NZD/JPY Price Analysis: Bulls push slightly up, testing resistance near 90.30

- NZD/JPY rose to 90.20 in Wednesday's session.

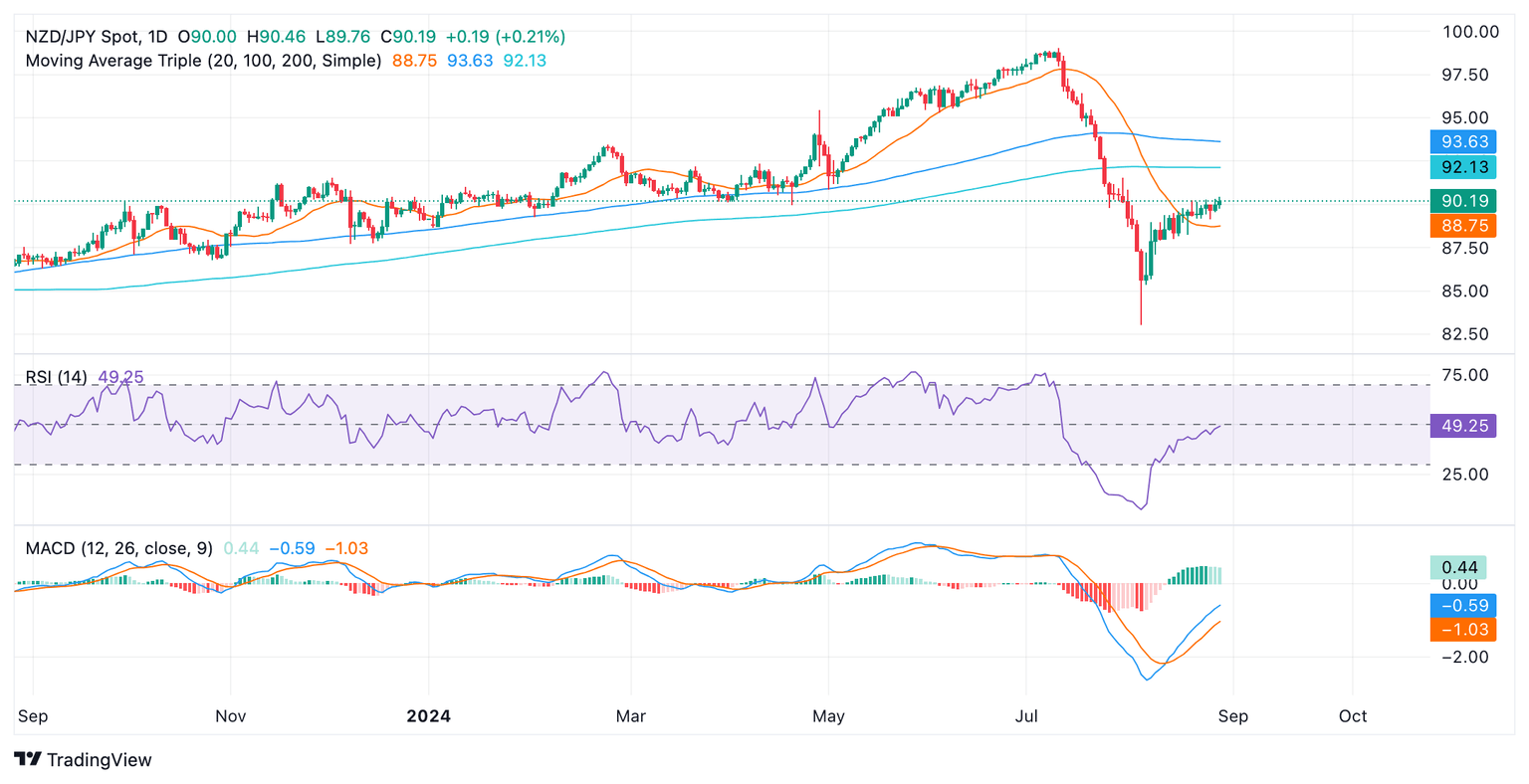

- The RSI is rising within neutral terrain, indicating increasing buying pressure.

- The MACD is flat green, suggesting that the buyer’s traction remains weak.

The NZD/JPY pair rebounded slightly in Wednesday's following session to settle around 90.20. Technical indicators are hinting that the pair might be approaching a bullish breakout in the short term as buyers seem to be waiting for a catalyst to test the 90.50 area.

The Relative Strength Index (RSI) is rising towards neutral terrain, currently at 49, indicating that buying pressure is increasing. This reading suggests that the pair is likely to continue its upward movement and challenge the resistance at 90.50. The Moving Average Convergence Divergence (MACD) is also showing a neutral bias, with flat green bars indicating that the bullish momentum is neither gaining nor losing strength.

NZD/JPY daily chart

As the pair seems to be gaining strength and with the RSI rising, the cross might continue trading within the 89.20-90.50 channel. A break above these levels might set the pace for the short term.

.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.