NZD/USD Price Analysis: Bulls take charge, outlook bullish

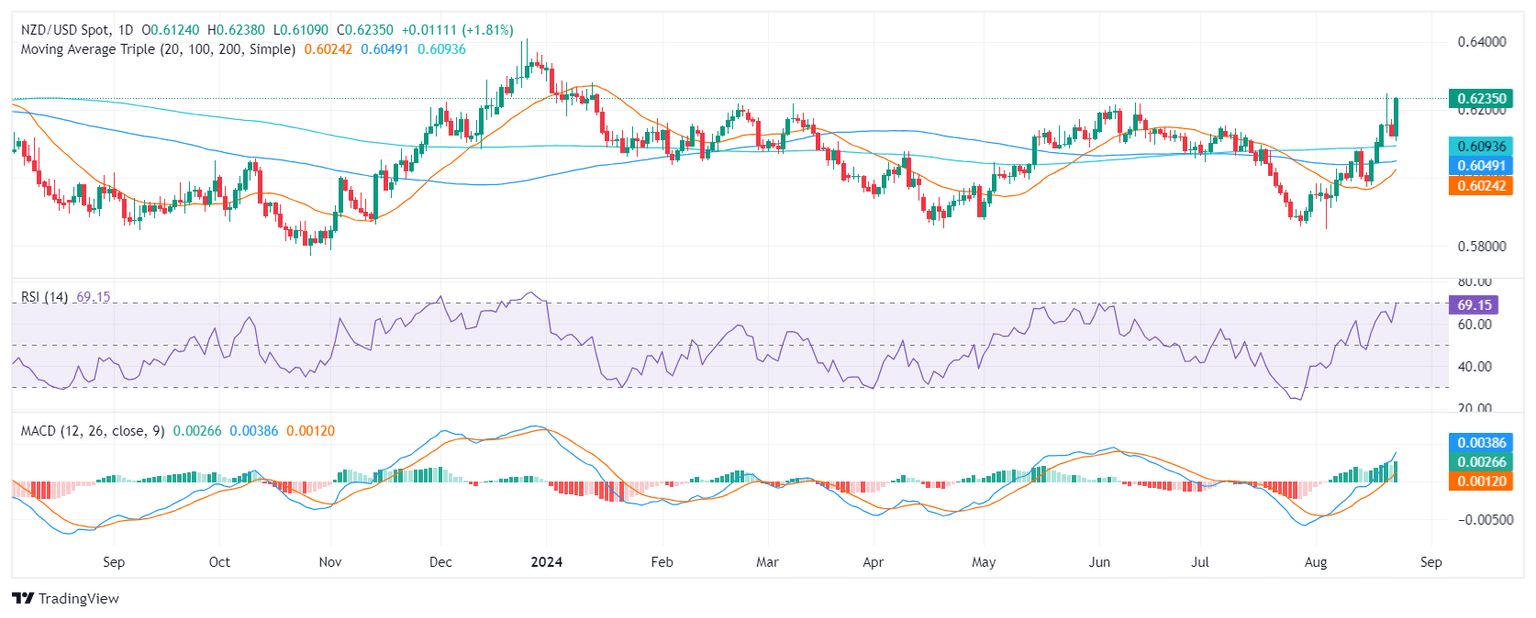

- NZD/USD rose by 1.55% to close at 0.6235.

- The RSI has risen above 70, while the MACD is showing rising green bars, indicating strong bullish momentum.

- A break above 0.6250 could lead to a further rally towards 0.6300.

In Friday's session, the NZD/USD rose by 1.55% to 0.6235, ending the week on a strong bullish note. The pair has broken out of a short-term consolidation range and is now facing a key resistance level at 0.6250. A break above this level could lead to a further rally towards 0.6300.

On the daily chart, the RSI has risen near 70, indicating strong bullish momentum but with the potential of a downward consolidation. The MACD is also showing rising green bars, supporting the positive outlook. The volume has been increasing over the past few sessions, suggesting that the current bullish momentum is likely to continue.

NZD/USD daily chart

The NZD/USD pair is facing immediate resistance at 0.6255. A consolidation above this level could open the door for a further rally to retest the 0.6300 zone. On the downside, immediate support lies in the range of 0.6200 and 0.6150. A break below 0.6150 could lead to a further decline towards 0.6100.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.