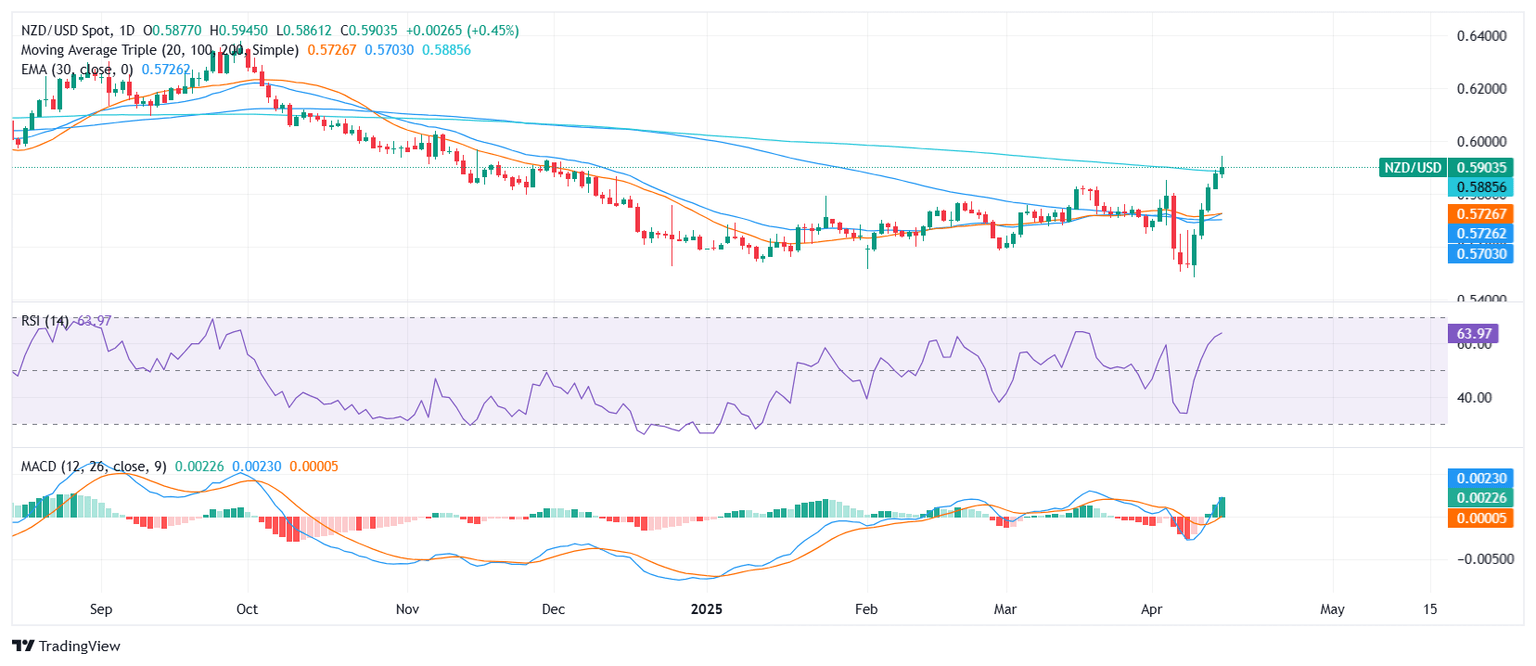

NZD/USD Price Analysis: Kiwi holds near 0.5900 amid sustained bullish signals

- NZD/USD trades near the 0.59 zone after gaining ground during Tuesday’s session

- Technical outlook remains bullish, with key moving averages pointing north

- Support aligns near 0.5890, with resistance seen at the 0.5910–0.5920 region

The NZD/USD pair moved higher on Tuesday, seen trading near the 0.59 area ahead of the Asian session. The Kiwi continues to benefit from sustained buying interest, holding mid-range between the day’s lows and highs, and showing resilience despite broadly neutral oscillators.

From a technical perspective, the momentum bias leans bullish. The Relative Strength Index (RSI) stands at 63.91, still in neutral territory but comfortably above the midline and mildly rising. The Moving Average Convergence Divergence (MACD) prints a green histogram bar, signaling continued bullish momentum. However, some oscillators like the Stochastic RSI Fast (100.00) and Bull Bear Power (0.03077) remain neutral, suggesting the pair may be pausing after recent gains.

Further strengthening the positive tone are the moving averages. The 10-day Exponential Moving Average at 0.57612 and 10-day Simple Moving Average at 0.57198 both signal buy. The broader trend is reinforced by the 20-day (0.57265), 100-day (0.57076), and 200-day (0.58908) Simple Moving Averages, which are all aligned to the upside and continue to offer support on dips.

Looking ahead, support rests at 0.58908, followed by 0.58413 and 0.57612. Resistance is seen at 0.59128, with a breakout above this level potentially paving the way for further gains toward the 0.5950–0.6000 region.

Daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.