PLTR News: Palantir Technologies trades lower despite strong support from Guardian Fund

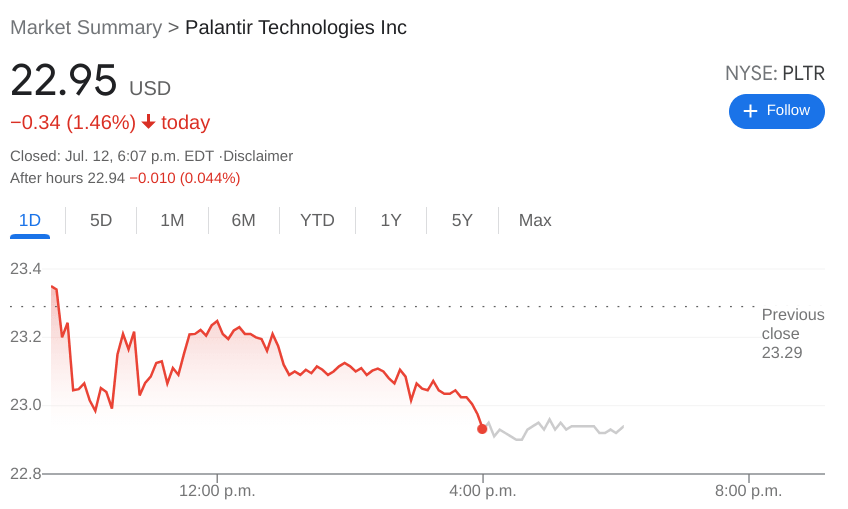

- NYSE:PLTR fell by 1.46% on Monday, as growth stocks struggled to gain any traction.

- Guardian Fund releases its Q2 investor letter with kind words for Palantir’s business.

- Palantir finds itself trading right at its median analyst price target for the year.

/stock-market-graph-gm532464153-55981218_XtraLarge.jpg)

NYSE:PLTR is still having a hard time shaking off the bears, as the stock continues to trade mostly sideways over the past few weeks. On Monday, Palantir fell by 1.46% to start the week, and closed the trading day at $22.95. Shares of Palantir remain trading below both the 50-day and 200-day moving averages, which is usually indicative of a downward trend for the stock. Nervous or impatient shareholders can confirm this downtrend, as Palantir dropped by 16% over the first two weeks of July in what has been a rocky start to the third quarter of 2021.

Stay up to speed with hot stocks' news!

Guardian Fund, an investment management firm based in the Netherlands, released its Q2 investor letter on Monday and the group was very high on Palantir as an investment moving forward. Guardian Fund points out that Palantir’s positioning as a platform that services both the private and public sectors will serve it well in the long-run. The firm also pointed out that Palantir has become a significant investor in startup companies, and compared it to other brands like Tencent (TCEHY), Alphabet (NASDAQ:GOOGL), and Shopify (NYSE:SHOP).

PLTR stock forecast

At the close of trading on Monday, Palantir finds itself slightly below the median analyst price target for the stock this year. Does this mean Palantir may continue to trade at these levels? Not exactly. Analyst price targets should just be taken as one person or firm’s opinion on the stock, and is mostly based on previous performance of both the individual stock and sector. Price targets range from as low as $17 to as high as $30, so where Palantir’s stock goes from here is anyone’s guess.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet