NZD/USD Price Analysis: Kiwi rallies toward 0.5700 despite persistent bearish backdrop

- NZD/USD trades near the 0.5700 area following a strong upward move during Wednesday’s session.

- Despite the rally, overall indicators maintain a bearish tone as the price nears short-term resistance.

- Key resistance levels emerge near the 0.5669 zone, with support holding around 0.5537.

The NZD/USD pair advanced firmly on Wednesday, rising sharply ahead of the Asian session and trading near the 0.5700 mark. The pair is testing the upper region of its daily range, reflecting a strong intraday bounce despite a broader backdrop that still leans bearish. Technical indicators show mixed momentum, with near-term strength clashing against longer-term trend signals.

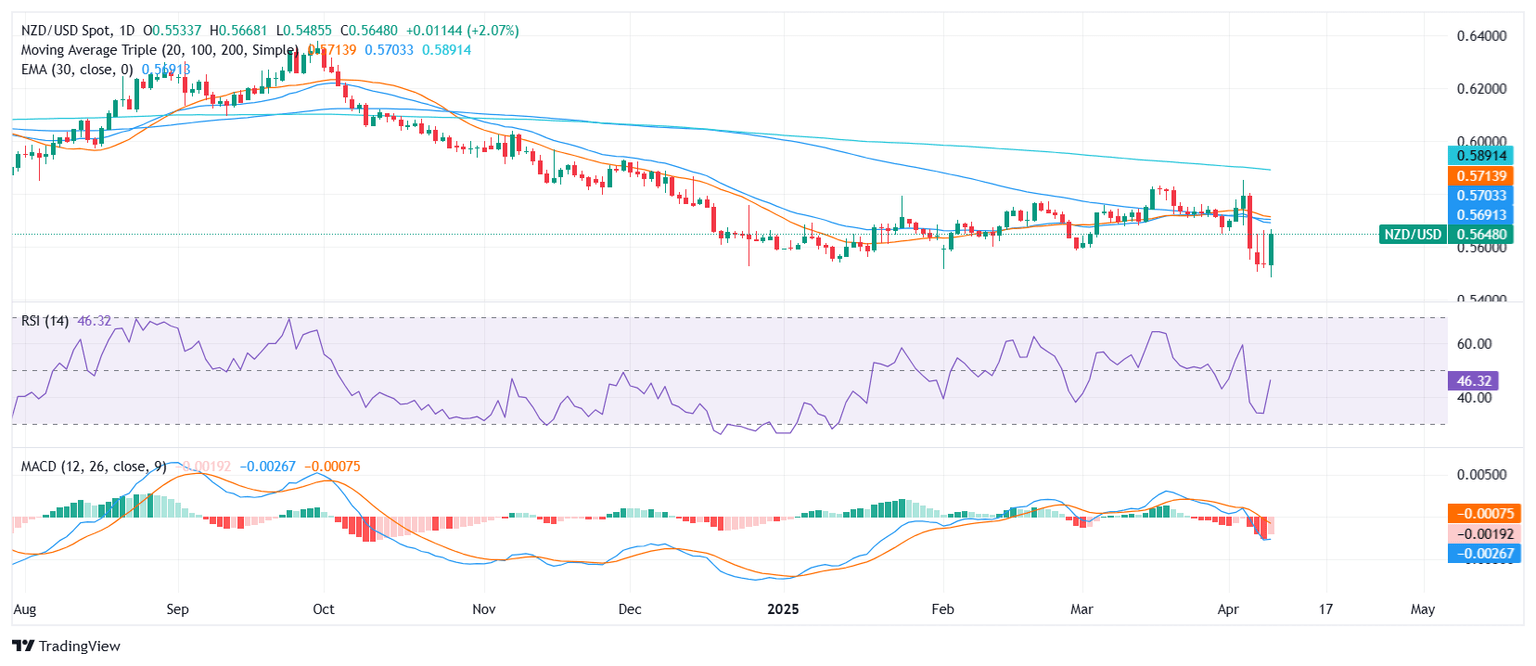

Daily chart

From a momentum perspective, the Relative Strength Index (RSI) stands at 46.72 and the Average Directional Index (ADX) at 12.28 — both neutral, but with the RSI recovering in negative area. The Moving Average Convergence Divergence (MACD), however, is still producing a sell signal, suggesting the rally may face headwinds. Stochastic %K at 21.04 is also neutral, providing no clear short-term cue.

The broader trend outlook remains bearish. The 20-day Simple Moving Average (SMA) at 0.57139, 100-day SMA at 0.57090, and 200-day SMA at 0.58963 are all trending lower, pointing to sustained downside pressure. Additionally, the 10-day Exponential Moving Average (EMA) and 10-day SMA at 0.56542 and 0.56697, respectively, continue to reinforce this view.

Looking at price levels, resistance is seen near 0.56542, followed by 0.5667 and 0.56692 — a cluster that could cap further upside in the near term. Support rests at 0.55375, offering a key floor should bearish pressure resume. Overall, while the pair has shown strength today, it remains technically vulnerable unless it can establish itself firmly above the moving average congestion zone.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.