Pound Sterling Price News and Forecast: GBP/USD gains for the first time in four weeks

GBP/USD bulls step in on US dollar weakness and eye 1.2500

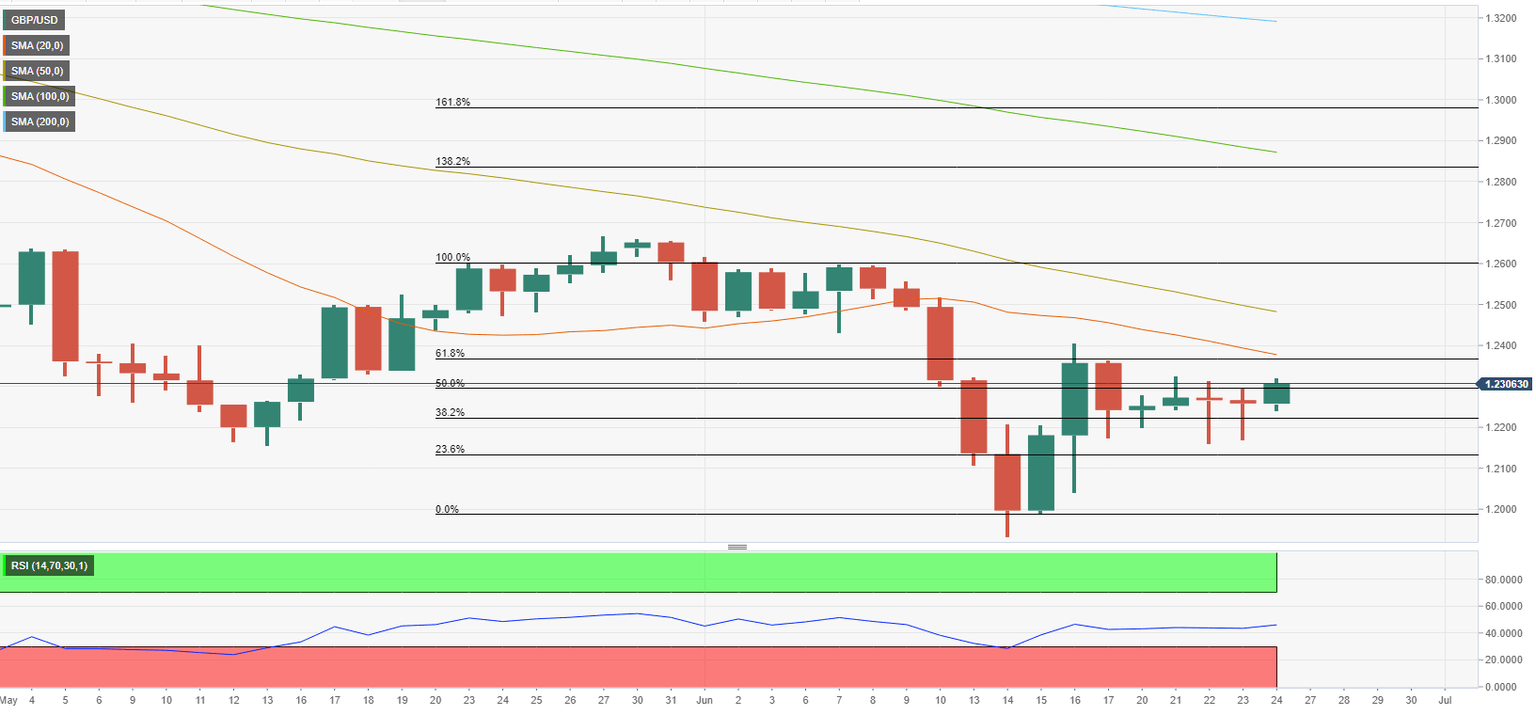

Where there is a price imbalance, PI, on a 4-hour perspective on the way there that guards an order block, OB, above it. At 1.2292, GBP/USD is up 0.16% as the US dollar falls away below a key structure on the DXY chart. The US dollar is extending the downside after it slipped on Friday and posted its first weekly decline this month.

GBP/USD Weekly Forecast: Sellers remain hopeful whilst below key Fibo level

GBP/USD snapped a three-week downtrend and staged a decent comeback despite a variety of mixed fundamental factors from the UK. A pullback in the US dollar from two-decade highs kept cable afloat, although within a familiar 200-pip trading range. Persistent inflation and recession worries kept investors on edge.

Author

FXStreet Team

FXStreet