NZD/USD Price Analysis: Rebounds firmly above 0.6170 ahead of US/NZ Employment data

- NZD/USD has shown a decent recovery above 0.6170 as USD Index has sensed selling pressure.

- As per the consensus, the US economy added 150K jobs in April lower than the former additions of 145K.

- NZD/USD is continuously facing pressure near the downward-sloping trendline plotted from 0.6386.

The NZD/USD pair has scaled sharply above the immediate resistance of 0.6170 in the early Tokyo session. Earlier, the Kiwi asset witnessed an intense sell-off on Monday after failing to claim the round-level resistance of 0.6200.

The US Dollar Index (DXY) has sensed sheer selling pressure near its two-week-old resistance of 102.20. It seems that investors are digesting pre-Federal Reserve (Fed) policy anxiety.

Wednesday’s New Zealand and United States Employment data will be keenly watched. NZ’s Employment Change (Q1) is expected to remain steady at 0.2%. While the Unemployment Rate is seen rising to 3.5% from the former release of 3.4%.

On the US front, investors will keep an eye on Automatic Data Processing (ADP) Employment data. As per the consensus, the US economy added 150K jobs in April lower than the former additions of 145K.

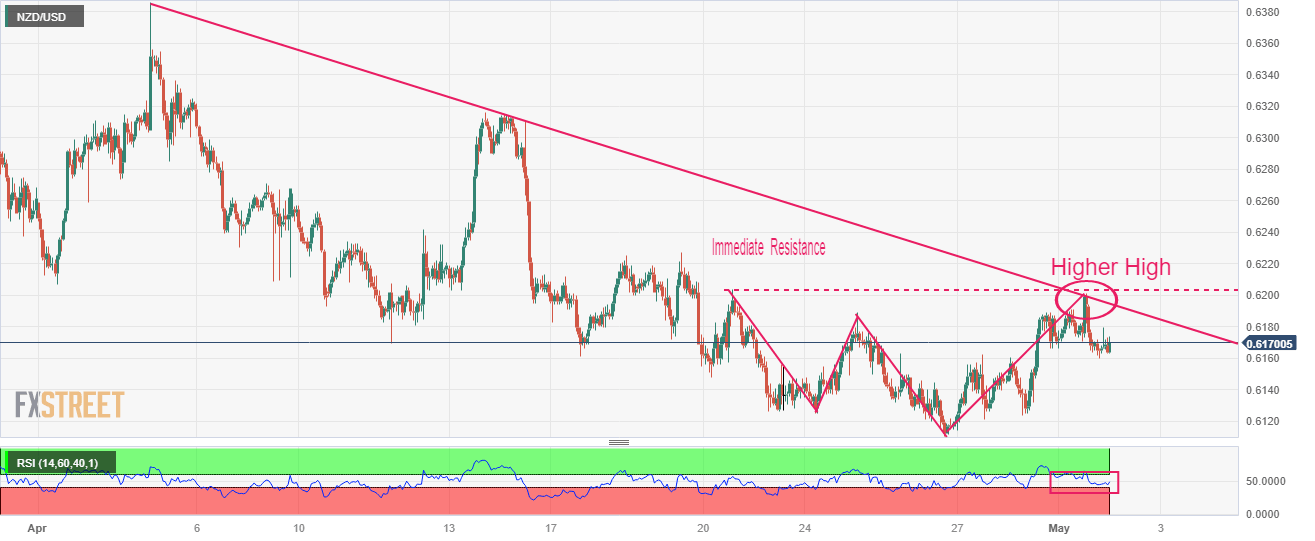

NZD/USD is continuously facing pressure near the downward-sloping trendline plotted from April 05 high at 0.6386 on an hourly scale. The Kiwi asset has made a higher high after a lower high lower low structure, hinting for a potential bullish reversal ahead.

The New Zealand Dollar is facing immediate selling pressure near horizontal resistance placed from April 20 high at 0.6204.

Meanwhile, the Relative Strength Index (RSI) (14) has slipped back into the 40.00-60.00 range, indicating consolidation ahead.

Should the asset break above April 20 high at 0.6204, kiwi bulls will drive the asset towards April 19 high at 0.6227 followed by April 07 high at 0.6265.

In an alternate scenario, a breakdown of April 26 low at 0.6110 will drag the asset toward March 08 low at 0.6088 followed by the 15 Nov 2022 low at 0.6058.

NZD/USD hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.