NZD/JPY price analysis: Cross retreats near daily lows ahead of Asian session

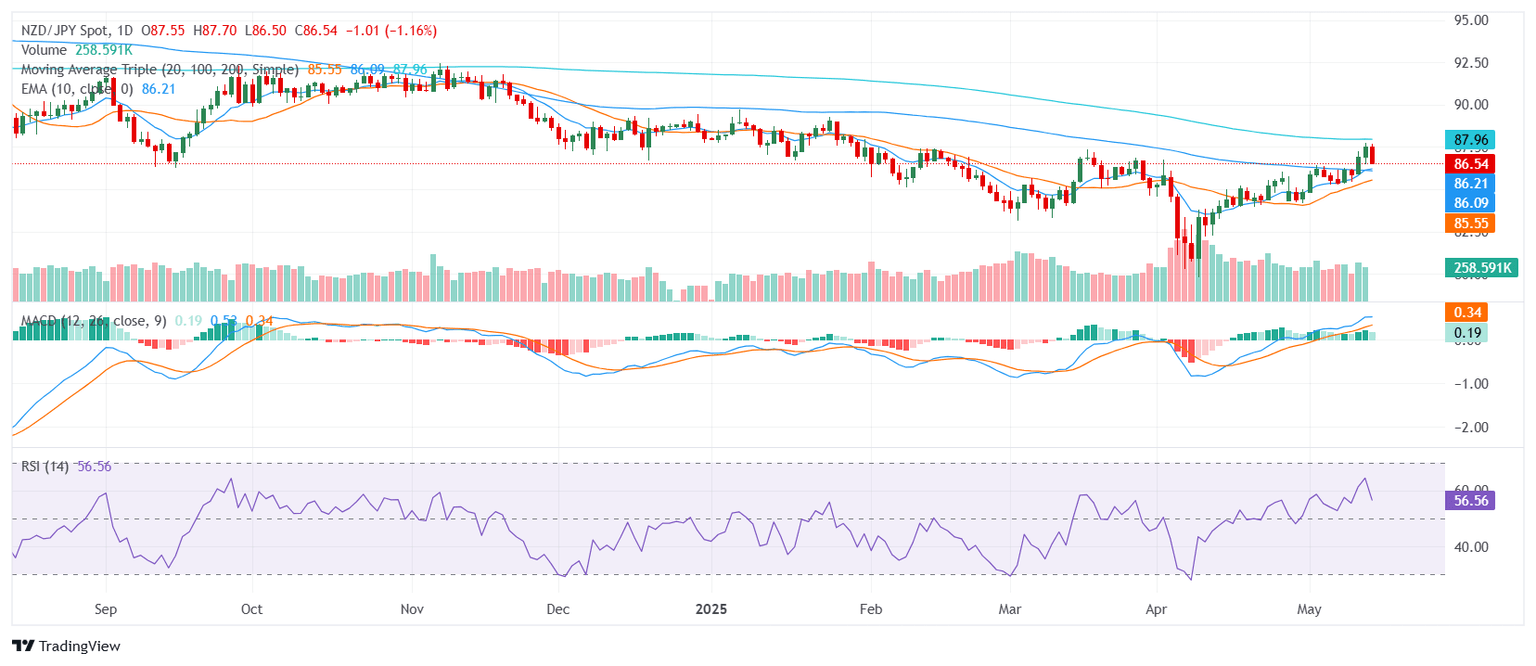

- NZD/JPY trades near the 86.50 zone, under pressure despite a broader bullish outlook.

- Momentum signals are mixed, with short-term averages supporting the upside but longer-term signals introducing caution.

- Key support rests around 86.20, with resistance near 87.20 and 87.60.

The NZD/JPY cross is trading near the 86.50 zone on Wednesday, down approximately 1% as it approaches the lower end of its daily range ahead of the Asian session. Despite maintaining a broader bullish signal, the cross has faced selling pressure, reflecting a mixed technical landscape as traders navigate recent volatility.

From a technical standpoint, the Relative Strength Index (RSI) hovers in the 50s, reflecting neutral momentum, while the Moving Average Convergence Divergence (MACD) indicates ongoing buy momentum, offering a more supportive tone for the cross. However, the Awesome Oscillator, sitting around 2, suggests a lack of clear directional strength, aligning with the broader mixed sentiment.

Adding to this cautious tone, the Stochastic %K (14, 3, 3) and Stochastic RSI Fast (3, 3, 14, 14) both remain in the 80s, signaling overbought conditions and hinting at potential near-term selling pressure. Despite this, the 20-day and 100-day Simple Moving Averages (SMAs) continue to support the buy side, as do the 10-period Exponential Moving Average (EMA) and 10-day SMA, both aligned in the 80s, reinforcing the overall positive outlook.

Immediate support is identified around 86.23, followed by deeper levels at 86.21 and 86.18. On the upside, resistance is expected near 87.21, with stronger barriers at 87.62 and 87.96, potentially capping gains in the short term.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.