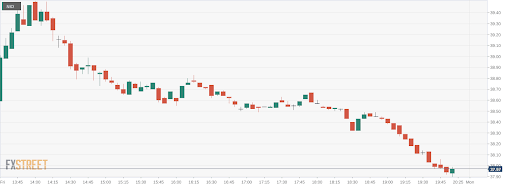

NIO Stock Price and News: Nio gains early but falls late in a volatile session to close the week

- NYSE:NIO fell by 1.22% on Friday to close out a difficult week for the stock.

- Nio had rebounded from the sell-off earlier this week, but fell into the close.

- The company debuted its ET7 sedan in Europe and announced the German launch.

NYSE:NIO investors are growing accustomed to the volatility, as the stock closes out another week of losses. Nio fell by 5.36% this week, and is down nearly 14.0% during the past month. On Friday, shares of Nio dipped by 1.22% to close the week at $37.98. It was a bearish session all around for electric vehicle stocks, as Tesla (NASDAQ:TSLA) dropped by 2.46%, XPeng (NYSE:XPEV) fell by 2.11%, and Li Auto (NASDAQ:LI) lost 1.40% during the day.

Stay up to speed with hot stocks' news!

On Wednesday, Nio sent investors reeling when it announced late in the day that it would raise $2 billion of capital. The stock dropped by over 5.0% the following day, as the market overreacted to a fairly common business tactic, particularly for growth companies in volatile sectors. Nio also has a healthy balance sheet, so the decision obviously sparked some confusion amongst investors. Nio investors had mostly accepted the decision by the next session, and the stock had recovered most of the losses by Friday, until a late dip by the broader markets sent Nio tumbling into the red.

NIO stock forecast

Nio continued its European expansion on Friday as it showcased its ET7 sedan. The vehicle was only recently unveiled in China earlier this year, but is now set to launch in Germany, a market Nio is planning to enter by 2022. There are still no announcements regarding charging stations or battery swap stations like the company does in China and Norway.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet