NZD/USD Price Analysis: Bears continue their reign sinking further to May lows

- NZD/USD deepens losses, slipping near the 0.5900 mark, marking a consistent bearish trend since last week.

- The pair lost almost 2.5% in the last five trading sessions.

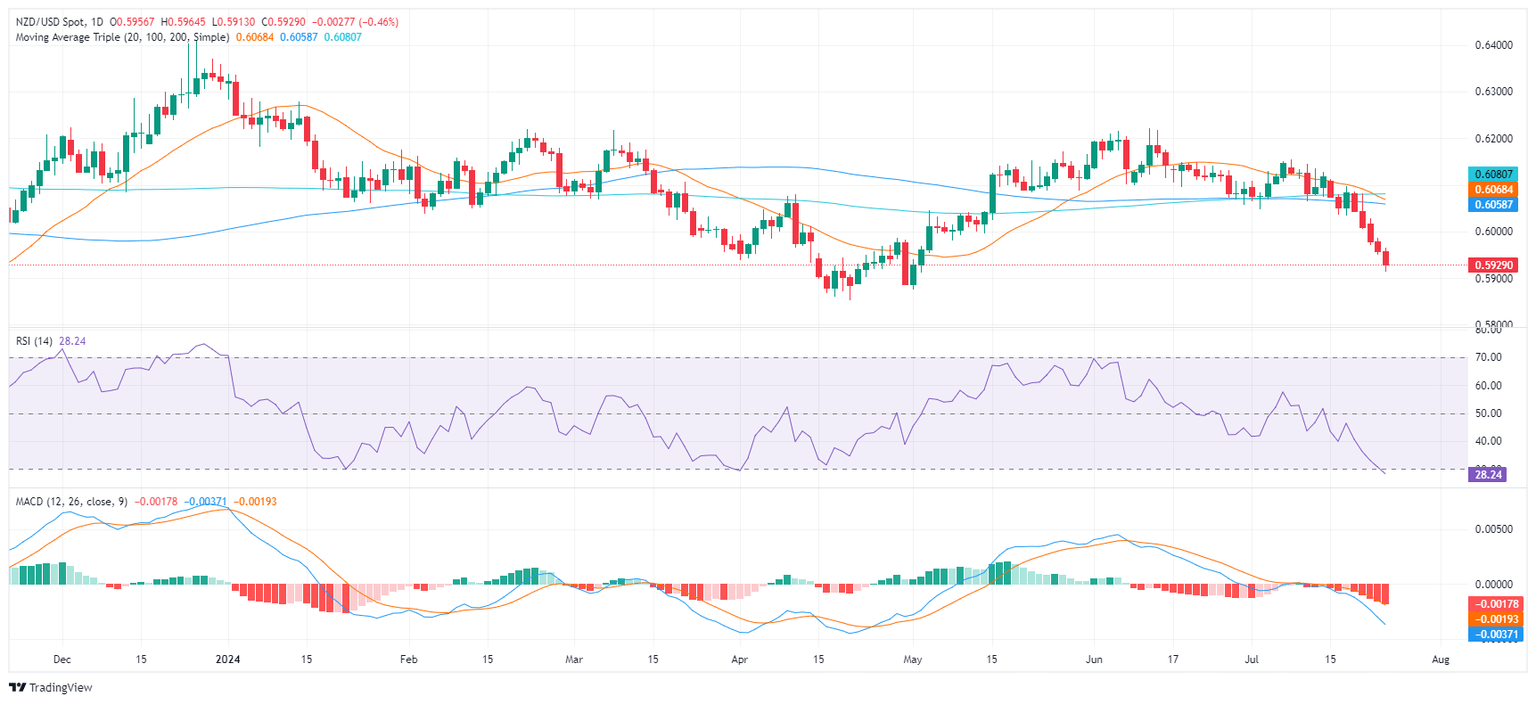

In Wednesday's session, the NZD/USD extended its downward trajectory, decreasing by 0.55% and stabilizing at around 0.5925. The unceasing advance of the bears led to a further decline below the 0.5900 level, plummeting to the May lows around 0.5880 earlier in the session. This establishes a firm bearish sentiment surrounding the currency pair, with a five-day losing stream underlining this trend.

The daily technical indicators fortify this deteriorating trend. The Relative Strength Index (RSI) is now well within the oversold territory at 27. Concurrently, the Moving Average Convergence Divergence (MACD) shows rising red bars, further underlining the bearish sentiment. However, as RSI nears a highly oversold state, there might be potential for a correction looming on the horizon.

NZD/USD daily chart

From a daily perspective, robust support is currently detected at the 0.5900 line, and further below that, at the May lows around 0.5880. Conversely, resistance is still seen at the former support level of 0.6000, followed by 0.6050.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.