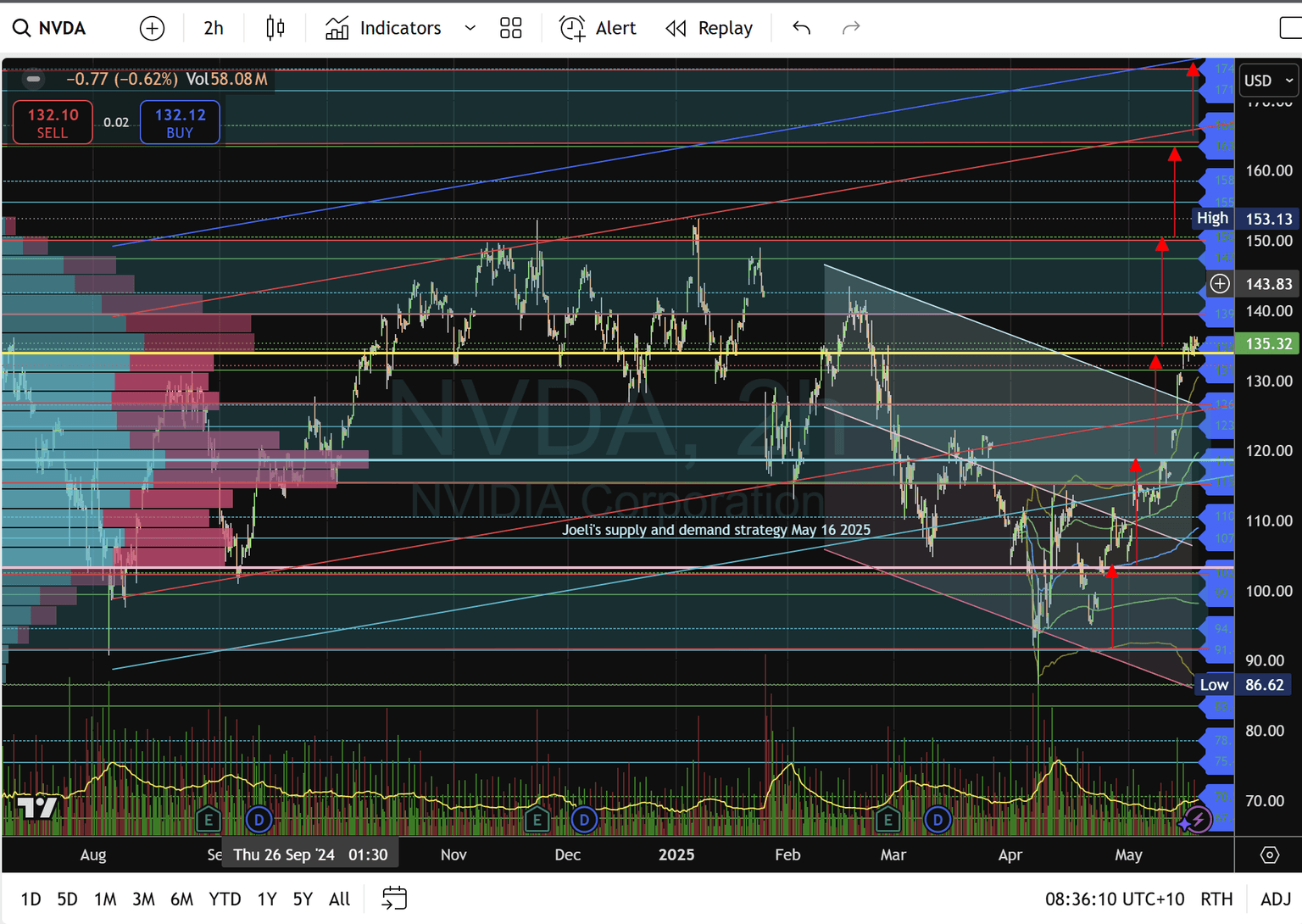

NVIDIA's next leg up: Bullish breakout sets sights on $163–$174 after clearing $135

Breaking $135 opens the door to $163–$174 amid AI data-centre demand and institutional flows.

Highlights

-

NVDA cleared the 131.42–134.48 demand zone and closed at 135.32 on May 16.

-

Volume-profile POC (115.43–126.48) now acts as strong support; VWAP remains bullish.

-

Near-term targets: 139.42 (VAH), 142.47, then all-time high 153.13.

-

Pullback entry zone: 131.42–134.48; stop-loss below 131.42 (or 126.48 for wider buffer).

-

Key catalysts: May 28 Q1 earnings, AI data-centre capex updates, China export regulations.

Technical analysis

Price structure and channels

NVDA has re-entered its medium-term bullish channel after reclaiming 126.00, rallying from 102.50 to 135.32 in six weeks. Higher highs and higher lows within the ascending regression channel confirm sustained buyer conviction.

Volume profile and VWAP

-

Value area (115.43–126.48): High-volume node providing demand support.

-

VWAP: Price has held above the VWAP midline since early April, signalling institutional accumulation.

Key levels

- Support:

- 131.42–134.48 (breakout retest zone)

- 126.48 (prior VAH)

- 115.43 (POC)

- Resistance:

- 139.42 (VAH)

- 142.47

- 153.13 (all-time intraday high)

- 163.40–174.45 (upper channel boundary)

Fundamental drivers

-

AI & data-centre demand: Q1 Data Centre revenue hit $22.6 billion (up 427% YoY), driven by hyperscaler orders for Hopper/Blackwell GPUs.

-

Strategic partnerships: The new 500 MW AI data-centre partnership with Saudi firm Humain initially deployed 18,000 GB300 chips.

-

Earnings outlook: Consensus expects Q2 revenue of ~$28 billion and double-digit EPS growth into FY 2026.

- Valuation & upgrades: Recent price-target raises from UBS, Melius, and others reinforce a constructive outlook amid a $3 trillion market cap.

Outlook and trading plan

-

Bullish continuation

-

Aggressive entry: Long on daily close > 134.48; target 139.42 → 142.47.

-

Conservative entry: Wait for pullback into 131.42–134.48; confirm demand with uptick in volume.

-

-

Risk management

-

Stop-Loss: Below 131.42 for breakout entries; below 126.48 for deeper buffers.

-

-

Profit taking

-

Scale out 25–50% at 139.42; next tranche at 142.47.

-

Trail stops to lock in gains on remaining position, aiming for 153.13 and beyond.

-

-

Watchlist catalysts

-

May 28 Q1 earnings: Guidance and margin outlook.

-

AI Capex trends: Announcements from major data-centre customers.

-

Geopolitical & regulatory: China export rules, U.S. trade policy updates.

-

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.