NZD/JPY Price Analysis: Cross extends losses and falls to lows since mid-June

- NZD/JPY continued its significant decline in Friday's session.

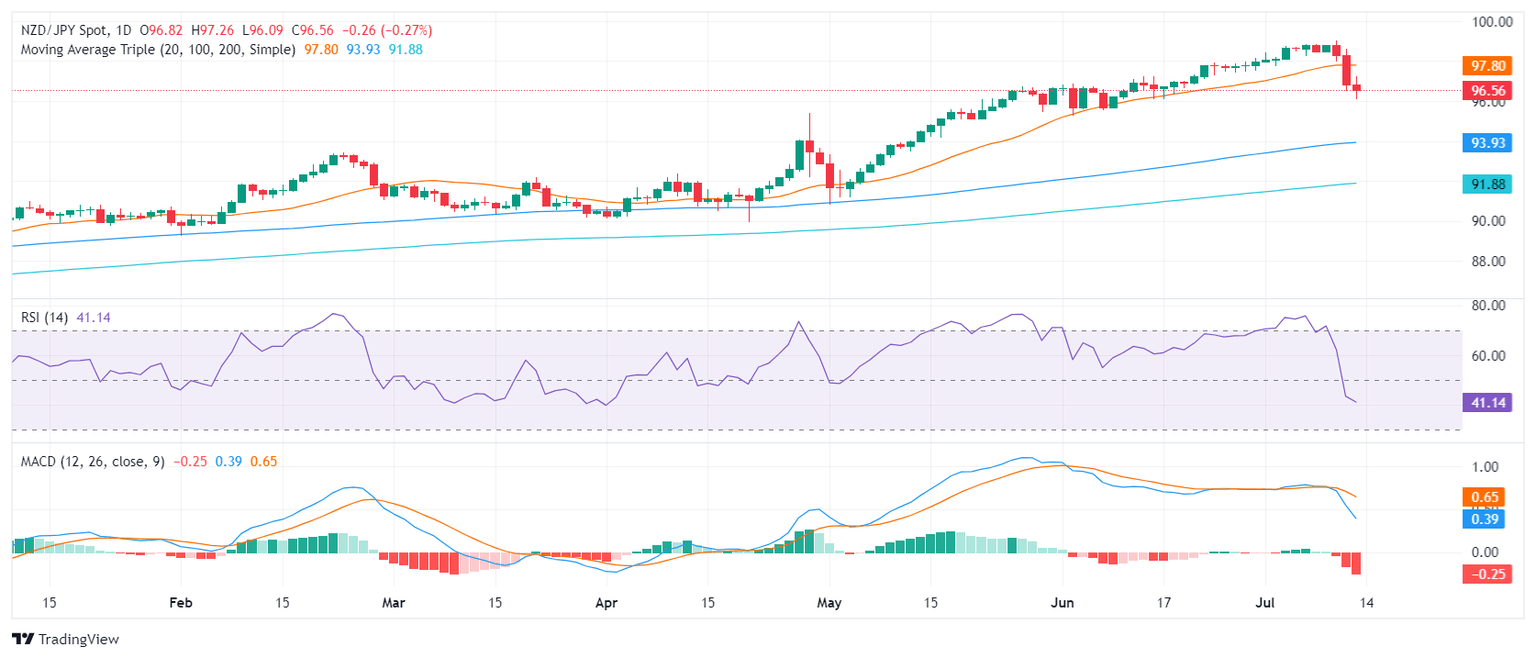

- The bearish activity remains with the pair below the crucial 20-day SMA, suggesting persistent control by the bears.

- Indicators in negative terrain now signal a bearish short-term outlook for the pair.

During Friday's trading session, the NZD/JPY pair continued its substantial drop from Thursday, recording a further loss of 0.20% and settling at 96.65. The pair remains well below the 20-day Simple Moving Average (SMA) of 97.80, reinforcing the bearish outlook in the short term.

The daily chart signals sustained negative conditions. The Relative Strength Index (RSI) improved slightly from Thursday's session but still remains in the negative territory at 40, indicating a continued declining market momentum. The Moving Average Convergence Divergence (MACD) concurs with this scenario, printing rising red bars indicative of rising selling activity.

NZD/JPY daily chart

Bearing in mind the bearish momentum, immediate support levels lie at 96.50 96.00, and 95.50. Breaking these points would further validate the bearish perspective. On the other hand, resistance encounters are expected at past support levels of 97.00, 97.70 (20-day SMA), and the critical level of 98.00.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.