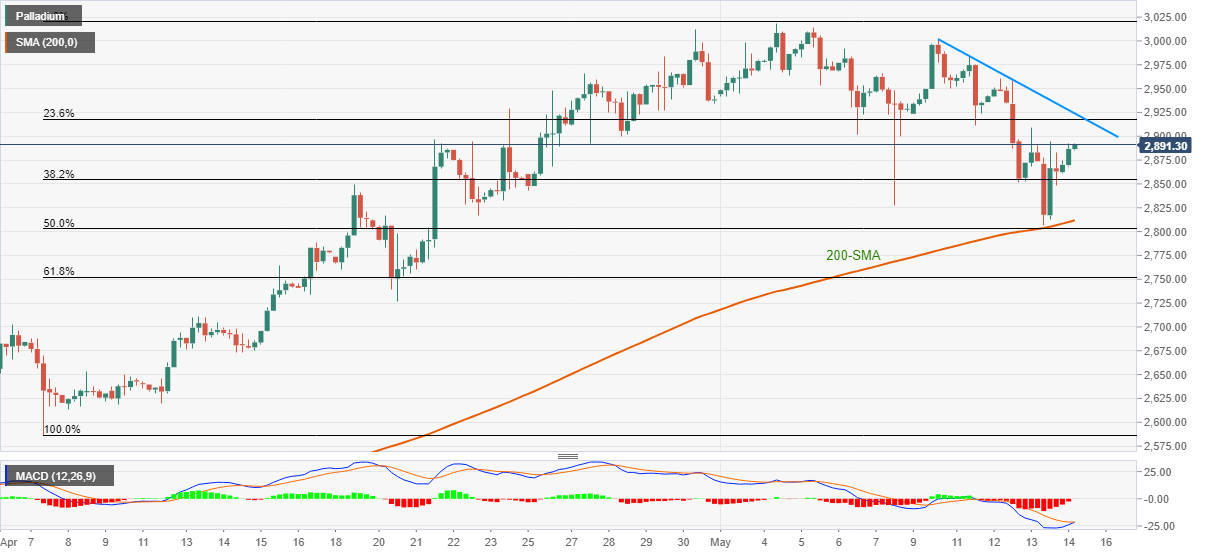

Palladium Price Analysis: XPD/USD bounces off 200-SMA towards $2,900

- Palladium holds onto previous day’s recovery moves from key SMA, Fibonacci retracement level.

- Monthly horizontal hurdle, short-term falling trend line test the bulls.

- Easing bearish bias of MACD backs further upside, 61.8% Fibonacci retracement offers extra support.

Palladium (XPD/USD) prices pick-up bids around $2,891, up 0.88% intraday, ahead of Friday’s European session. In doing so, the bullion justifies the previous day’s bounce off 200-SMA and 50% Fibonacci retracement level of April–May upside. Also backing the recovery movement is the receding bearish bias of the MACD.

Even so, multiple lows marked since late April around $2,900-901 guard the commodity’s immediate upside.

During the quote’s run-up beyond $2,901, a weekly falling trend line near $2,920-21 will be the key as it holds the gate for the pair’s run-up towards the all-time high of $3,020.

Meanwhile, 200-SMA and 50% Fibonacci retracement, respectively around $2,810 and $2,800 will direct the palladium sellers toward the 61.8% Fibonacci retracement level of $2,751.

It should, however, be noted that the bears will gain strength on the break of $2,751, which in turn could recall the $2,700 threshold back to the chart.

Palladium four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.