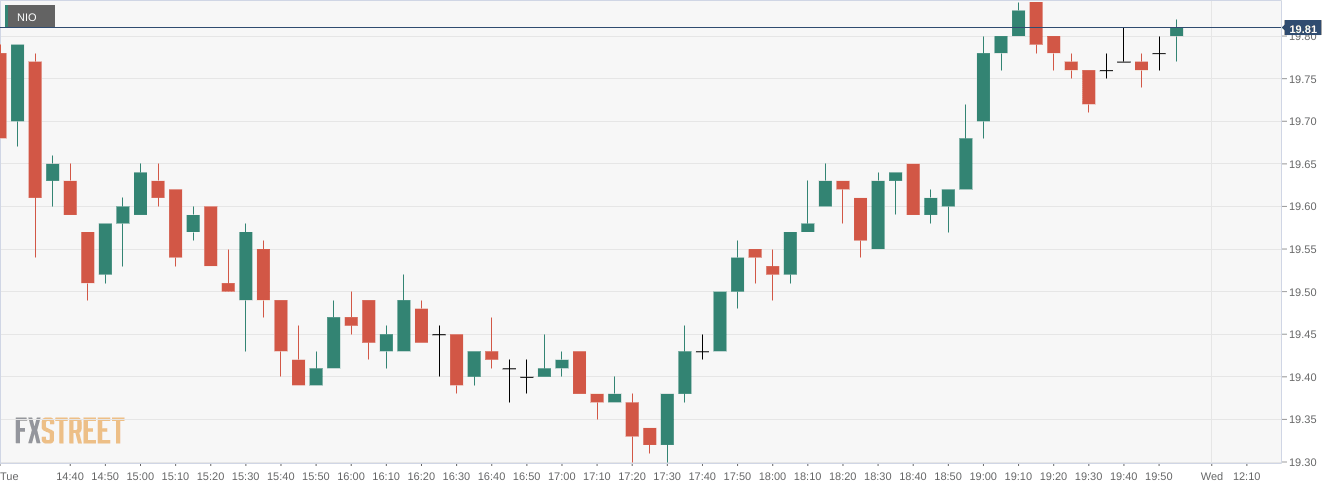

NIO Stock News: Nio is flat on Wednesday despite market optimism

- NYSE:NIO gained 0.10% during Tuesday’s trading session.

- Chinese EV makers are preparing to report August deliveries on Thursday.

- Warren Buffett trims his stake in BYD ahead of the deliveries report.

UPDATE: Nio's share price has mostly been flat on Wednesday even as the Nasdaq jumped at the start of the session. An hour into the regular session, NIO is off half a percentage point at $19.75, while the Nasdaq is up more than 0.3%. Deutsche Bank cutting its price target on NIO from $45 to $39 on Monday is still not helping sentiment ahead of earnings. Originally estimated to come in mid-August, NIO is now scheduled to deliver Q2 earnings on September 7.

NYSE:NIO investors shrugged off the price downgrade from Deutsche Bank on Monday and managed to push Nio higher despite the markets continuing to fall. On Tuesday, shares of Nio inched higher by 0.10% and closed the trading session at $19.83. Stocks extended their declines on Tuesday as all three major indices once again closed lower. The move lower came after a better than expected job openings report suggested that the US economy continues to be stronger than most believe. Overall, the Dow Jones dropped lower by 308 basis points, the S&P 500 fell by 1.10%, and the NASDAQ sank by 1.12% during the session.

Stay up to speed with hot stocks' news!

Chinese electric vehicle makers were mixed on Tuesday ahead of the key August delivery report on Thursday. While Nio closed higher, the same can not be said for XPeng (NYSE:XPEV) and Li Auto (NASDAQ:LI) which fell lower by 1.35% and 1.06% respectively during the session. Most are predicting softer than usual deliveries as China continues to deal with lockdowns, supply chain issues, and even a drought from earlier in the month. During its note from yesterday, Deutsche Bank did mention that it anticipates production and delivery levels to return to normal later this year.

NIO stock forecast

Ahead of Thursday’s delivery report, Warren Buffett trimmed his stake in Chinese EV leader BYD. Many believed earlier in the month that Buffett was selling his entire stake as a similar sized position was being sold on the Hong Kong Stock Exchange. According to a filing with the Hong Kong Stock Exchange, Buffett only sold about 1% of his stake and still owns about 219 million shares.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet