PayPal (PYPL Stock) after joining the world of cryptocurrency

Q4 Earnings Report

PayPal, one of the biggest winners of the epidemic, has shown more than 140% growth from last January’s price level. It is due to publish its revenue report for the fiscal quarter ending January 2021 on Wednesday, February 3 2021.

This is the first quarterly report since it was announced that their platform will also host virtual currencies, so many investors and traders are eager to see the impact on the company’s revenue and prospects.

According to data from 12 analysts at Zacks Investment Research, the EPS (earnings per share) forecast for the quarter is $0.74. The reported EPS for the same quarter last year was $0.67, while Seeking Alpha forecasts $1.00 for EPS and $6.09bln for total revenue.

The PayPal report is one of the easiest reports to analyze. There is a small amount of key data such as the number of active accounts, transactions paid, total value of payments and payment transactions per account, which were $361 million, $4.0 billion, $247 billion and $40.1 respectively in the last quarter, as reported on investor.pypl.com, generating $1.07 per share for investors and $5.46 billion in total corporate revenue.

In the forthcoming report, the Zacks consensus estimate is $373 million for active customer accounts, $41.3 million for paid transactions and $4.5 billion for total transactions. (Zacks.com). Now, according to the company’s latest update, in addition to these numbers, what we need to focus on is the company’s vision for the crypto market: what they actually intend to do, when they plan to launch it Worldwide, not just for the United States, but also what currencies they want to have on their list.

Technical review:

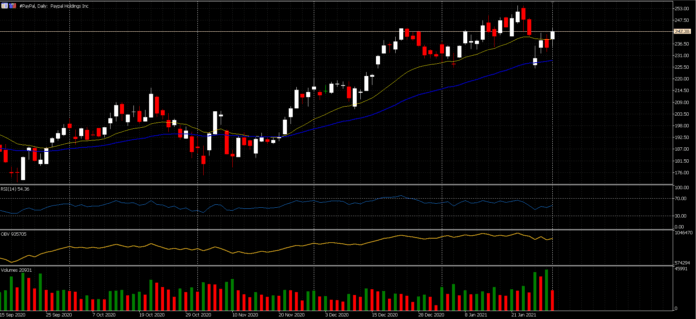

On the daily chart, the high price of both the 20- and 50-day main lines is trading average, however the OBV trend line has been flat since last week and is below 20 DMA, as well as the RSI at 54, which can technically be a warning signal of a decline in the strength of the current uptrend. Below this level and in case of negative reports, 50 DMA at $229 and then 100 DMA at $215 are the main support levels, while a positive report will help maintain the growing trend as optimism about the cryptocurrency market also increases.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.