NZD/JPY Price Analysis: Pair Stabilizes Around 88.10 as Bears Take a Breather

- NZD/JPY stabilized at 88.10 on Wednesday after recent declines.

- Indicators flattened in negative territory, signaling a pause in bearish momentum.

- Bears remain in control, but oversold conditions could limit further immediate downside.

The NZD/JPY pair stabilized around 88.10 on Wednesday, following a decline earlier in the week that saw the pair drop towards the 88.00 level. While the bears remain in control, the recent pause suggests a potential breather as technical indicators show signs of flattening in negative territory.

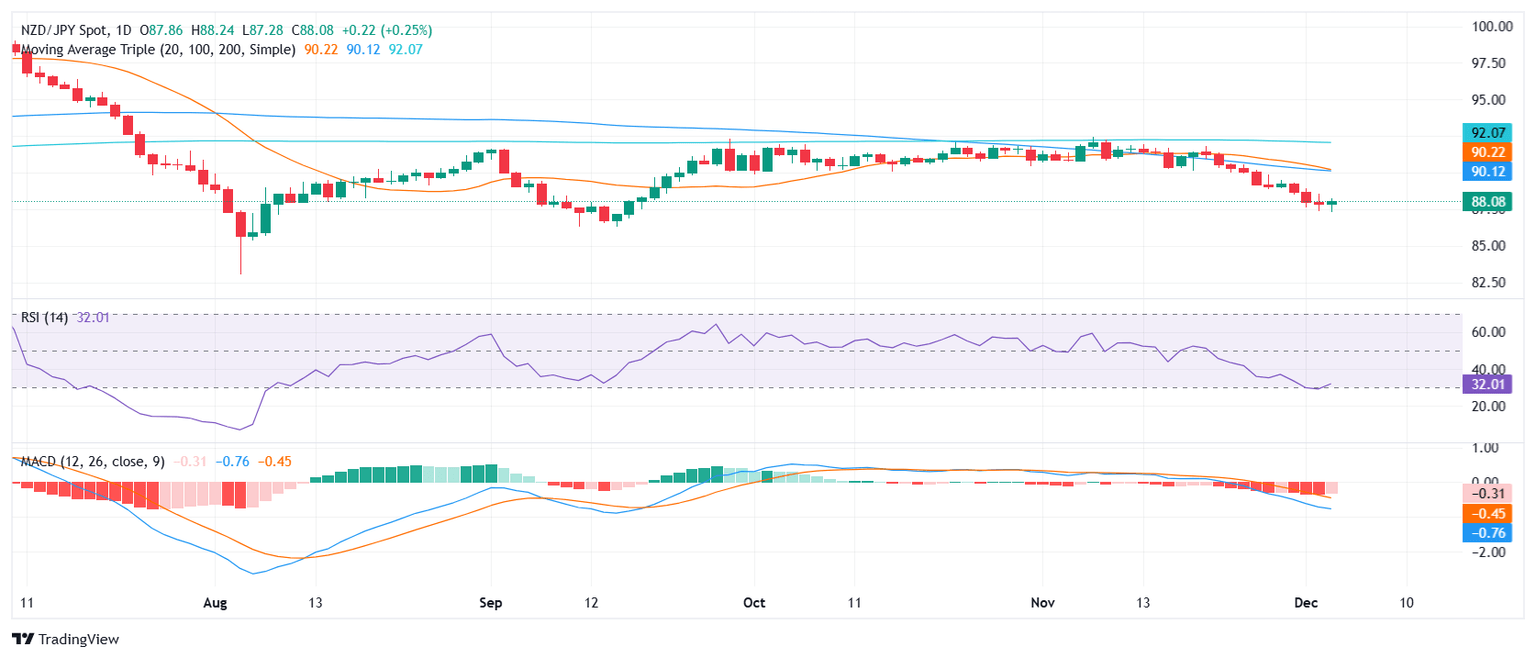

The Relative Strength Index (RSI) remains near oversold levels, currently at 32, reflecting subdued buying interest but signaling that further immediate downside might be limited. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram continues to print in the red but shows signs of stabilization, indicating weakening bearish momentum. This technical setup could prompt a period of consolidation before the next directional move.

On the upside, a recovery toward the 89.00 level could challenge bearish control, with 90.00 serving as a key resistance level for bulls. Conversely, if the bearish momentum resumes, the pair could retest the 88.00 level and potentially extend losses toward the 85.00-86.00 range.

NZD/JPY Daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.