Pound Sterling Price News and Forecast: GBP gains against its peers, except antipodeans

Pound Sterling gains against USD despite US-Japan trade agreement confirmation

The Pound Sterling (GBP) gains against its peers, except antipodeans, on Wednesday. The British currency attracts bids even as United Kingdom (UK) fiscal risks have resurfaced, following the government borrowings report from the Office for National Statistics (ONS) on Tuesday.

The report showed that the administration raised the second-highest amount of funds since 1993 in order to mitigate the increase in debt costs, which accelerated due to higher inflation. Mounting UK borrowings pave the way for tax increases by the administration in its upcoming Autumn Statement. Read more...

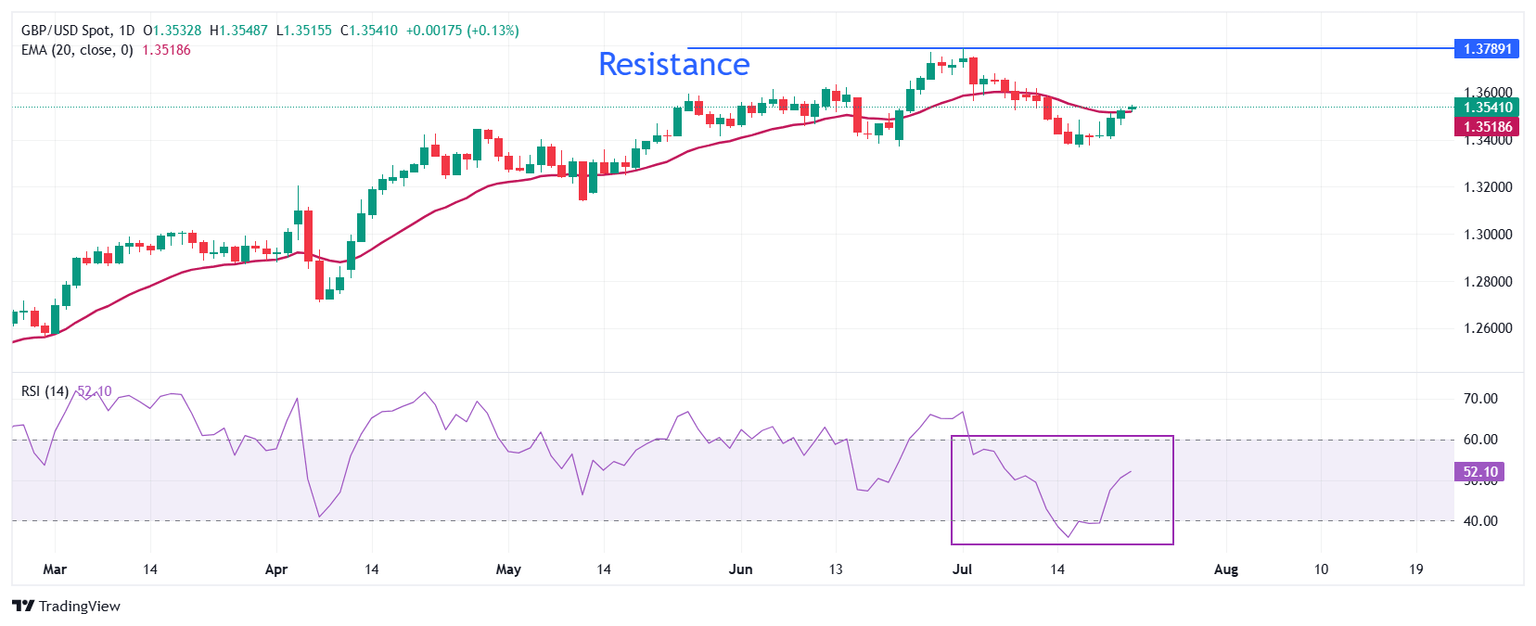

GBP/USD Forecast: Pound Sterling looks to stretch higher on improving risk mood

GBP/USD stays in a consolidation phase above 1.3500 after posting gains on Monday and Tuesday. The improving risk sentiment and the technical outlook suggests that the pair could stretch higher in the near term.

The US Dollar (USD) remained under selling pressure on Tuesday and allowed GBP/USD to build on Monday's gains. The uncertainty regarding the United States' trade relations with major partners and the deepening feud between US President Donald Trump and Federal Reserve (Fed) Chairman Jerome Powell made it difficult for the USD to find demand. Read more...

Author

FXStreet Team

FXStreet