NZD/JPY Price Analysis: Pair stumbles below 100-day SMA, leaving rally in doubt

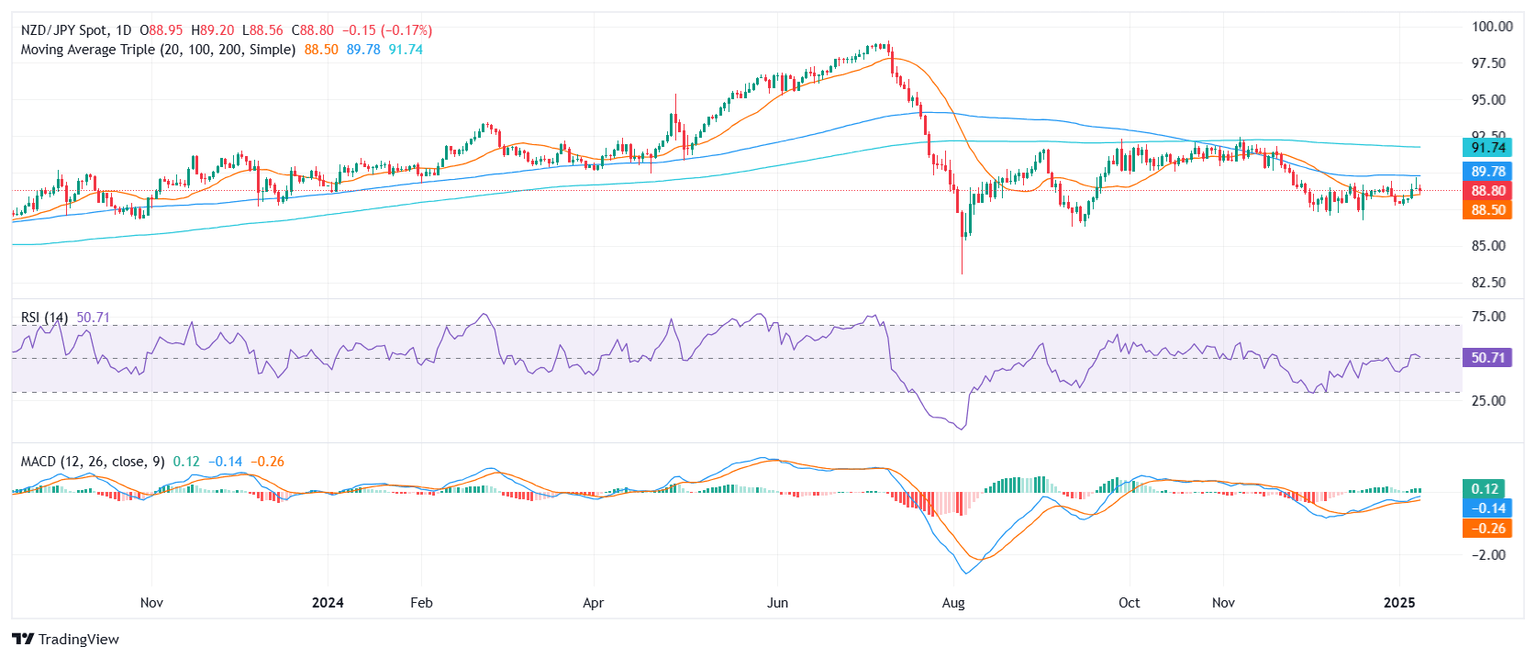

- NZD/JPY slips on Wednesday, hovering around 88.75 after failing to overcome a mid-week ceiling.

- RSI dips to 53 in positive territory, signaling a sudden loss of bullish momentum.

- MACD histogram shows flat green bars, hinting that the recent upside may be running out of steam.

NZD/JPY retreated on Wednesday, declining by 0.33% to settle near 88.75. Earlier attempts to break above the 100-day Simple Moving Average (SMA) near 90.00 faltered, curbing the pair’s recent rebound. The Relative Strength Index (RSI) has pulled back to 53, indicating fading buying interest, while the Moving Average Convergence Divergence (MACD) histogram remains flat, suggesting limited follow-through on the upside push.

Should the bulls continue to struggle at the 100-day SMA, the pair may face additional downside pressure. Immediate support levels could appear around 88.50, with a deeper drop targeting 88.00 if selling accelerates. Conversely, a clean break above the 100-day SMA might reignite bullish momentum, paving the way toward the 89.50 zone before encountering potential psychological resistance at 90.00.

NZD/JPY daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.