Pound Sterling Price News and Forecast: GBP/USD buyers hesitate after modest recovery

GBP/USD Forecast: Pound Sterling buyers hesitate after modest recovery

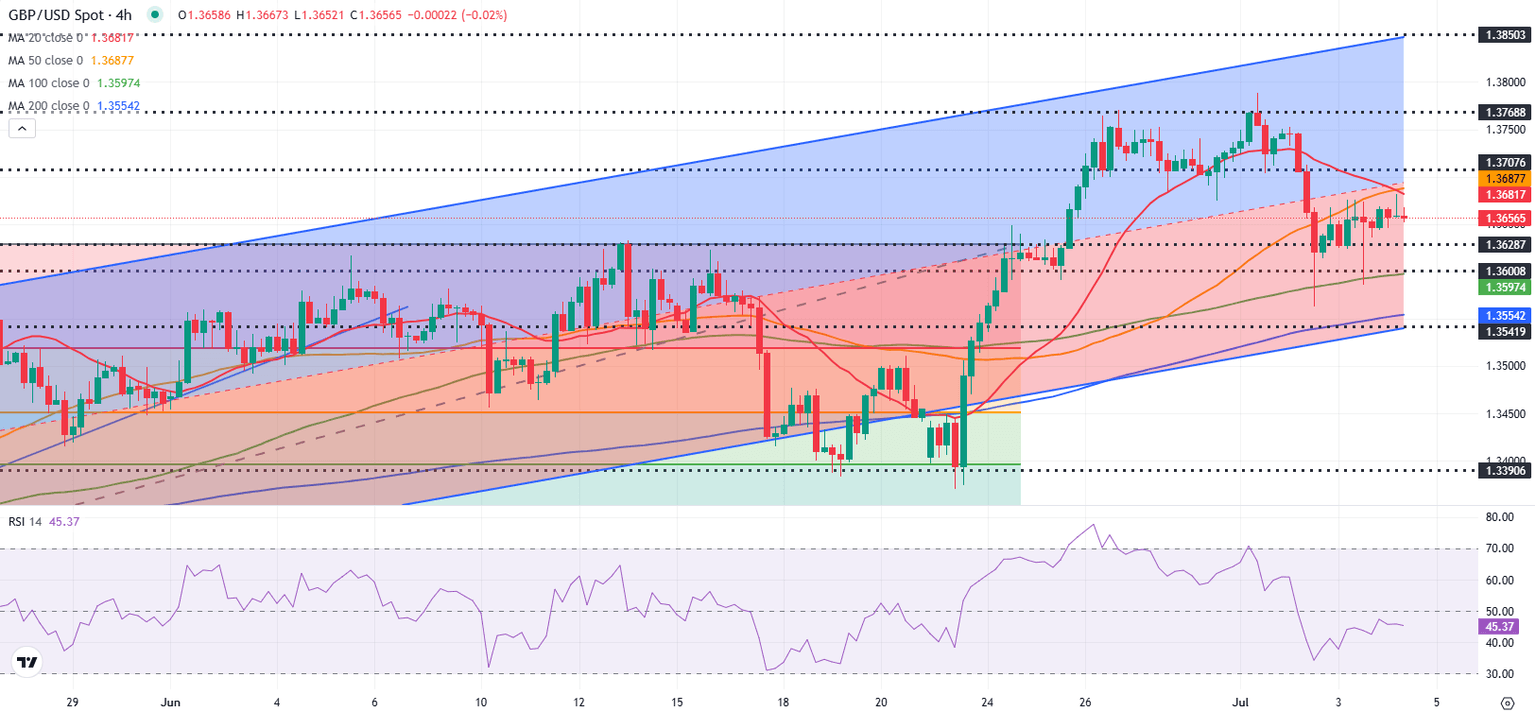

Following the sharp decline seen on Wednesday, GBP/USD found support on Thursday and closed the day marginally higher. The pair, however, struggles to extend its rebound and trades in a narrow band at around 1.3650 in the European session on Friday.

Easing geopolitical concerns in the UK helped Pound Sterling hold its ground early Thursday after British Prime Minister Keir Starmer reassured that finance minister Rachel Reeves will remain in her position. Read more...

