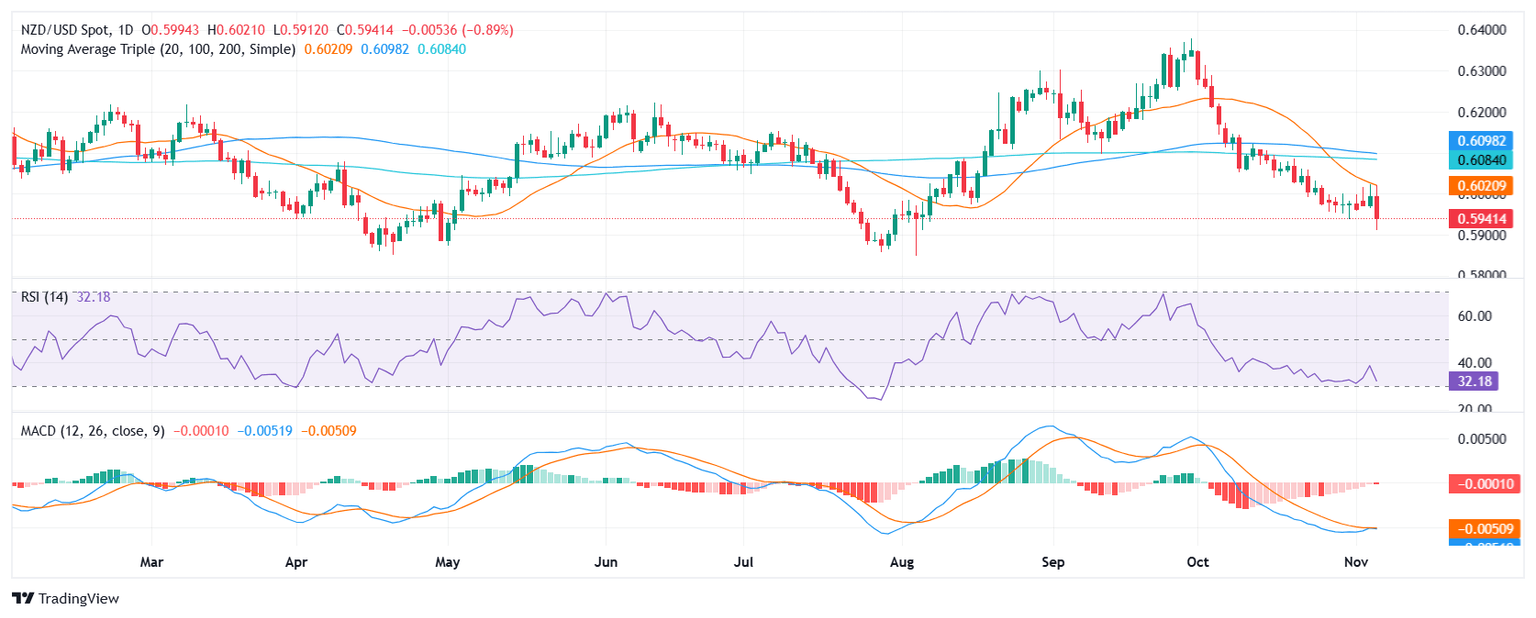

NZD/USD Price Analysis: Bearish signals emerge as pair plunged after 20-day SMA rejection

- NZD/USD drops to fresh lows, technical bias bearish

- RSI below 35, MACD histogram rising red, indicating selling pressure

- Pair fell back to lows since August.

On Wednesday, the NZD/USD pair declined sharply by 1% to 0.5945, reflecting the strengthening US dollar across the board. This weakness suggests a shift in sentiment, as the New Zealand dollar has been unable to regain the key 20-day Simple Moving Average (SMA) and fell back to lows since August.

The technical outlook for NZD/USD remains bearish, as indicated by the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators. The RSI has remains deep in negative territory, reaching 35, and is declining sharply, suggesting that selling pressure is rising. The histogram of the MACD is red and rising, another sign of increasing selling pressure.

A break below 0.5950 could open the door to a test of 0.5900 and even 0.5850. On the other hand, a breakout above 0.6000 could pave the way for a move towards 0.6050 and 0.6100.

NZD/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.