Pound Sterling Price News and Forecast: GBP/USD approaches key resistance [Video]

![Pound Sterling Price News and Forecast: GBP/USD approaches key resistance [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/iStock-900067218_XtraLarge.jpg)

GBP/USD Forecast: Pound Sterling approaches key resistance

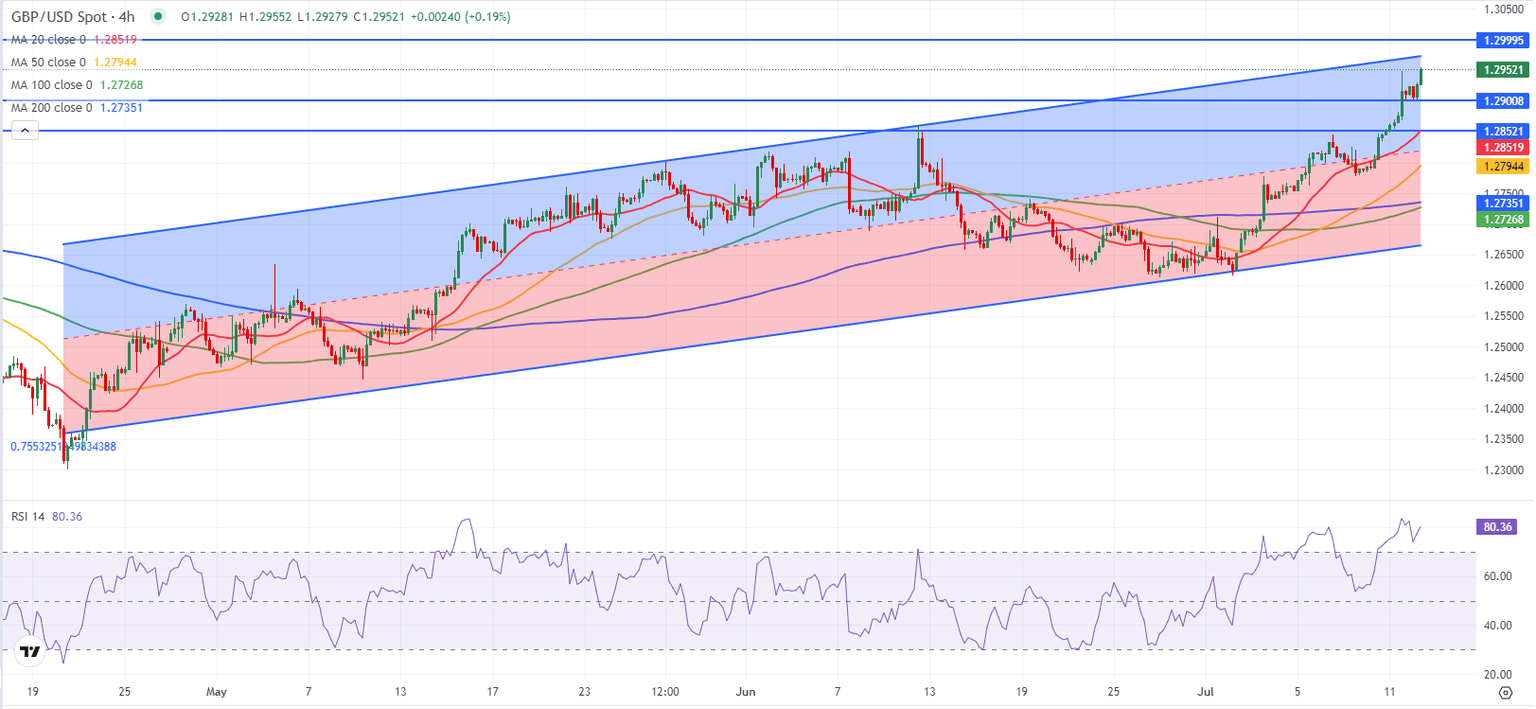

After closing the day decisively higher on Thursday, GBP/USD continued to edge higher and touched its strongest level in nearly a year, a few pips above 1.2950. The near-term technical outlook shows that the pair remains overbought.

The broad-based selling pressure surrounding the US Dollar (USD) fuelled GBP/USD's rally during the American trading hours on Thursday. The US Bureau of Labor Statistics (BLS) reported that annual inflation in the US, as measured by the change in the Consumer Price Index (CPI), softened to 3% on a yearly basis in June from 3.3% in May. This reading came in below the market expectation of 3.1%. Additionally, the CPI declined 0.1% on a monthly basis. Read more...

GBP/USD Elliott Wave technical analysis [Video]

The GBPUSD Elliott Wave Analysis on the day chart focuses on an impulsive trend movement, indicating a strong market direction with significant momentum. The current wave structure under analysis is Navy Blue Wave 3, positioned within Gray Wave 3. This means the market is in the third wave of a larger third wave sequence, suggesting a powerful trend continuation.

The direction of the next higher degrees continues within Navy Blue Wave 3, indicating that the strong trend movement is expected to persist. This phase shows that Navy Blue Wave 2 is considered complete, meaning the market has finished its corrective phase and is now fully engaged in Navy Blue Wave 3. Read more...

Author

FXStreet Team

FXStreet