald Trump’s whiplash tariff strategy can be observed. Read more...

GBP/USD holds above 1.3600 as ceasefire lifts mood, BoE turns dovish

The Pound Sterling (GBP) extends its gains to three straight days during the week, amid an upbeat market mood triggered by the ceasefire of the Israel-Iran conflict. Nevertheless, the truce remains fragile after both parties exchanged blows close to or after the deadline proposed by Washington. GBP/USD trades above 1.3600 after falling below it earlier, up 0.05%.

Wednesday marks the second and latest appearance of Fed Chair Jerome Powell's semi-annual testimony at the US Congress. He is expected to deliver the same message of a wait-and-see mode at the central bank, as they assess the possible impact of tariffs on inflation. He stated that tariffs one-impact on inflation, but he wants to approach it carefully when inflation is not back at 2%. Read more...

Author

FXStreet Team

FXStreet