NZD/USD Price Analysis: Bulls defend ground despite stalled momentum

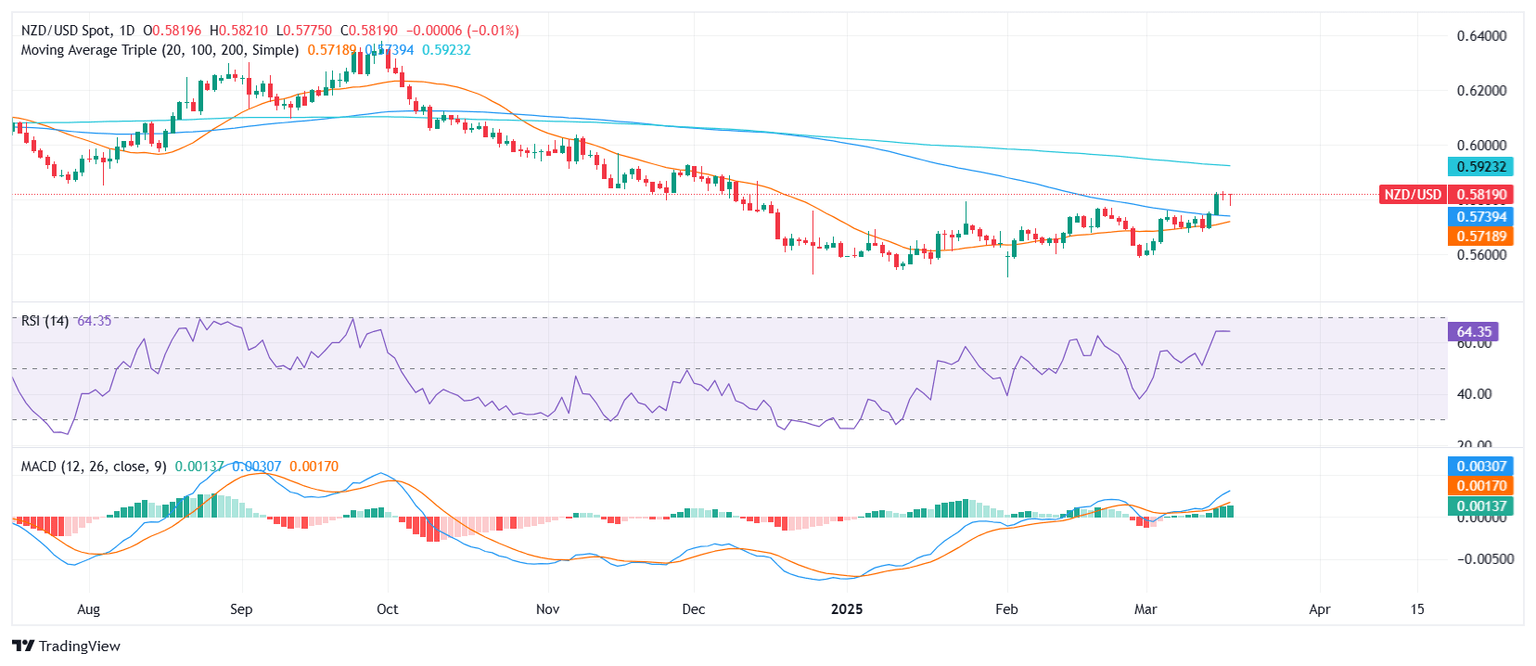

- NZD/USD holds around 0.5810, posting a neutral session after reversing earlier losses.

- Despite bulls fighting back, indicators seem to have stalled in positive territory, limiting further upside potential.

NZD/USD traded near the 0.5810 area on Wednesday ahead of the Asian session, marking a day of choppy price action. The pair initially saw mild losses but managed to stabilize, as bulls stepped in to defend recent gains.

Technical indicators show a mixed picture. The Relative Strength Index (RSI) is positioned near the overbought zone but is declining sharply, indicating a slowdown in buying momentum. Meanwhile, the Moving Average Convergence Divergence (MACD) is still printing rising green bars, suggesting the broader trend remains bullish despite some hesitation.

On the downside, immediate support is found at 0.5775, aligning with the 20-day Simple Moving Average (SMA). A break below this level could expose further weakness toward 0.5730. To the upside, resistance sits near 0.5850, followed by a key hurdle at 0.5900.

NZD/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.