NZD/USD Price Analysis: Bulls gaining control, closes week above critical resistance

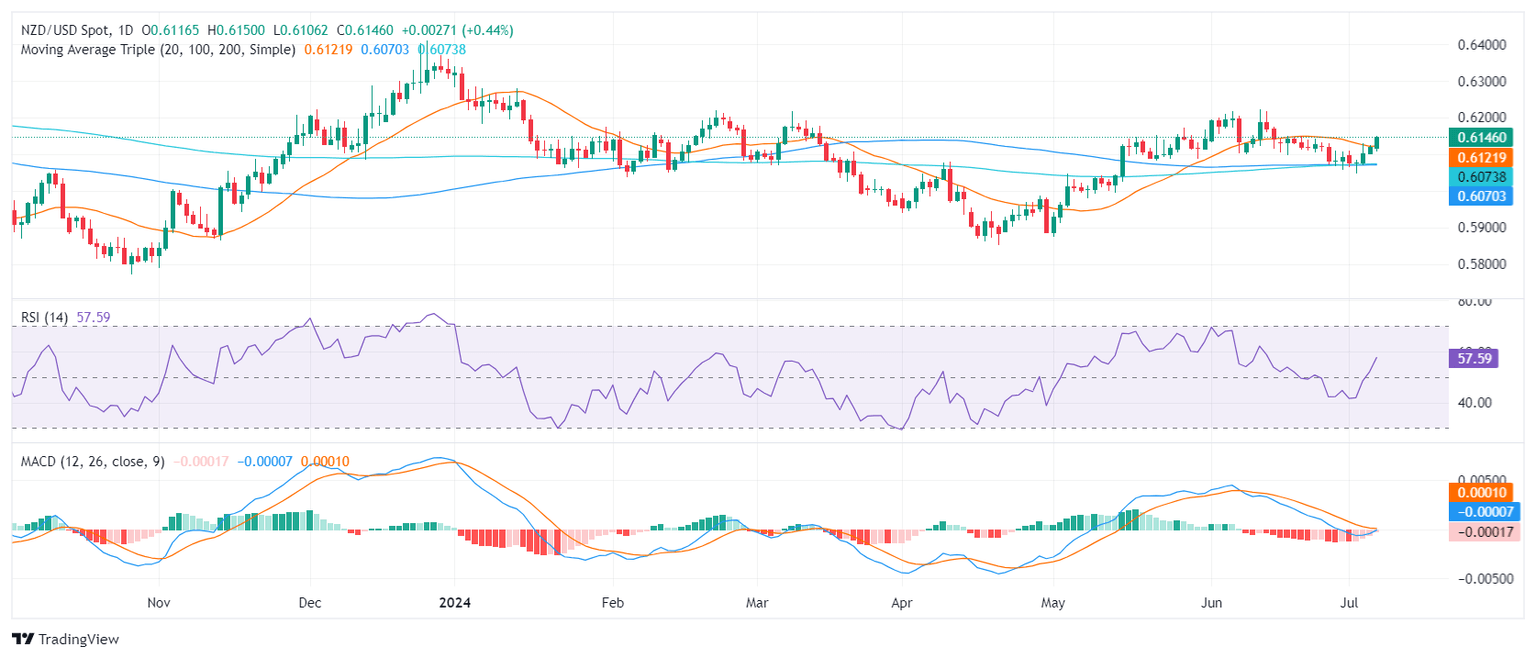

- NZD/USD edged higher and closed above the 20 SMA support around 0.6120.

- With the technical outlook now showing signs of bullishness, the pair tests resistance around the 0.6150 level.

On Friday, the NZD/USD saw gains of 0.40% to 0.6050, as it managed to close above the 20, 100, and 200-day Simple Moving Averages (SMA).

As for the daily technical indicators, the Relative Strength Index (RSI), now at 57, indicates an increase in buying momentum. The Moving Average Convergence Divergence (MACD) continues to register decreasing red bars which could be seen as fading bearish strength.

NZD/USD daily chart

On the upside, resistance is at the 0.6150- 0.6170 zone, and above at the 0.6200 level. A firm break above these levels could be viewed as a full confirmation of the recent bearish dominance, driving the pair into bullish territory.

On the downside has immediate support near the 20-day SMA at 0.6120, and below at the crucial 0.6070 mark. If the sellers manage to drive the price lower, it will indicate strengthening selling pressure and the possibility of a deeper downward correction.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.