NZD/USD Price Analysis: Bulls seek a break of key trendline resistance

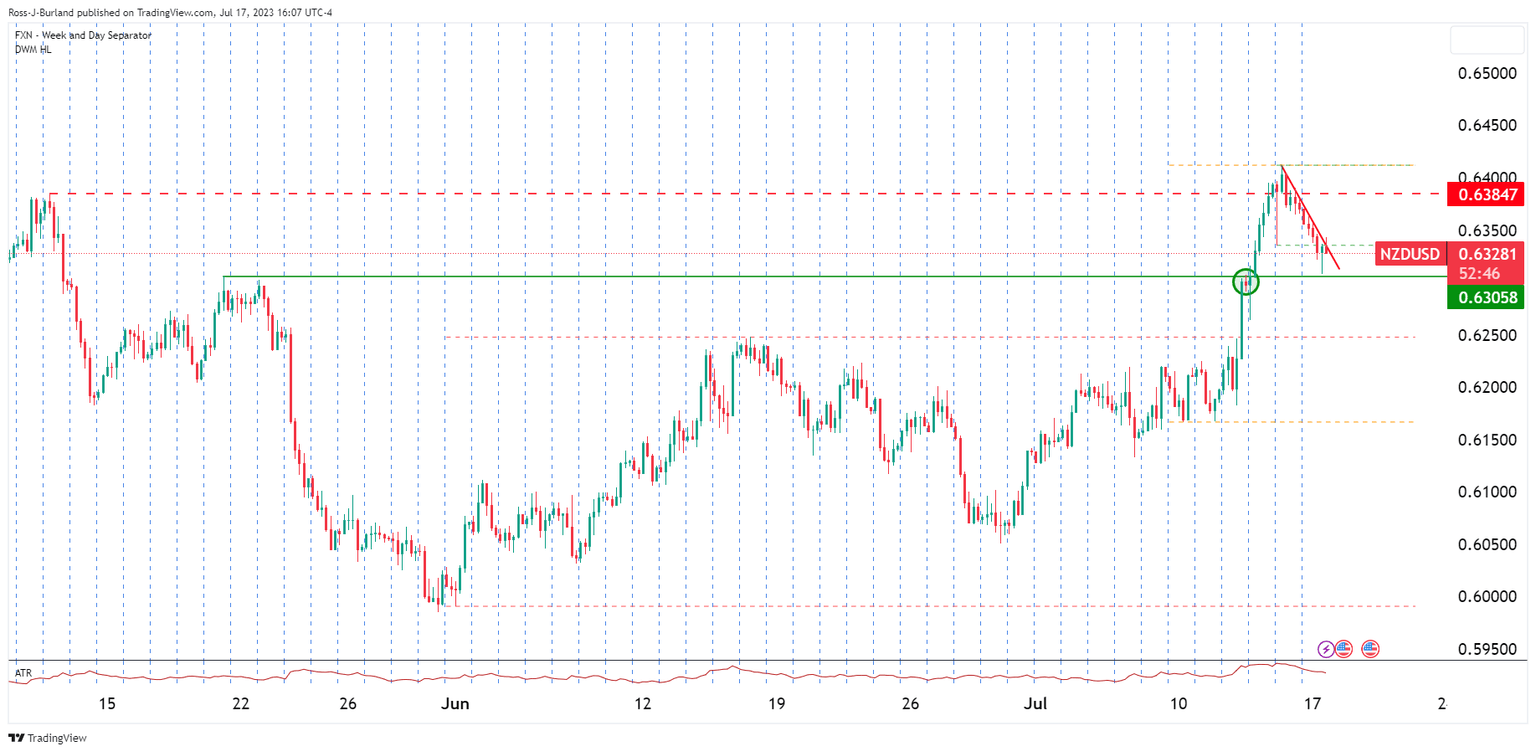

- NZD/USD bears are in the market, short-squeeze-eyed.

- Bulls eye a break of the trendline resistance following test below Friday's lows.

