Nvidia's blackwell chips: Raising the bar in generative AI

Key points

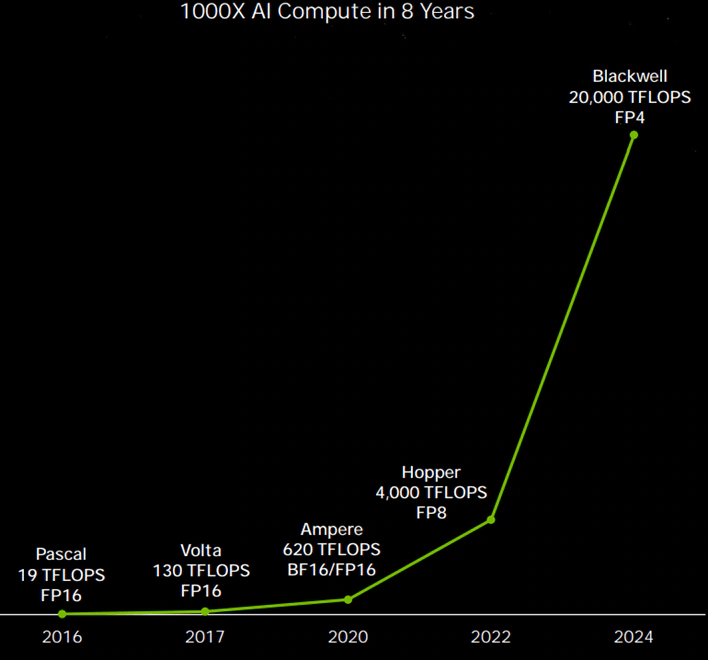

Revolutionary performance: Nvidia's Blackwell chips offer up to 4x faster training and 30x faster inference than their predecessor, the Hopper H100, making them a game-changer in AI computing. They are also far more energy efficient, helping to reduce the carbon footprint.

Big tech adoption: Companies like Amazon, Microsoft, Google, Tesla and Oracle are integrating Blackwell into their AI infrastructure, driving innovation across various sectors.

Risks to consider: Despite its potential, Blackwell faces challenges, including competition, AI spending pullbacks, regulatory scrutiny, supply bottlenecks and possible restrictions in the China market.

Nvidia's Blackwell chips are set to make a major impact, with billions of dollars in shipments expected to start in Q4 (quarter ending January 2025). The Blackwell family includes the B200 GPU and the GB200 system, succeeding the Hopper H100 series.

Here's how Blackwell differentiates itself:

Processing power & efficiency: Blackwell GPUs offer up to 4x faster training and 30x faster inference compared to the H100. They enable large AI models to be trained more efficiently with a lower carbon footprint by connecting multiple GPUs and incorporating accelerated decompression of data formats.

Scalability: The GB200 NVL72 system combines 36 GB200 Superchips into a single GPU, with each GB200 linking two B200 GPUs to a Grace CPU. This setup maximizes processing power and efficiency.

Energy efficiency: Training a version of the GPT model that powered ChatGPT will require only 2,000 Blackwells and 4 megawatts of energy, compared to 8,000 Hoppers and 15 megawatts for the same task.

Source: Nvidia

Big tech's adoption: Driving AI infrastructure

Leading tech giants like Alphabet, Microsoft, and Meta Platforms are set to be early adopters of Nvidia's Blackwell GPUs. These companies plan to integrate Blackwell into their AI infrastructure to power various applications—from AI-driven search and social media algorithms to advanced cloud services.

Some examples include:

-

Amazon: Blackwell will be included in AWS’s upcoming AI supercomputer, “Project Ceiba,” which will handle 414 exaflops of AI tasks. This system will support research in digital biology, robotics, and climate prediction.

-

Microsoft: GB200 will be on datacentres globally and enhance Azure instances, leveraging the GB200 and Nvidia’s Quantum-X800 InfiniBand networking for advanced AI functions.

-

Google: Google Cloud will adopt Blackwell for its cloud environment and offer DGX Cloud services. Blackwell GPU will also be used in Google DeepMind to accelerate future discoveries.

-

Oracle: Oracle will integrate Grace-Blackwell into its OCI Supercluster and OCI Computer services.

Beyond big tech: Sectors poised to benefit

Other industries stand to gain significantly from Blackwell's advancements:

-

Cybersecurity: Improved real-time threat detection and response through enhanced AI processing.

-

Healthcare: Accelerated drug discovery and enhanced medical imaging analysis.

-

Automotive: Advanced driver-assistance systems (ADAS) and autonomous driving technology.

-

Telecommunications: Optimized 5G networks and edge computing applications.

-

Energy and electric utilities: Enhanced grid management, renewable energy simulation, and smart infrastructure.

Risks: Navigating competition and constraints

Despite its potential, Blackwell faces several risks:

-

Competition: AMD remains a formidable competitor, and major clients like Amazon, Google, and Microsoft are developing their own chips.

-

AI spending pullback: Economic uncertainties may lead companies to scale back AI investments, affecting demand for Blackwell chips.

-

Regulation: Increased regulatory scrutiny around AI and data privacy could impact growth.

-

China market restrictions: Blackwell may not be sold in China due to U.S. export restrictions. Nvidia is working on compliant chips for the Chinese market.

-

Supply chain: Ongoing constraints may affect Nvidia’s ability to meet demand. Further delays or design issues could impact Nvidia's growth.

-

Technological shifts: Nvidia has released a new architecture approximately every two years, but rapid advancements may alter this cadence. The next architecture, Rubin R100, is expected in 2025.

Conclusion: Nvidia's role in the AI revolution

Nvidia's Blackwell chips represent a major leap in AI computing, positioning Nvidia as a leader in the AI “gold rush.” For long-term investors, Nvidia's role as a key enabler in AI infrastructure offers substantial potential, despite the associated risks.

Read the original analysis: Nvidia's blackwell chips: Raising the bar in generative AI

Author

Saxo Research Team

Saxo Bank

Saxo is an award-winning investment firm trusted by 1,200,000+ clients worldwide. Saxo provides the leading online trading platform connecting investors and traders to global financial markets.