NZDUSD registered weekly gains as traders focused on next week RBNZ’s decision

- Federal Reserve officials’ hawkish commentary bolstered the US Dollar, except against the New Zealand Dollar.

- US Existing Home Sales tanked, flashing an upcoming recession in the United States.

- Reserve Bank of New Zealand’s upcoming monetary policy meeting would determine NZDUSD direction

The New Zealand Dollar (NZD) regained composure and finished the week up by 0.50% against the US Dollar (USD), albeit hawkish commentary by Federal Reserve (Fed) officials bolstered the US Dollar (USD). Additionally, an upbeat market sentiment strengthened risk-perceived assets in the FX markets, the New Zealand Dollar. Hence, the NZDUSD is trading at 0.6150, above its opening price by 0.39%.

Federal Reserve officials warranted that further rate hikes are coming

During the week, Federal Reserve officials remained hawkish after the Consumer Price Index (CPI) and the Producer Price Index (PPI) reports for the United States (US) were softer than expected, meaning that inflation is cooling down. That said, US equities rallied, while US Treasury bond yields and the US Dollar plunged due to growing speculations that the Fed could pivot sooner than expected.

Nevertheless, policymakers led by the St. Louis Fed President James Bullard, who said that interest rates are not “sufficiently restrictive” and added that would be if the Federal Funds rate (FFR) hit the 5% to 5.25% area. Echoing his comments was Minnesota’s Fed President Neil Kashkari, stating that one-month data can’t over-persuade the Fed, as it needs to keep at it until they’re sure that inflation has stopped climbing. On Friday, the Boston Fed President Susan Collins noted that the Federal Reserve needs to continue hiking rates, adding that rates will need to keep high for some time.

US Existing Home Sales plummet, weakens the US Dollar

Data-wise, US Existing Home Sales for October plunged a staggering 5.9%, below a 4.17% increase estimated by analysts. Home sales have fallen since February of 2022 due to the Federal Reserve’s tightening monetary conditions as they try to curb stubbornly high inflation, which peaked around 9%. Following the release, the NZDUSD edged slightly up, though it retraced below 0.6180, to finish the day around current exchange rates.

New Zealand Dollar traders focused on RBNZ’s policy decision

An absent New Zealand’s economic calendar left the NZD adrift to USD dynamics and market sentiment. During the Asian session, China’s Covid-19 outbreak and geopolitical risk put a lid on the earlier NZDUSD rally, which could not decisively crack the 0.6200 psychological level. The week ahead, the New Zealand docket will feature the Balance of Trade for October, Retail Sales, and the Reserve Bank of New Zealand (RBNZ) monetary policy meeting, with analysts expecting a 75 bps rate hike.

On the US front, the economic calendar for the United States will feature the Chicago Fed National Activity Index, Durable Good Orders, housing data, and Initial Jobless Claims. Also, further Federal Reserve officials would cross newswires.

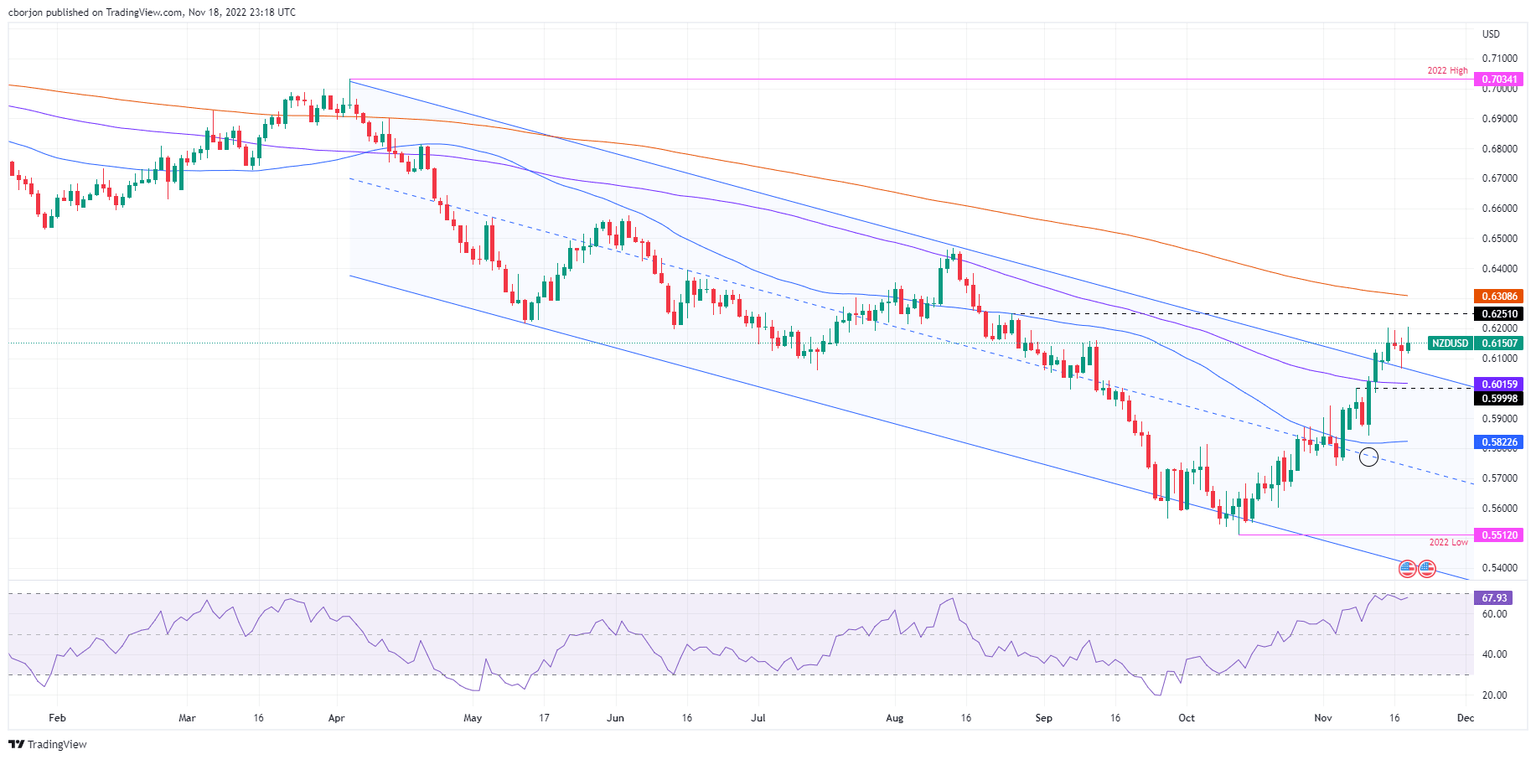

NZDUSD Price Analysis: Technical outlook

The New Zealand Dollar (NZD) ended the week almost flat after hitting a weekly high of 0.6203. Failure to crack the latter keeps the NZD exposed to selling pressure. Notably, the 0.6200 figure was tested three times, and with the Relative Strength Index (RSI) exiting overbought conditions, aiming slightly lower, a fall toward the 100-day Exponential Moving Average (EMA) at 0.6015 is on the cards.

NZDUSD key support levels lie at 0.6100, followed by the downslope top-trendline of a descending channel around 0.6065, followed by the 100-day EMA at 0.6015. On the flip side, the NZDUSD’s first resistance would be the 0.6200 mark, followed by the August 25 daily high at 0.6251, ahead of the 200-day EMA at 0.6308.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.