NIO Stock News: Nio poised to challenge critical $20.00 level

- NYSE:NIO edges lower on Tuesday despite substantial gains in Wall Street.

- AliBaba executives were questioned regarding a cyber security breach.

- BYD stock tumbles on fears that Warren Buffett is selling his stake in the EV maker.

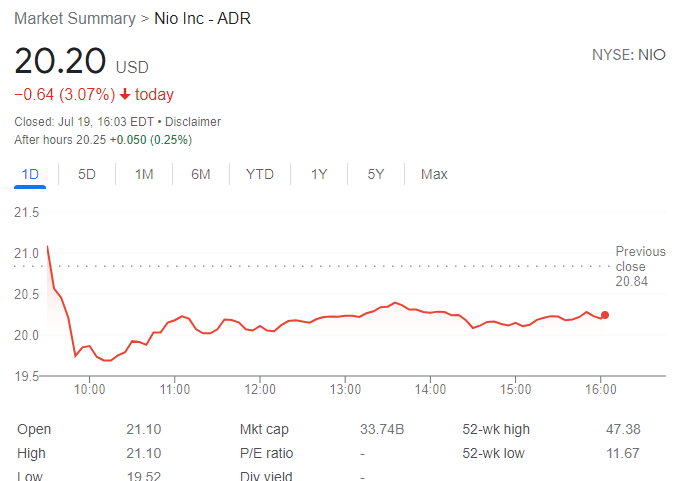

Update: Nio stock finished Tuesday at $20.20, down 3.07% on the day, hit by concerns about additional capital needs. The better market mood prevented the share from collapsing while easing recession fears boosted Wall Street. The Dow Jones Industrial Average added 754 points, while the best performer was the Nasdaq Composite, up 3.11%. The S&P 500 gained 105 points or 2.76%, moving off bearish territory.

Stocks started rallying in Europe, on market talks hinting at a potential 50 bps rate hike in the Union. Later in the day, the European Commission announced it would lift some sanctions on Russian banks to resume food trade, while Gazprom is said to resume providing gas to the Union as planned on July 21. Meanwhile, the latest US macroeconomic figures showed the economy remains resilient, partially cooling recession concerns. Nevertheless, the Treasury yield curve remains inverted, a worrisome sign for speculative interest.

Previous update: Nio stock is down sharply, off 5.8% at $19.63, in Tuesday's morning session. This is taking place despite all three US indices riding higher on the day. The Nasdaq is up 1%, the S&P 500 is up 1.4%, and the Dow is in between the two at 1.2% at the time of writing. Competitors Xpeng (XPEV) and Li Auto (LI) are down 5.4% and 4.7%, respectively, at the time of writing, so it would seem to be the case that the still extant worries over Chinese government crackdowns may still be affecting share prices. Call contracts for the $20 strike expiring this Friday fell 59% in value this morning to trade at $0.51. Still 6,200 contracts traded hands.

