NZD/USD steadies near 0.5890 after data-driven rebound, but broader bias remains weak

- The pair trades around 0.5890, snapping a two-day losing streak on stronger NZ inflation expectations and upbeat PMI.

- US sentiment dropped sharply, while soft inflation and retail data fuel Fed rate cut bets.

- Bearish bias holds; support at 0.5861 and 0.5847, resistance at 0.5880 and 0.5883.

NZD/USD is trading slightly higher near 0.5890 during early Friday trading, recovering from recent losses as upbeat domestic data supports the Kiwi. The pair snapped a two-day slide, buoyed by an improvement in local manufacturing and a rise in inflation expectations, while market action remains largely muted across G10 currencies. The New Zealand Dollar is outperforming peers, supported by improving local fundamentals, even as global risk appetite remains subdued.

New Zealand's Business NZ PMI rose to 53.9 in April from 53.2, signaling expansion in the manufacturing sector. More notably, RBNZ’s Q2 inflation expectations survey revealed a rise to 2.3% over the next two years, up from 2.2%, and 2.4% on the one-year horizon. While the Reserve Bank of New Zealand is still expected to cut rates by 25 basis points this month, the inflation rebound could temper the pace of further easing. ASB Bank’s Mark Smith said the central bank may be “somewhat wary” of the trend, particularly with tariff-related risks still unfolding.

On the US side, the University of Michigan Consumer Sentiment Index dropped sharply to 50.8 in May from 52.2, well below the 53.4 forecast. Consumer expectations and current conditions also declined, suggesting growing household concern amid mixed economic signals. Meanwhile, PPI and retail sales data earlier this week came in soft, adding to signs of disinflation and slower growth. Fed officials remain cautious, with market pricing indicating around 75 basis points of easing over the next year. However, upcoming tariff adjustments and broader uncertainty are keeping USD demand steady in the short term.

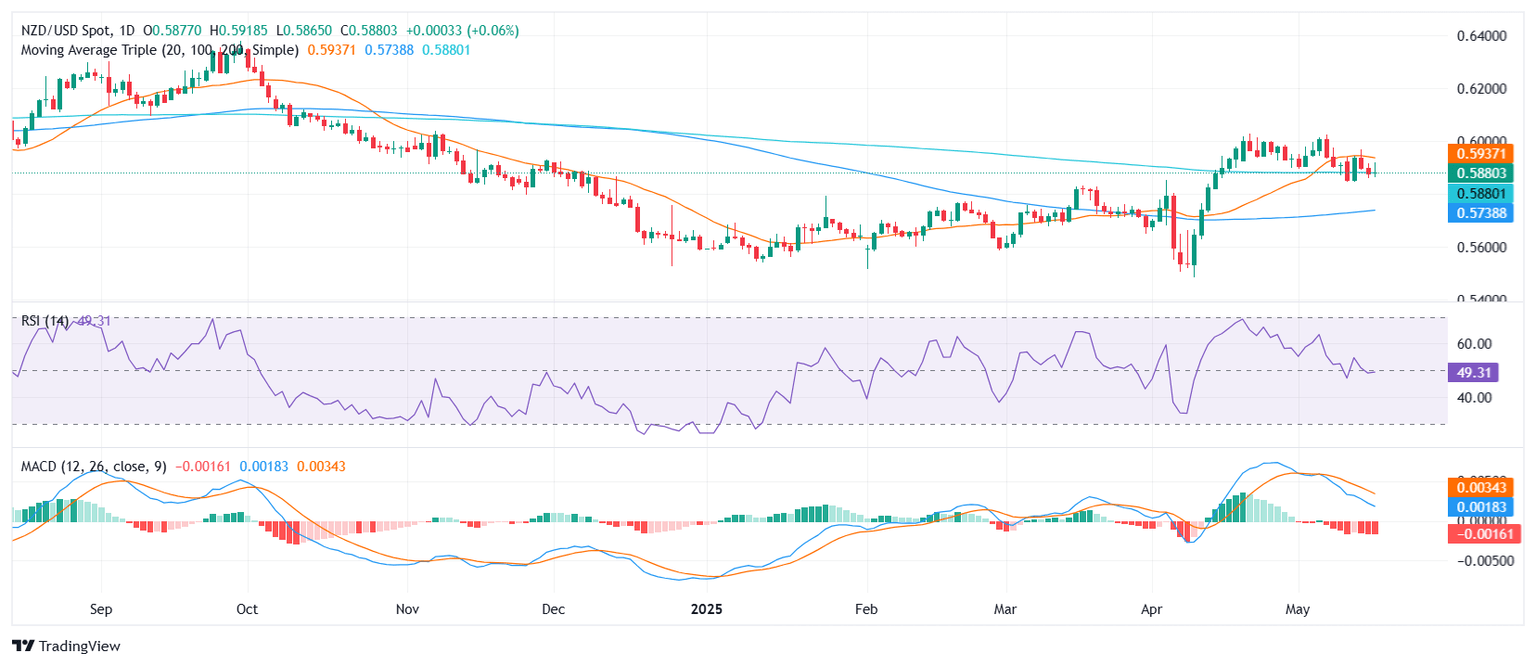

Technical Outlook

Technically, NZD/USD exhibits a bearish structure, despite Friday’s modest uptick. The pair trades within a mid-range band between 0.5865 and 0.5918. The RSI sits near 49, reflecting neutral momentum. The MACD remains in sell territory, while the Stochastic %K is in the 20s, also suggesting neutral positioning. The CCI (20) indicates slight buy conditions, but the Williams %R and broader moving averages skew bearish. The 10-day EMA, 10-day SMA, 20-day SMA, and 200-day SMA point to downside pressure, only offset by the 100-day SMA, which offers mild support.

Immediate support levels lie at 0.5861, 0.5847, and 0.5827, while resistance is seen at 0.5880, 0.5882, and 0.5883. Despite today's rebound, the technical outlook remains fragile, and unless new catalysts emerge from next week’s New Zealand PPI data or shifts in Fed rhetoric, NZD/USD may struggle to break higher.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.