British Pound retreats after recent rally

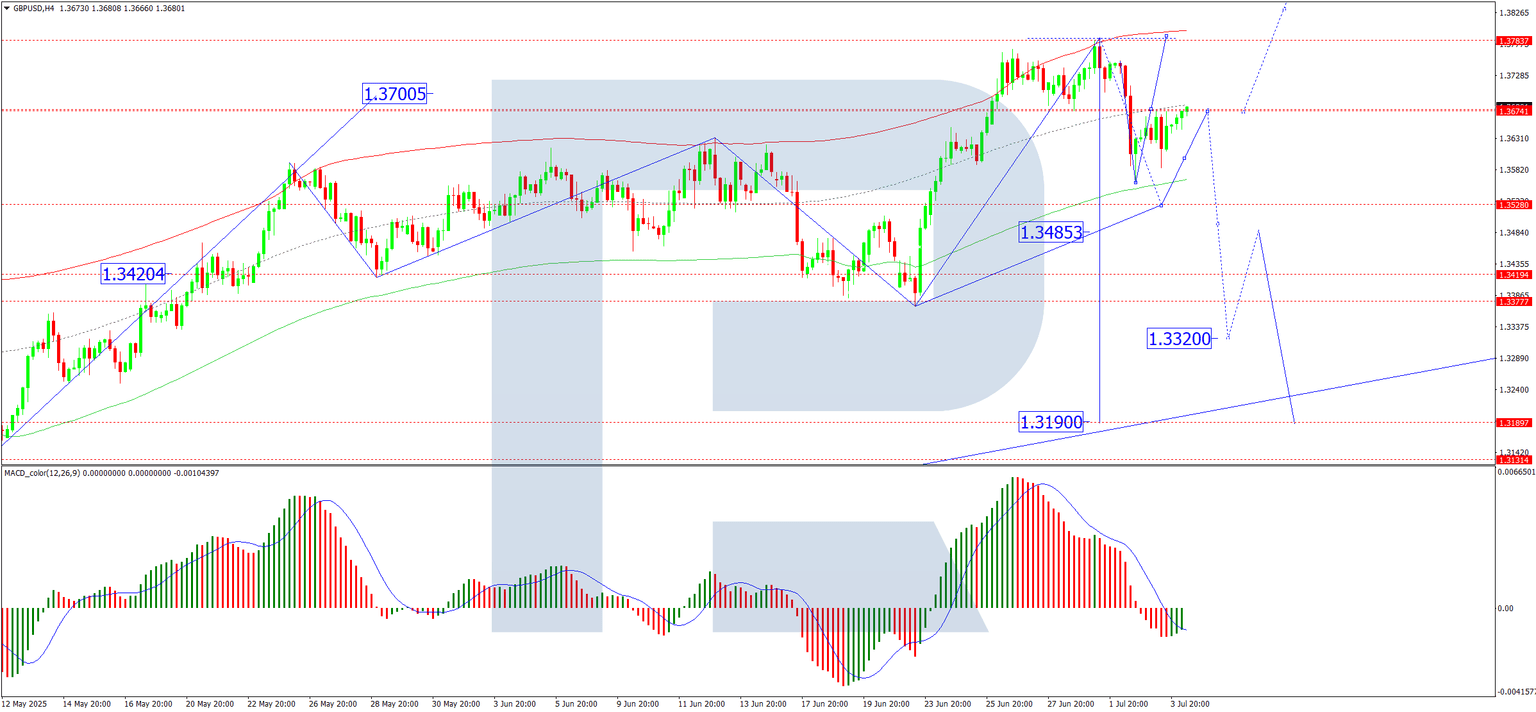

The GBP/USD pair is undergoing a correction, moving towards 1.3377 on Friday, marking its lowest level since 23 June this year. The pound came under renewed pressure after the release of a strong US employment report, which boosted demand for the US dollar.

Earlier in the session, the pound received support from Prime Minister Keir Starmer’s announcement confirming that Chancellor Rachel Reeves would remain in office for the foreseeable future. This eased fears of changes to economic policy and reduced concerns about increased fiscal stimulus through further borrowing. Read more...

Author

FXStreet Team

FXStreet