NZD/USD rallies tentatively to 0.6775 region, but lags non-US dollar peers

- NZD/USD recovered to the 0.6775 area on Tuesday amid a broad rally in risk appetite.

- But the kiwi continues to severely lag the Aussie and Loonie, weighed by unfavourable divergence in central bank policy expectations.

NZD/USD has seen a tentative rally on Tuesday, rebounding to around the 0.6775 area after printing fresh annual lows under 0.6740 earlier in the session. The broad risk-on market tone which is seeing global equities, commodities and risk/commodity-sensitive currencies perform well across the board is the main driver of the upside in the pair on Tuesday.

Looking ahead, there are no notable New Zealand economic events for the remainder of the week so focus will be on US-related themes and risk appetite. If the latter can remain supported as Omicron variant fears ease then that might be enough to keep NZD/USD from plunging back to annual lows under 0.6750. But is US macro data comes in strong and US inflation data hot (as is expected), this may keep USD underpinned in anticipation that the Fed will announce an acceleration of the pace of its QE taper next Wednesday.

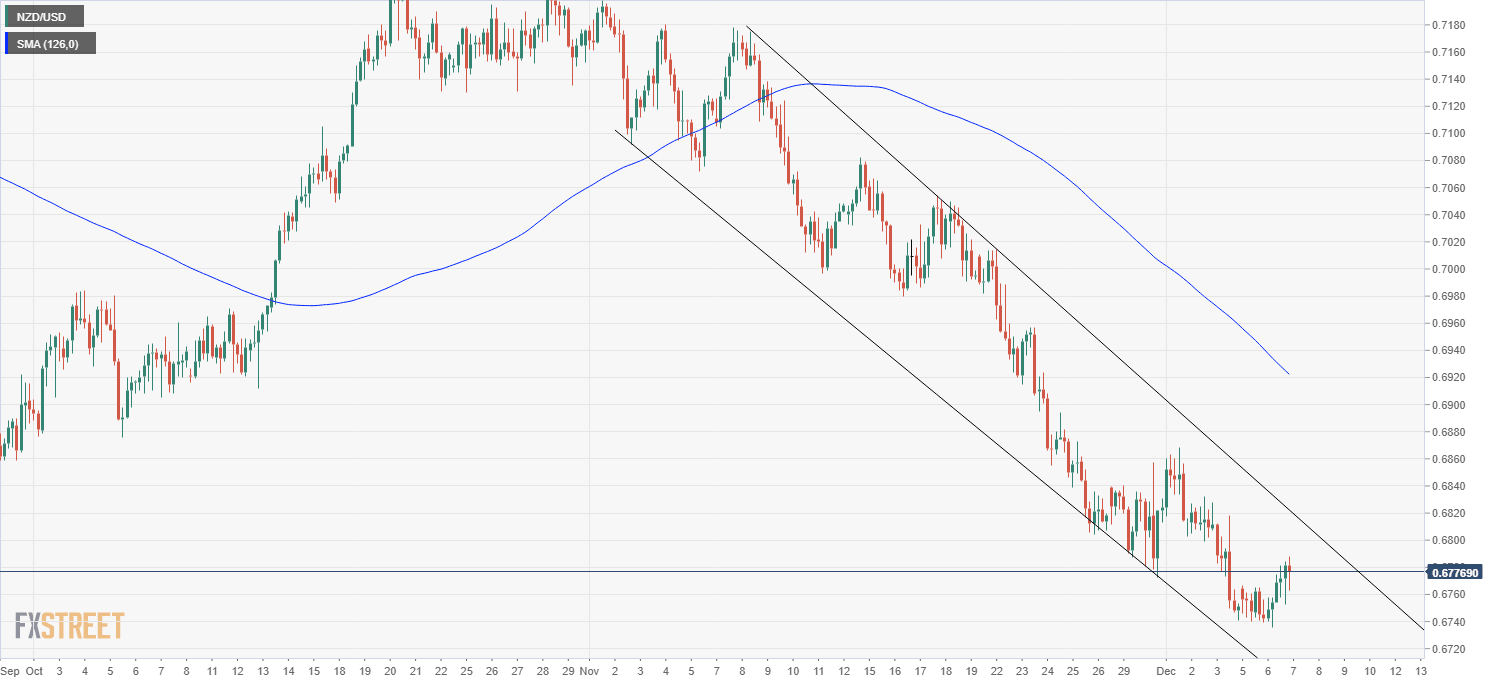

Looking at the pair from a technical standpoint, the descending trendline that has guided NZD/USD lower in recent weeks looks to still be very much intact. “NZD rallies remain selling opportunities,” said analysts at ANZ.

NZD underperforms as markets dial down hawkish RBNZ bets

Tuesday’s recovery only amounts to an on-the-day gain of about 0.4%, which is not particularly impressive in light of the 0.9% and 0.8% gains being seen in the kiwi’s fellow non-US dollars the Aussie and the loonie. Equally, NZD’s on the week gains versus the US dollar only stand around 0.5%, versus a more than 1.6% gain for AUD and a roughly 1.4% gain for CAD.

Recent NZD underperformance versus its peers and the US dollar (NZD/USD is down over 5.5% since the start of last month) owes itself to divergence in central bank policy expectations. In the last few days, money markets have rebuilt hawkish bets for the Fed, BoC and RBA (with a surge of hawkish RBA bets coming in wake of Tuesday’s policy decision), but the same cannot be said for the RBNZ. Indeed, over the past few weeks, markets have been dialing down their hawkish RBNZ bets.

Since mid-November’s not as hawkish as expected RBNZ meeting, the implied yield on the December 2022 NZ Bank Bill future has dropped from above 2.8% to current levels in the 2.50s%. Over the same time period, the implied yield on the December 2022 three-month eurodollar future has remained steady close to 1.10%.

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset