Polestar Stock News and Forecast: PSNY falls on big loss

- PSNY stock slumps as financial data is released.

- Investors appear concerned over growing loss.

- Delivery estimates are reconfirmed for 2022.

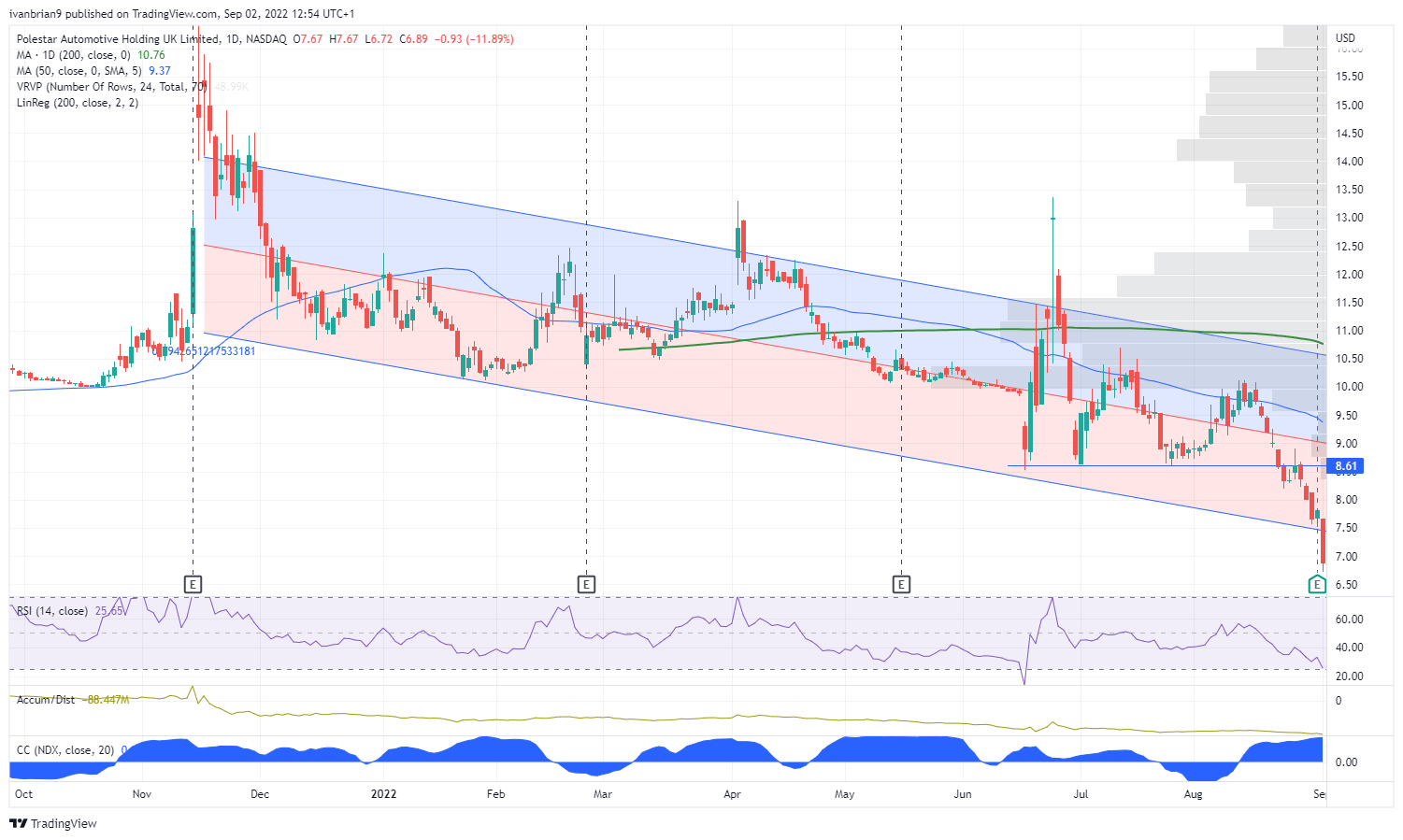

Polestar (PSNY) stock fell sharply on Thursday as the company released financial results for the first half of the year. PSNY closed nearly 12% lower at $6.89, so it seems fair to assume the results were not well-received.

PSNY stock news

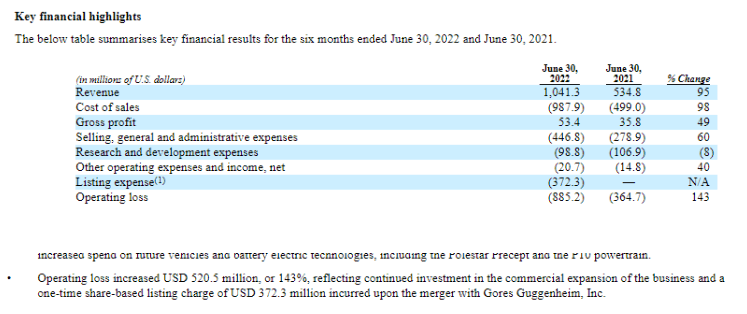

Investors took a dim view of the growing losses at the electric vehicle (EV) startup. Losses increased from $520 million to nearly $900 million as the company completed its merger from GGPI to PSNY. That meant it incurred some one-off charges such as a listing cost of over $300 million. Taking that out would see the loss closer to $500 million, still growing but at least not as alarming. We did note that margins have declined, which is no surprise in the current environment. The other worrying sign was the rise in SGA (selling & general administrative costs). The company said this increase in SGA is due to rapid expansion.

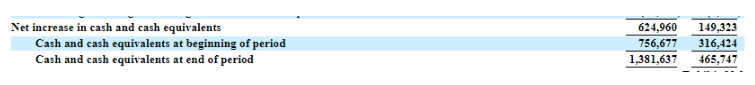

On the flip side, the cash balance is significant as it increased by about $600 million, so this should offset concerns over the increased losses to some extent. The bottom line is that these were not great results, but some can be explained by the one-offs. The margins falling is a worry, but at least guidance was reassured for 50,000 cars this year.

On that point of guidance, we note the tweet below saying the former concept car that Polestar decided to put into production has already sold out if this tweet is accurate.

Polestar 6 sells out in one week with $200k price tag https://t.co/9FlblikVBF by @WilliamWritin

— TESLARATI (@Teslarati) September 1, 2022

Admittedly, it was only 500 orders, and as far as we are aware it is not payment up front!

Polestar stock forecast

The sell-off on Thursday is interesting as startup EVs burn a lot of cash. I have spoken before about how Polestar can piggyback on Volvo and Geely's manufacturing abilities and so should not need as much capital as other EV makers. Already this week we see Lucid (LCID) filing for a potential future offering.

This is one to keep watching. It is a very early stage, but for me this would be a potential long-term play. Right now with such potential, it makes it more susceptible to further falls in the current high-yield environment. Note this move has taken it out of the linear regression channel, meaning it is a statistically unusual move and liable to revert. Amending the look-back period to include the spikes still shows this move to be oversold. It may make for an interesting scalp, but again we need to get over today's employment report first.

Polestar stock daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.