NZD/USD ascends as greenback retreats on risk-appetite, sliding US yields

- NZD/USD hovers around the 0.6000 mark, benefiting from a softer Greenback as US Treasury bond yields experience a decline.

- US inflation data reveals a 3.9% YoY rise in PCE, easing pressures on the Fed to increase rates beyond the current 5.25%-5.50% range.

- Upcoming RBNZ decision and potential US government shutdown add elements of anticipation and uncertainty to the market’s future movements.

The New Zealand Dollar (NZD) climbs against the US Dollar (USD), sponsored by an improvement in market sentiment and a Greenback that is falling as US Treasury bond yields slide. The NZD/USD remains trading at around the 0.6000 mark, at the time of writing, gains 0.76%.

New Zealand Dollar gains ground, rising 0.76% against a weakening US Dollar, US inflation data eases Fed rate hike pressures

Wall Street is trading in a better mood, as the US Department of Labor revealed the US Federal Reserve’s preferred gauge for inflation, the Personal Consumption Expenditures (PCE), which rose by 3.9% YoY, below July’s 4%, while headline inflation was 3.5% YoY as expected, a tick up from the prior’s month 3.4%.

The data eases off pressure on the Fed to increase rates to a higher level past the current 5.25%-5.50% range. Although most policymakers remain hawkish, others remain more cautious and fear overtightening monetary policy. From those, San Francisco, Boston, and Chicago Fed Presidents Mary Daly, Susan Collins, and Austan Goolsbee commented that patience is required while they remain undecided in regard to the next FOMC decision.

Additional data from the University of Michigan (UoM) showed that Consumer Sentiment for September's final reading deteriorated, while inflation expectations ticked up to 3.2% from 3.1% for one year. Americans see inflation at 2.8% on a five-year horizon, up from 2.7%.

In the meantime, next week’s economic docket will feature the Reserve Bank of New Zealand (RBNZ) decision, in which the central bank is projected to hold rates unchanged. On the US front, if a possible US government shutdown is dodged, the S&P and ISM PMIs would be released on Monday, and a tranche of Fed speakers.

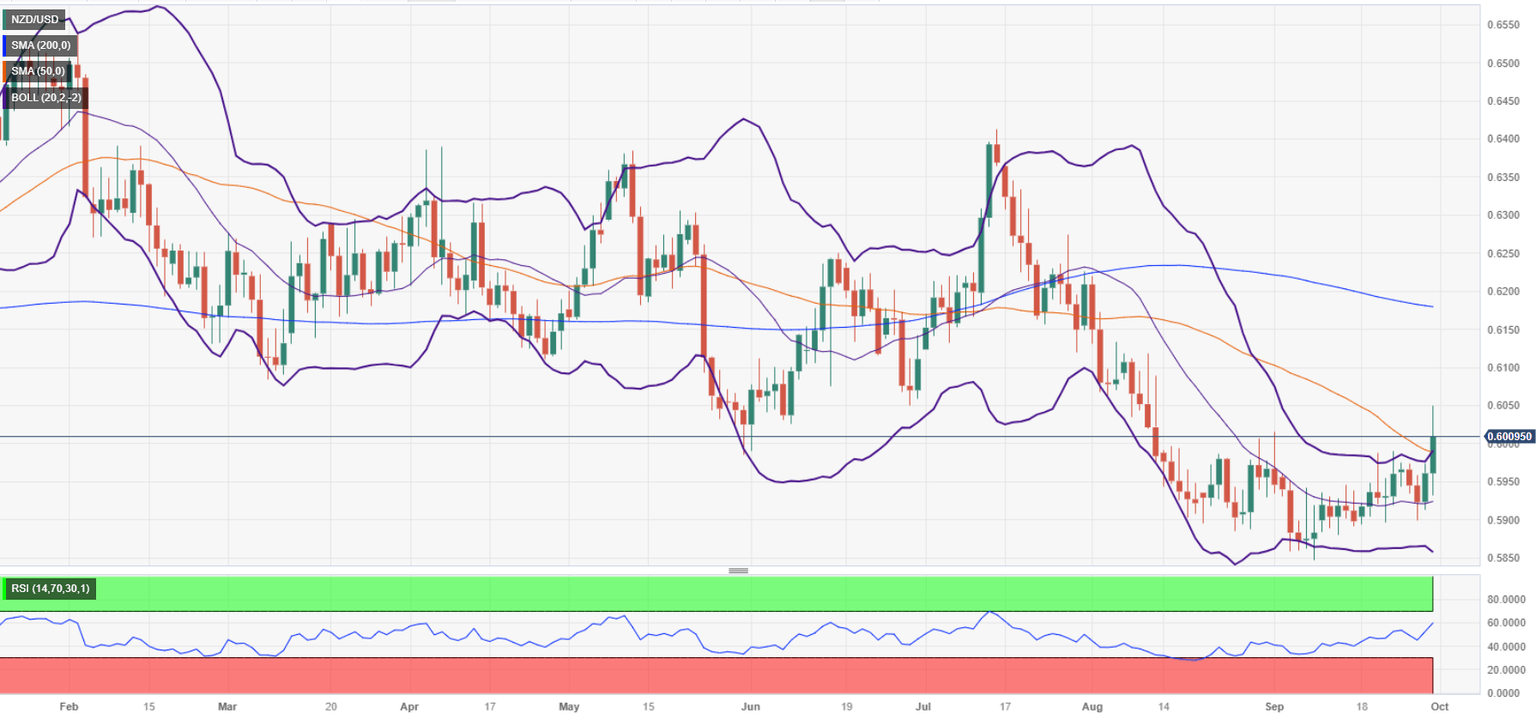

NZD/USD Price Analysis: Technical outlook

Despite rallying, the NZD/USD is downward biased despite reaching a 7-week high, and although it is trading above the 0.6000 figure, it needs a daily close above the latter to keep buyers hopeful of higher prices. Key resistance levels lie on the upside, like the June 29 daily low of 0.6050, followed by the 0.6100 mark. Conversely, if the pair ends below 0.6000, the first support would be the 50-day moving average (DMA) at 0.5986, followed by the psychological 0.5950 mark and the September 27 swing low of 0.5899.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.