NZD/USD Price Analysis: Technical pullback allows the consolidation of gains

- The NZD/USD pair is showing signs of consolidation after reaching yearly highs last week.

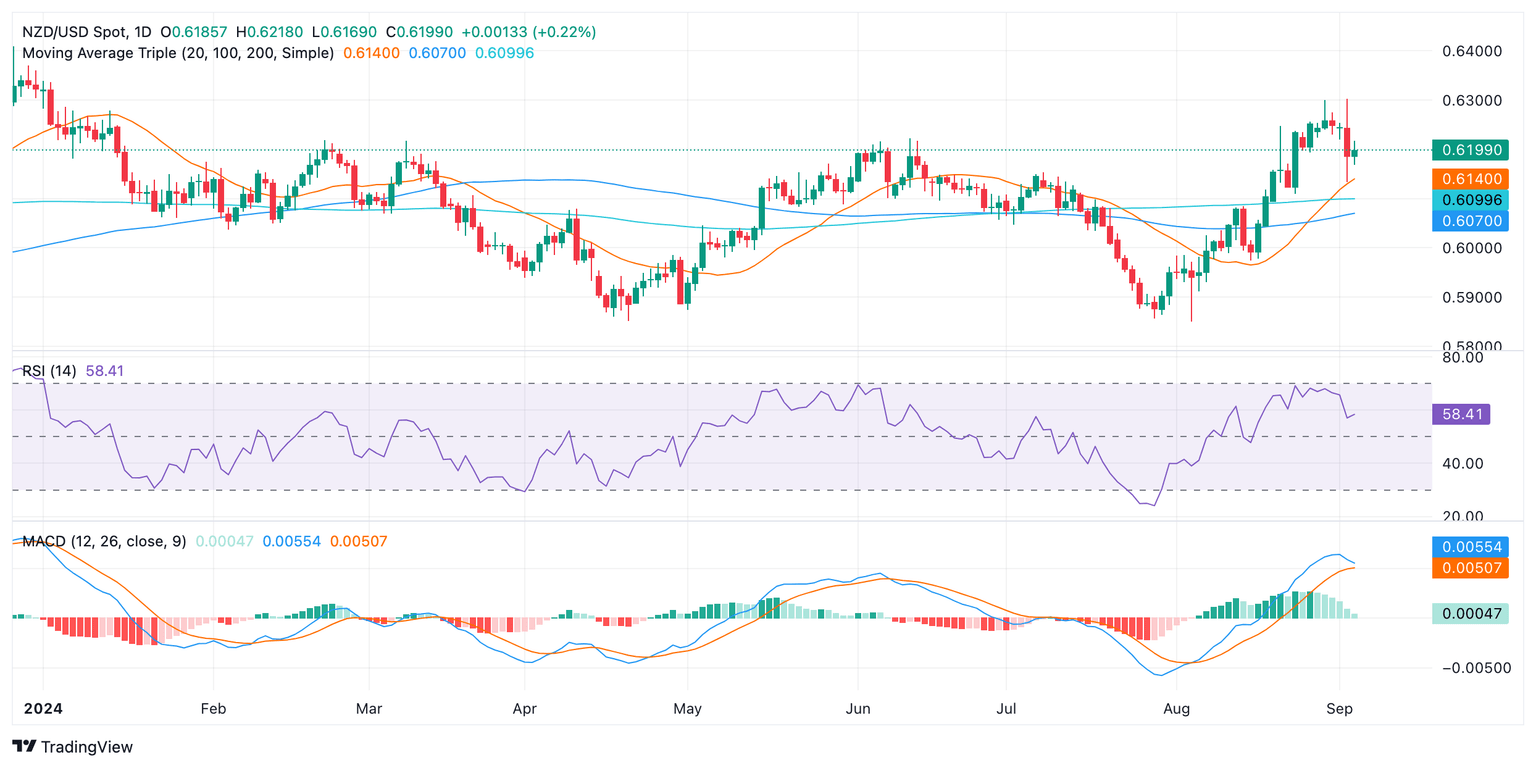

- The RSI and the MAC point to a flattening bullish traction.

The NZD/USD pair is consolidating near the 0.6200 support level as bulls take a breather after August's rally.

The Relative Strength Index (RSI), at 57 remains in positive territory but flat. However, the decreasing green bars in the Moving Average Convergence Divergence (MACD), suggest that bullish momentum remains steady but decreasing. If the MACD turns to bearish momentum, it could confirm to a reversal of sentiment.

NZD/USD daily chart

Looking at the daily chart, the NZD/USD pair is facing resistance at the 0.6230 level. A break above this level could open the door for further gains. On the downside, the pair is facing support at the 0.6170 level. A break below this level could shift the tide in favor of the bears. Overall, the outlook is positive but a healthy correction was needed after rising to highs since January last week where the upside movement became over-extended. Now the pair is set to consolidate.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.