Nucor expects Q4 earnings to dip on seasonality, stays bullish on 2026

Key takeaways

- NUE expects Q4 EPS of $1.65-$1.75, below Q3 but above the year-ago quarter.

- Nucor sees lower steel mill and products profits from softer volumes, margin pressure and higher costs.

- NUE returned about $1.2B in 2025 via buybacks and dividends and cites higher backlogs into 2026.

Nucor Corporation (NUE - Free Report) has provided an earnings outlook for the fourth quarter ended Dec. 31, 2025, in the range of $1.65 to $1.75 per share. While this guidance implies a sequential decline from the $2.63 reported in the third quarter of 2025, it indicates an improvement over $1.22 per share recorded in the fourth quarter of 2024.

The company attributed the anticipated quarter-on-quarter decline across its businesses to seasonal factors and fewer shipping days. Within the steel mills segment, earnings are expected to moderate due to lower shipment volumes and margin pressure, particularly in sheet products.

The steel products segment is also forecast to see reduced profitability, reflecting lower volumes and higher average costs per ton, partly offset by improved realized pricing. Meanwhile, the raw materials segment is expected to underperform because of two planned outages at Nucor’s direct reduced iron facilities.

Nucor prioritizes shareholders, upbeat on 2026 demand

Despite the earnings softness, Nucor continues to emphasize shareholder returns. During the quarter, the company repurchased around 0.7 million shares at an average price of approximately $145.23, bringing total year-to-date repurchases to about 5.4 million shares at an average cost of roughly $128.66 per share. Including dividends, Nucor has returned about $1.2 billion to shareholders year to date in 2025.

Management struck an optimistic tone for 2026, highlighting materially higher order backlogs compared with the prior year, particularly across construction-related end markets such as energy, infrastructure, data centers and manufacturing. The company also expects a gradual improvement in market conditions, supported by favorable monetary, tax and trade policies. Nucor is scheduled to report fourth-quarter results after market close on Jan. 26, 2026.

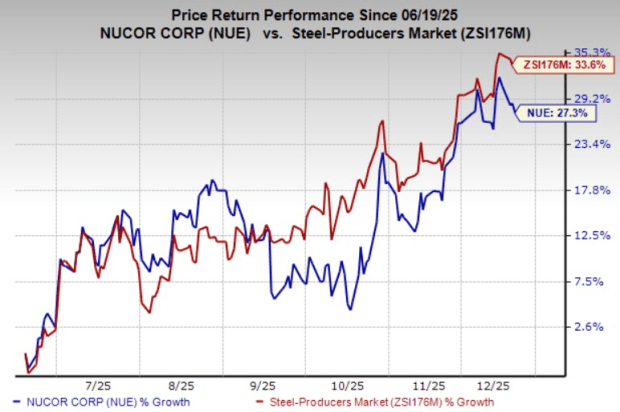

Shares of NUE are up 27.3% in the past six months compared with the industry’s 33.6% rise.

Image Source: Zacks Investment Research

NUE Zacks rank and key picks

NUE carries a Zacks Rank of #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Commercial Metals Company (CMC - Free Report) , Ternium S.A. (TX - Free Report) and Centerra Gold, Inc. (CGAU - Free Report) . CMC sports a Zacks Rank #1 (Strong Buy), while TX and CGAU carry a Zacks Rank of #2 (Buy).

The Zacks Consensus Estimate for CMC’s current fiscal-year earnings is pegged at $7.05 per share, indicating a 125.24%% year-over-year increase. Shares of CMC have surged 42.7% over the past six months.

The Zacks Consensus Estimate for TX’s current fiscal-year earnings stands at $2.96 per share, implying a 84% year-over-year increase. Shares of TX have jumped 27.7% over the past 6 months.

The Zacks Consensus Estimate for CGAU’s current fiscal-year earnings is pegged at 97 cents per share, indicating a 37% year-over-year increase. Its earnings beat the Zacks Consensus Estimates in three of the trailing four quarters and missed once, with the average earnings surprise of 22%.

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days. Click to get this free report

Author

Zacks

Zacks Investment Research

Zacks Investment Research provides unbiased investment research and tools to help individuals and institutional investors make confident investing decisions.