NZD/JPY Price Analysis: Sharp decline extends bearish outlook

- NZD/JPY drops on Monday, settling at 87.95 as selling pressure intensifies.

- Momentum indicators remain subdued, reflecting persistent bearish sentiment.

- Key support levels are in focus as the pair approaches critical technical thresholds.

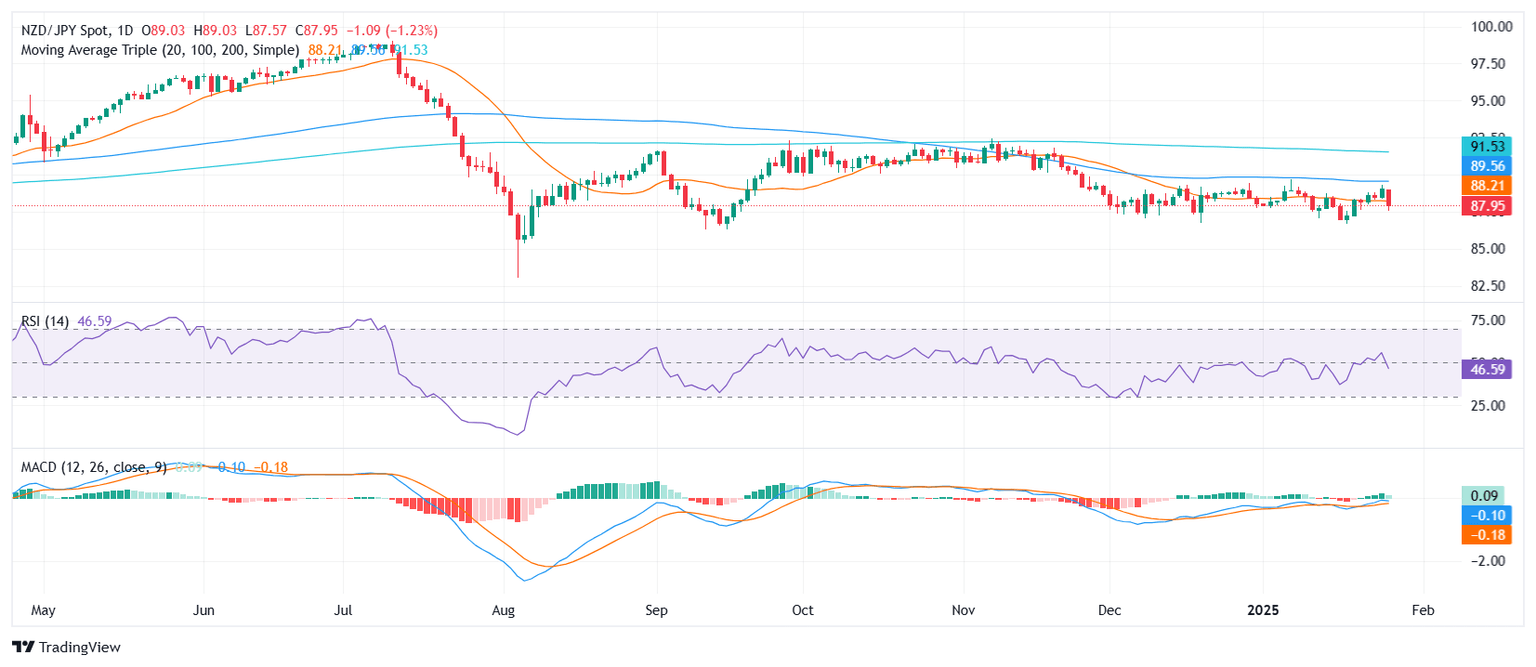

The NZD/JPY pair saw a steep decline on Monday, falling 1% to land at 87.95 dropping below its 20-day Simple Moving Average (SMA). This move extends the bearish trajectory observed in recent sessions, with the pair breaking below near-term support levels. The broader sentiment remains negative, as traders grapple with intensified selling pressure and uncertain momentum.

Technical indicators highlight the challenges facing NZD/JPY. The Relative Strength Index (RSI) has dropped sharply to 45, remaining in negative territory and signaling continued downward momentum. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram remains flat with green bars, pointing to a lack of directional clarity and suggesting that bearish momentum has yet to fully abate.

Traders will closely monitor critical levels for the next directional move. Immediate support is seen at 87.50, with a break below this potentially opening the door to 87.00. On the upside, resistance at 88.20 and the 20-day SMA must be reclaimed for any signs of recovery to materialize. Until then, the outlook is likely to remain bearish, with further downside risks dominating near-term sentiment.

NZD/JPY daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.