NIO Stock Forecast: Nio shares rise 5% in Hong Kong

- NYSE:NIO gained 3.37% during Friday’s trading session.

- Nio has reportedly unveiled some plans for imminent US expansion.

- Tesla receives a nod of conviction from a long-time bullish analyst.

UPDATE: Nio stock closed up 5.4% on Monday in Hong Kong's session, while the US markets remained closed due to Memorial Day. Shares of the Chinese EV leader are receiving optimistic buying pressure from news that it might be the first Chinese automotive company to begin selling units in the US market. Another Chinese EV startup, Polestar, is expected to use the facilities of its parent company, Volvo, to eventually produce vehicles for the US market, but that expansion has not yet begun. Chinese media have reported that Nio is currently hiring manufacturing employees in the US and has been linked to a property in San Jose, California. Shares closed at 132.50 Hong Kong dollars on Monday.

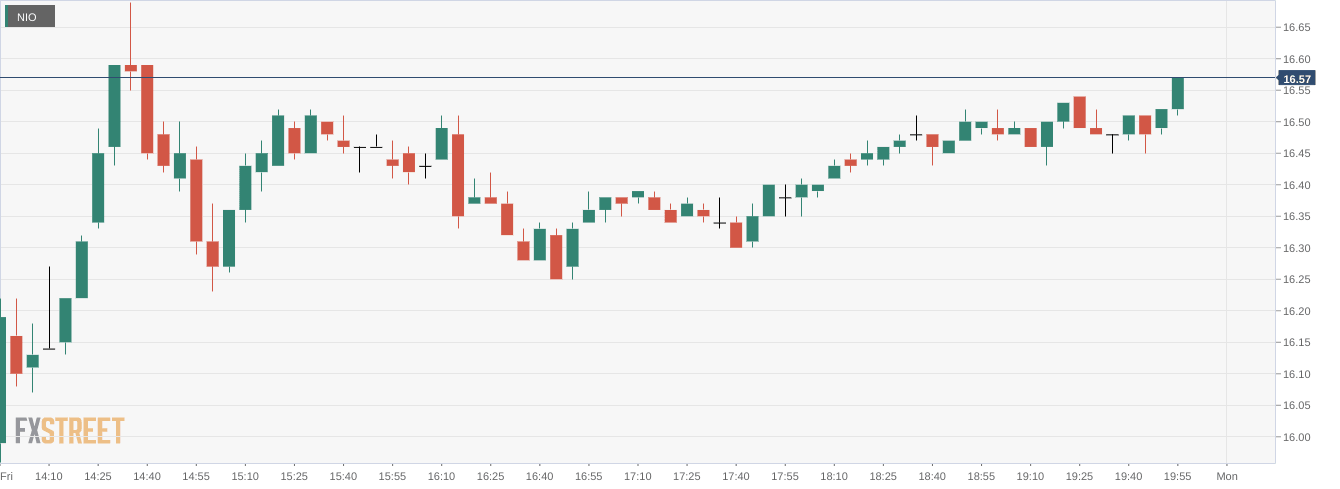

NYSE:NIO closed out a positive week on the markets as the Chinese EV maker saw its stock rise by nearly 5% since Monday. On Friday, shares of Nio added a further 3.37% and closed the trading week at $16.57. Investors rejoiced as the US markets posted their third straight positive session to snap their seven-week losing streak. It was the best overall week for the broader markets since November of 2020. On Friday, the Dow Jones gained 575 basis points, the S&P 500 added 2.47%, and the NASDAQ rose higher by 3.33% during the session.

Stay up to speed with hot stocks' news!

According to a report from the Chinese media outlet Yicai, Nio is looking to hire manufacturing jobs in the US. This likely means that the US is on Nio’s expansion list sooner rather than later. The company was linked to some property in San Jose, California earlier this year, which appears to be a research and development facility. There is no official word from Nio on a potential US expansion, but the job listings seem like a clear indication that this will be happening in the near future.

NIO stock price

How quickly sentiment changes after a couple of green days in a row for the markets. Industry leader Tesla (NASDAQ:TSLA) recovered this week by adding back gains of nearly 16% over the past five sessions. Now, a long-time bullish Tesla analyst from Credit Suisse has reiterated his conviction in the stock. Dan Levy recently visited Tesla’s Fremont GigaFactory and this was enough for him to reiterate his Overweight rating on the stock with a price target of $1,125 for the next twelve months.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet