Overbought, overextended – What's the buzz in S&P 500 now? [Video]

![Overbought, overextended – What's the buzz in S&P 500 now? [Video]](https://editorial.fxstreet.com/images/Markets/Equities/SP500/wall_street_nyse1-637299020939878938_XtraLarge.jpg)

Watch the video extracted from the WLGC session before the market open on 13 Feb 2024 below to find out the following:

-

The key support level for the Nasdaq 100

-

The directional bias for the long-term, swing and immediate term.

-

The red flags you need to be aware of in this current market.

-

and a lot more...

Market update 14 Feb 2024

A sharp selloff happened after the live session as the market reacted to the CPI data.

The magnitude and supply are slightly less than 31 Jan 2023. So far yesterday’s drop in S&P 500 (ES) did not pose a great concern yet. 4850 is a meaningful support that needs to hold.

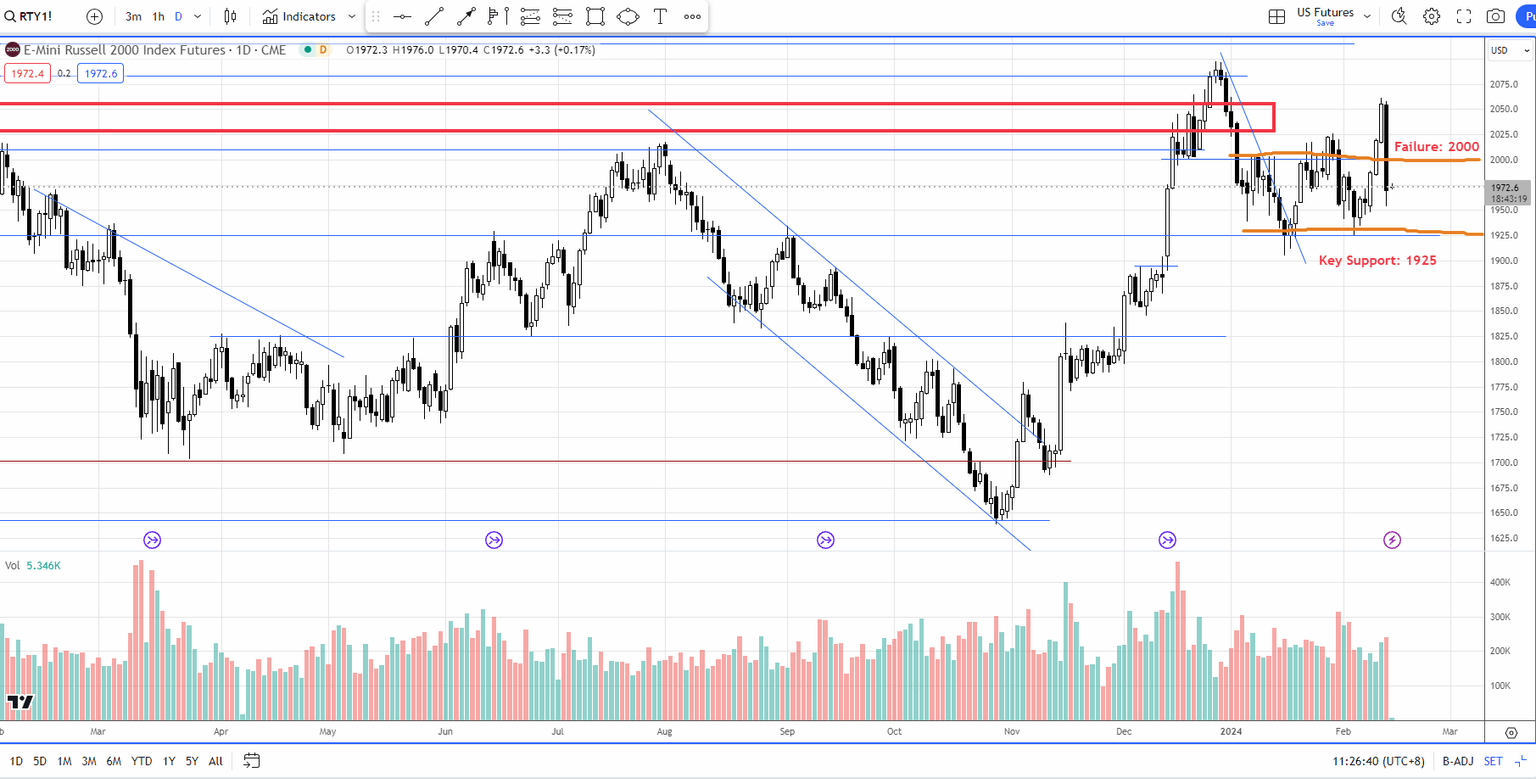

Meanwhile, Russell 2000 (RTY) had a more severe drop, as shown below:

RTY failed at the key level - 2000 twice.

If it breaks below the support at 1925, the major indices like S&P 500, Nasdaq 100, and Dow Jones are likely to join the sell-off as Russell 2000 leads the way down.

A commitment above 2000 is the key to broadening market breadth and the bullish momentum will return.

We will get more clues in the next few days.

The bearish analogue in S&P 500 discussed in the tweet below is still valid and could be unfolding accordingly.

"This is like a topping formation. We have seen it right here. Although this probably like a megaphone type of the formation rather than a rectangle.

— Ming Jong Tey (@MingJong) February 7, 2024

In terms of the overbought condition analog. There's a chance for it to follow this kind of the pullback." $ES $SPX #SP500 pic.twitter.com/fVEZuen9iQ

Market environment

The bullish vs. bearish setup is 812 to 27 from the screenshot of my stock screener below.

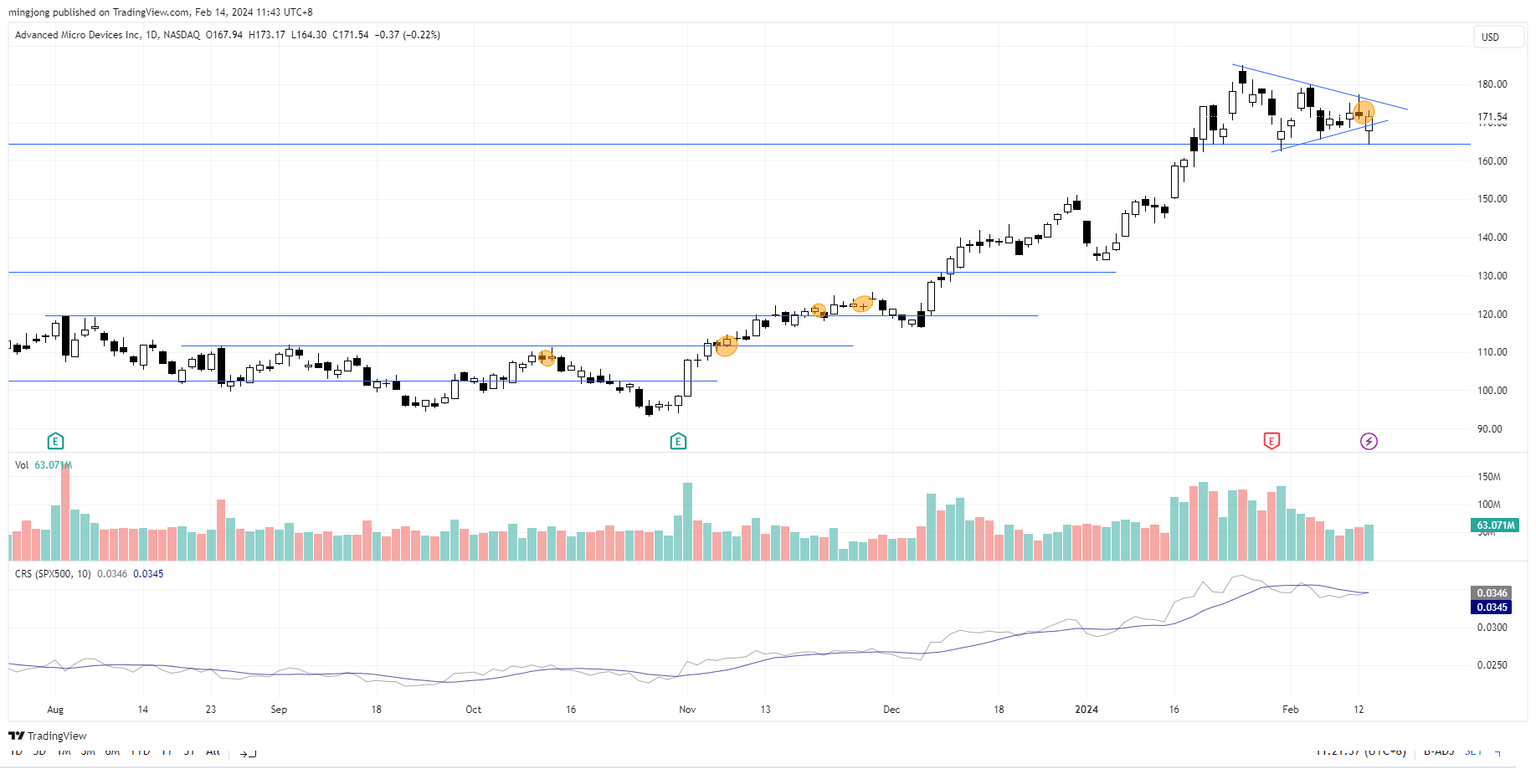

9 “low-hanging fruits” (NFLX, CYTK, etc…) trade entries setup + 12 actionable setups (AMD etc…) plus 11 “wait and hold” candidates have been discussed during the live session before the market open (BMO).

CYTK

NFLX

AMD

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.