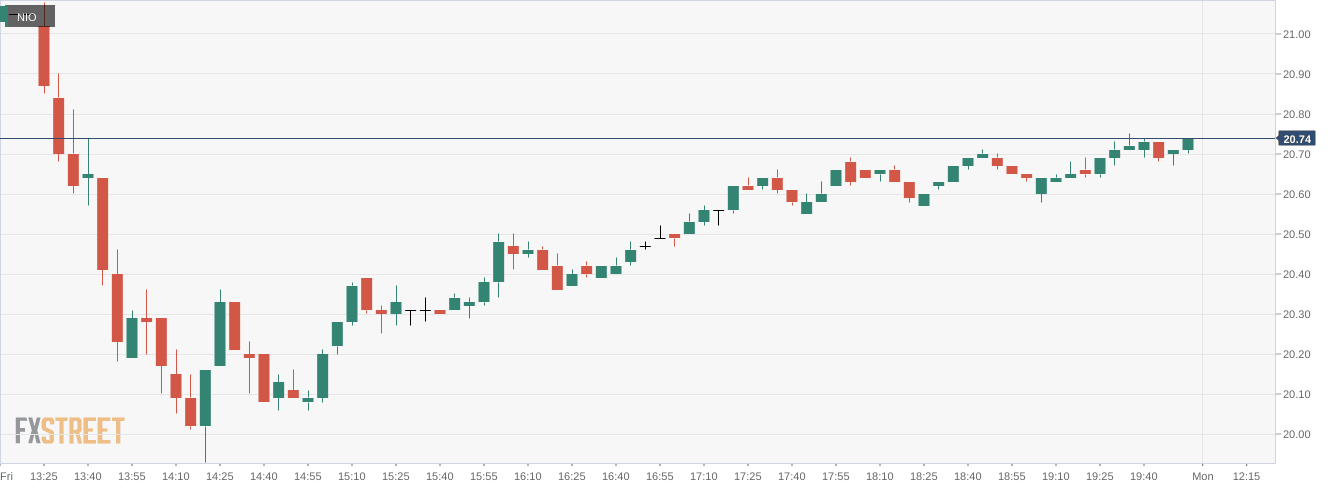

NYSE:NIO dipped lower to close the week as renewed crackdowns on Chinese tech companies sent ADR stocks tumbling into the weekend. On Friday, shares of Nio fell by 1.57% and closed the trading week at $20.72. Stocks soared higher on Friday as investors shrugged off the record CPI report from June and a mixed start to Wall Street earnings season. Overall, the Dow Jones jumped higher by 658 basis points, the S&P 500 rose by 1.92%, and the NASDAQ posted a 1.79% during the session.

Stay up to speed with hot stocks' news!

Chinese stocks were trading lower in both the American and Asian trading sessions on Friday. AliBaba (NYSE:BABA) executives were being questioned by Chinese authorities on the country’s largest known cyber security breach. In other news, Tencent has also been forced to close down one of its NFT Marketplace sites, due to not complying with government regulations. It’s a reminder to investors that regulation will continue to have an effect on these businesses into the future, and that ADR stocks like Nio and AliBaba could fall further before turning things around.

NIO stock forecast

Nio-rival and Chinese electric vehicle market leader, BYD, saw its share price tumble earlier this week. The fear is over belief that Warren Buffett might be pulling out his stake in the company, which is equivalent to about 20% of the outstanding shares in Hong Kong. The reason for the fear is that there is an order for 225 million shares of BYD in the Hong Kong Stock Exchange clearing system. This matches Buffett’s position, although neither Berkshire Hathaway or BYD have commented on the matter.

Previous updates

Update: NIO fell sharply from a six-day high of $21.80 but managed to end Monday 0.58% higher at $20.84, having defended the $20.50 psychological barrier. The negative shift in the market perception of risk sentiment after a report that Apple Inc. would slow hiring and spending knocked down the major US indices at the start of the week. The downside in the NIO stock price still remained cushioned as investors cheered easing bets of aggressive Fed tightening. China’s pledge to support economic growth also saved the day for NIO stock buyers. Earnings of the tech companies will be closely examined this week for fresh trading direction in the stock price of the Chinese Electric Vehicle (EV) maker.

Update: NIO share trimmed early gains and finished Monday at $20.85, barely 0.63% up on the week's first trading day. Wall Street rallied ahead of the opening as investors welcomed upbeat US data released on Friday but closed the day in the red. The Dow Jones Industrial Average lost 216 points, while the Nasdaq Composite finished the day 0.81% lower. The S&P 500 lost roughly 1%, as optimism was short-lived. Market players are waiting for central banks' monetary policy announcements, the European Central Bank is scheduled for this week, while the US Federal Reserve for the next one. Investors are concerned about the slower economic performance and constant price pressures, the latter indifferent to aggressive quantitative tightening.

Update: NIO shares advanced 4.4% to $21.63 on Monday morning after a general risk-on mood embraced markets. Bitcoin advanced more than 7%, which acts as a sort of risk barometer in markets. More than 8,000 call contracts expiring this Friday were purchased in the first hour at the $21, $21.50 and $22 strike prices. Premiums on the three strikes jumped 59% or more from Friday's prices as buyers make an optimistic bet on Nio's short-term price movement.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet