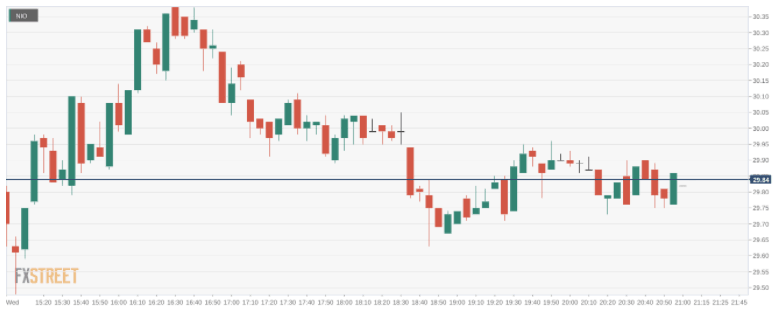

NIO Stock Price: Nio Inc retreats as EV investors jump back to Tesla stock

- NYSE: NIO fell by 0.96% during Wednesday’s trading session.

- EV Stocks fell as investors pile back into Tesla following Musk’s announcement.

- Nio’s catalysts should have investors excited for 2022.

NYSE: NIO pulled back below the $30 price level on Wednesday as the EV sector was mostly mixed following Tuesday’s bull rally. Shares of NIO fell by 0.96% on Wednesday and closed the trading session at $29.87. All three major indices closed higher once again on Wednesday, led once again by the NASDAQ which posted a 1.18% gain. The NASDAQ’s resiliency this week has led some investors to believe that the recent sell off in growth names may have found a bottom. The Dow Jones added 261 basis points and the S&P 500 also climbed higher by 1.02% giving investors an inkling of hope that the Santa Claus Rally could be here in time for Christmas after all.

Stay up to speed with hot stocks' news!

Electric vehicle stocks had a mixed session on Wednesday, as Nio and electric truck maker Rivian (NASDAQ: RIVN) showed weakness. Nio’s rivals XPeng (NYSE:XPEV) and Li Auto (NASDAQ: LI) did manage to climb higher by 4.55% and 1.43% respectively, while Lucid Group (NASDAQ:LCID) eked out a minimal gain before the closing bell. The big winner on Wednesday was industry leader Tesla (NASDAQ: TSLA) which surged by 7.49% on the news that CEO Elon Musk has completed his sale of 10% of his stake to cover his taxes for the year.

NIO stock news

Nio’s recent NIO Day event was received positively by investors and analysts, but the stock hasn’t quite reflected that this week. The excitement over the new ET5 sedan has been somewhat muted, and further European expansion next year could already have been baked into the stock’s performance. No matter what the stock is doing right now, the catalysts that Nio presented should have investor’s excited for the future.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet