Pound Sterling Price News and Forecast: GBP/USD chalked in a third straight gain, recovering 1.3500

GBP/USD extends soft bullish march ahead of looming US inflation data

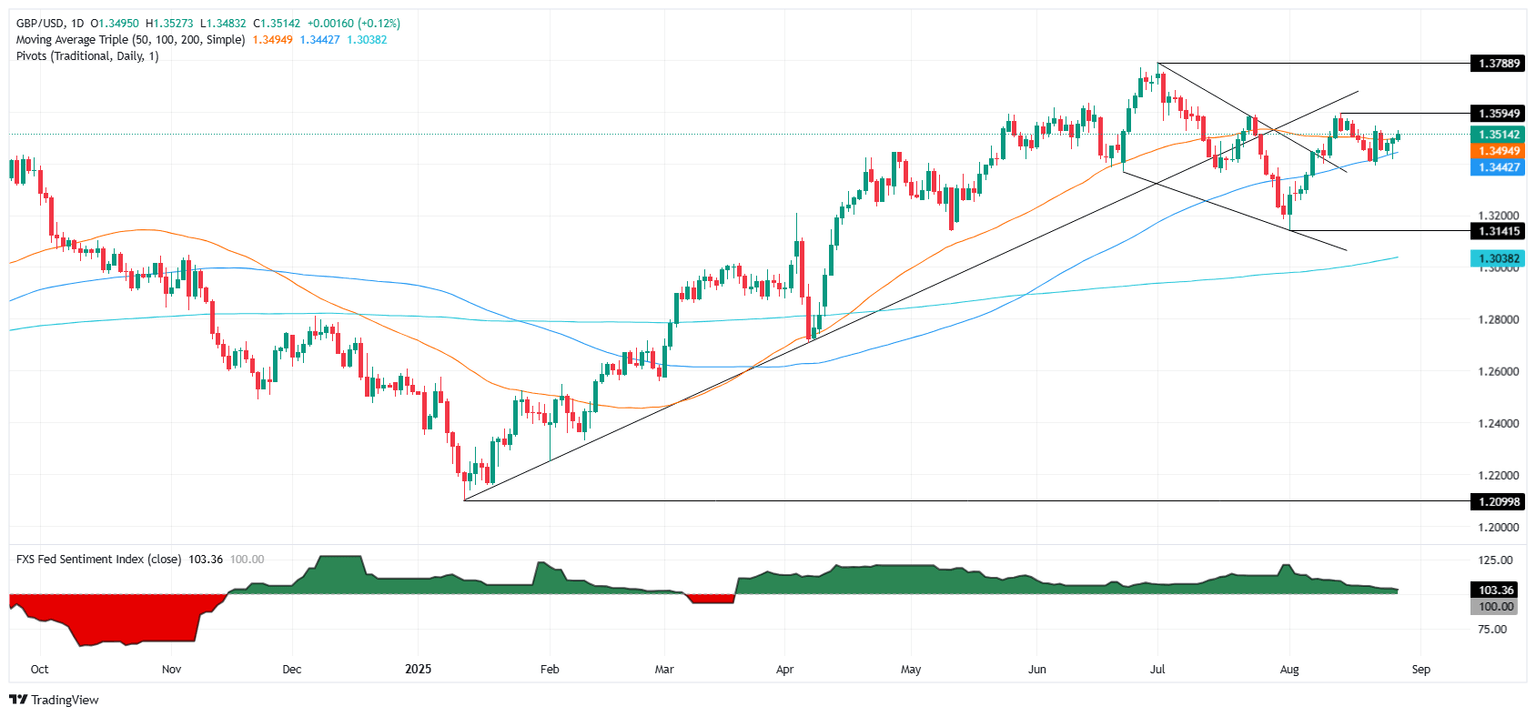

GBP/USD marched its way into a third consecutive bullish session on Thursday, climbing back over the 1.3500 handle and paring away most of the early-week losses from Monday’s half-percent decline. Cable remains firmly entrenched in recent consolidation, but markets are positioning themselves for an upside reaction after Friday’s upcoming US Personal Consumption Expenditures Price Index (PCE) inflation print.

GBP/USD is tilting into the bullish side after skidding across the 50-day Exponential Moving Average (EMA) near 1.3455 over the past couple of weeks. Cable still remains over 2% down from multi-year highs posted in July, but has climbed 2.8% from four-month lows near 1.3140. Read more...

GBP/USD climbs above 1.3500 as solid US data caps US Dollar

GBP/USD rises during the North American session after economic data released in the United States (US) showed that the economy remains solid, suggesting it may not warrant an interest rate cut. At the time of writing, the pair trades at 1.3524, up 0.19%. The US Dollar has failed to gain traction, despite Gross Domestic Product (GDP) figures for Q2 exceeding estimates for 3.1% growth, which came in at 3.3% in the second estimate. In Q1, the economy contracted by 0.5%, according to the US Bureau of Economic Analysis.

The figures indicate that the economy is expected to grow at a moderate pace as businesses and households adjust to the current administration's trade policies. At the same time, US Initial Jobless Claims for the week ending August 23 rose by 229K, below forecasts of 230K and the previous week 234K. Following the downward revision of Nonfarm Payroll figures at the beginning of the month, the statistics showed that the economy added 35K jobs per month during the last three months, compared to 123K in 2024 for the same period. Read more...

Author

FXStreet Team

FXStreet