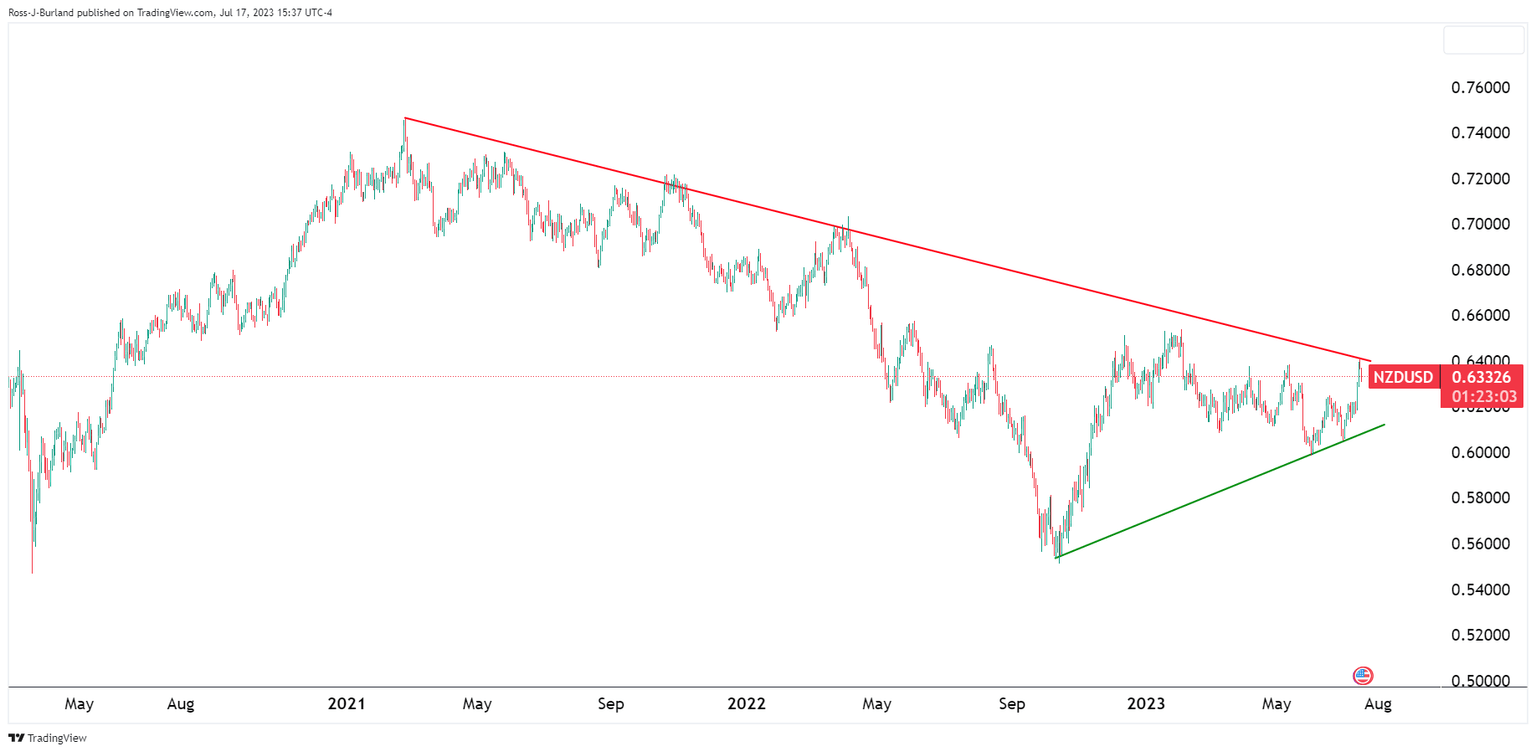

The New Zealand Dollar is lower by some 0.75% towards the close in New York trade and is down for the second straight session, after hitting the strongest level in over five months touched last Thursday. The price is on the front side of the dominant bearish trend and is coming into a coil which will lead to a breakout, eventually:

NZD/USD daily chart

A correction is underway and a continuation will be eyed for in due course.

