Northern Star Resources Ltd – NST stock analysis and Elliott Wave technical forecast [Video]

![Northern Star Resources Ltd – NST stock analysis and Elliott Wave technical forecast [Video]](https://editorial.fxsstatic.com/images/i/stock-01_XtraLarge.jpg)

ASX: NST Elliott Wave technical analysis – One-day chart

Today’s Elliott Wave update focuses on NORTHERN STAR RESOURCES LTD – NST listed on the Australian Stock Exchange (ASX).

Our technical analysis suggests that ASX:NST is likely entering a short-term bearish trend, potentially heading towards 16.86. Based on our assessment, a bullish reversal is not expected at this point.

-

Trend function: Major Trend (Minor Degree - Grey).

-

Market mode: Motive.

-

Wave structure: Impulse.

-

Wave position: Wave C) - Orange of Wave 4)) - Navy.

Detailed outlook

Currently, Wave 4)) - Navy is unfolding downward, appearing to develop as an ABC - Orange Zigzag.

Wave A)B) - Orange seems completed, and since the high at 22.78, Wave C) - Orange has likely started to move lower.

The projected target is around 16.86, showing no signals of a bullish setup.

- Invalidation level: 23.78.

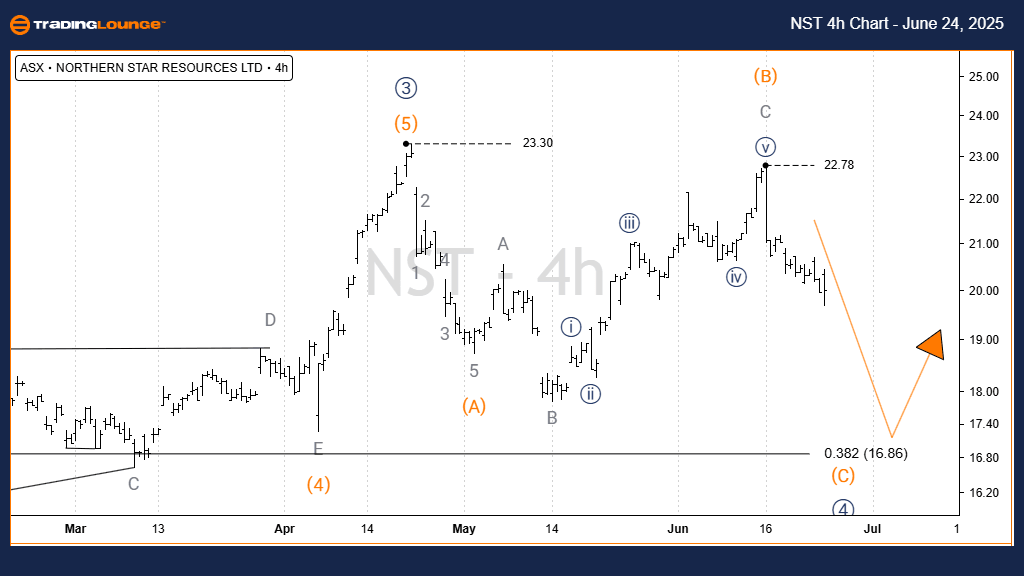

NST Elliott Wave technical analysis – Four-hour chart

-

Trend function: Major Trend (Minor Degree - Grey).

-

Market mode: Motive.

-

Wave structure: Impulse.

-

Wave position: Wave C) - Orange of Wave 4)) - Navy.

Details:

In the shorter 4-hour timeframe, no bullish evidence is observed.

After the high at 22.78, Wave C) - Orange appears to continue declining toward 16.86.

- Invalidation level: 22.78

Conclusion

This analysis delivers a contextual understanding of short-term trends for ASX: NST.

We identify key levels that act as validation or invalidation signals, aiding the accuracy of our wave counts.

Our goal is to offer a clear, professional insight into current market trends, helping traders make informed decisions.

NST stock analysis and Elliott Wave technical forecast [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.