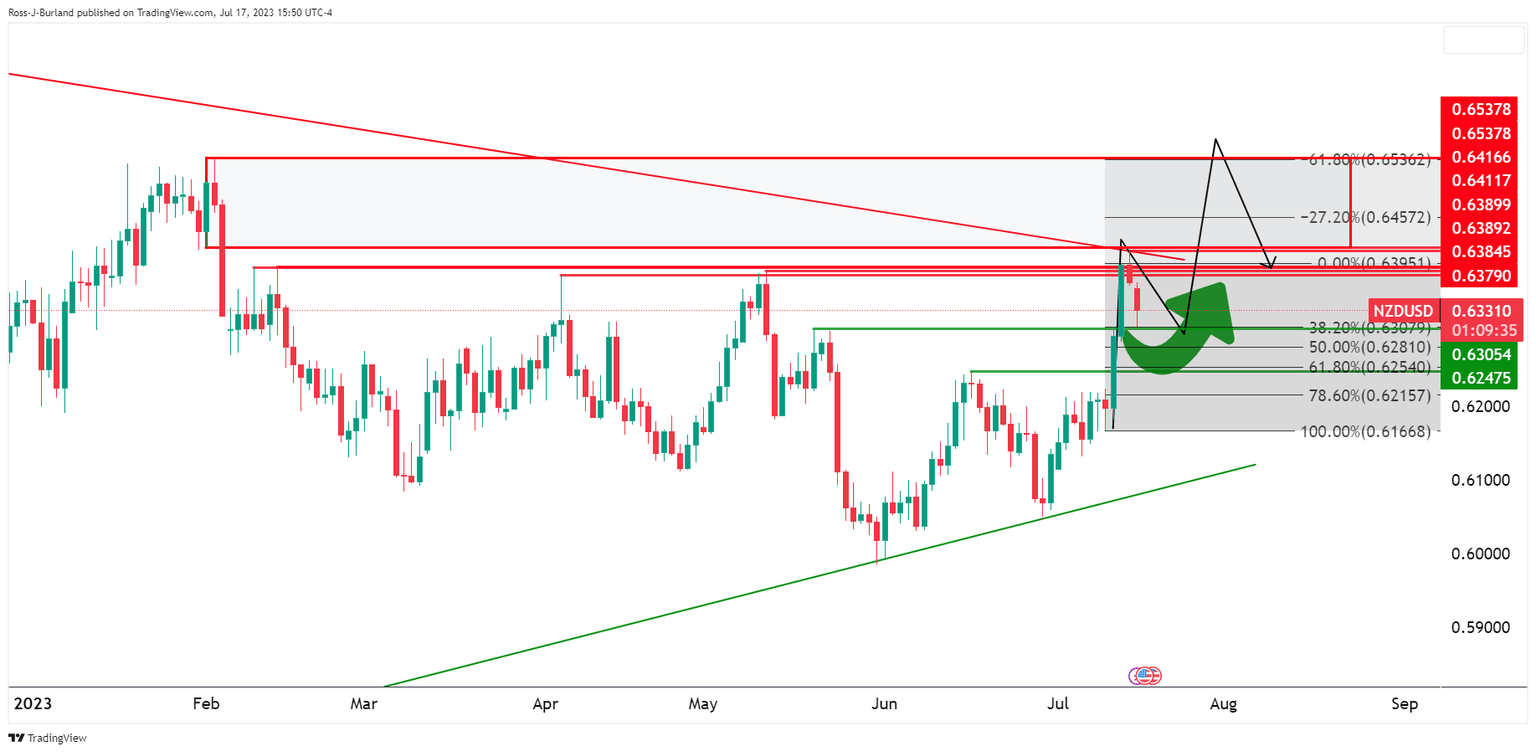

NZD/USD H4 charts

We had breakout traders in the market and a long squeeze is moving in on prior resistance.

NZD/USD is on the front side of the bearish trendline and may have induced sellers due to the break below the prior day's lows. This leaves the trendline vulnerable to a break thereof and the prior support from which the downtrend originated.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.