NIO Stock Forecast: Nio Inc jumps higher as Chinese EV demand returns

- NYSE:NIO gained 6.08% during Monday’s trading session.

- Nio and AMD join forces to supply new chups for Nio’s vehicles.

- A positive story in the South China Morning Post has investors bullish on Chinese EVs.

NYSE:NIO kicked off the second week of June on the right foot as some bullish headlines and a new tech partnership has investors feeling bullish. On Monday, shares of Nio rose by 6.08% and closed the trading session at $19.18. Nio is now back firmly above its 50-day moving average price of $17.87, as the stock’s bounce from hitting a 52-week low has been impressive. US markets closed Monday mostly flat although all three major indices managed to post a small gain for the day. The Dow Jones inched higher by 16 basis points, the S&P 500 gained 0.31%, and the NASDAQ posted a 0.40% gain for the session.

Stay up to speed with hot stocks' news!

Nio announced a new partnership with chip giant AMD (NASDAQ:AMD) on Monday as the EV maker secured the chips for the next generation of vehicles. Nio will use AMD’s EPYC line of chips for its HPC or High Performance Computer platform. The belief is that the powerful AMD chips will be able to accelerate the machine learning aspects of the program. Nio is currently using chips from Qualcomm (NASDAQ:QCOM), NVIDIA (NASDAQ:NVDA), and Mobileye. Shares of AMD were down by 0.61% on Monday.

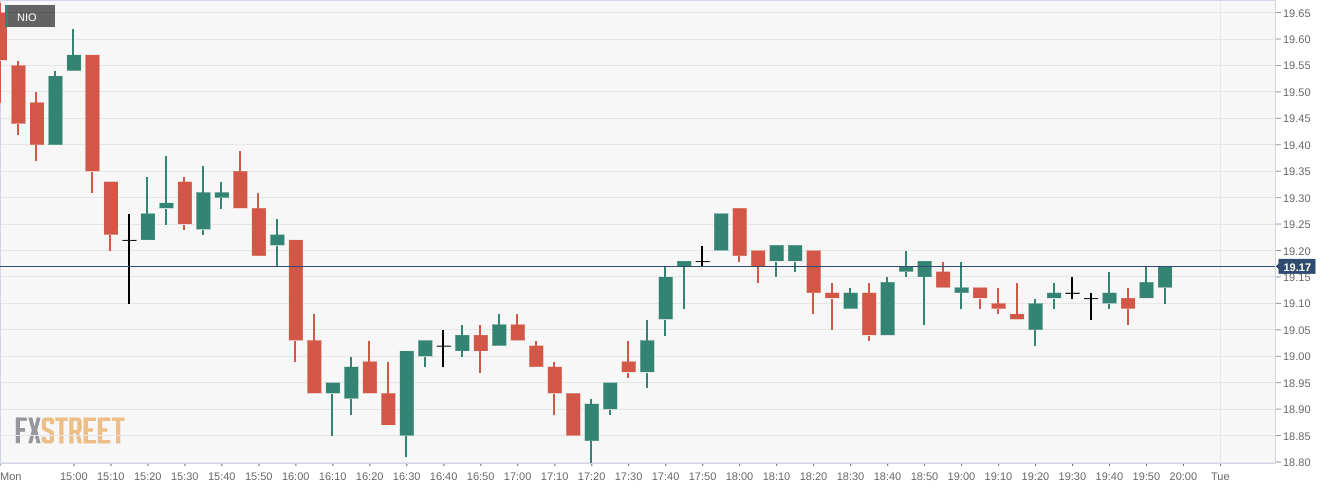

NIO stock price

An article in the South China Morning Post on Monday reported that Chinese demand for electric vehicles is as strong as ever. After the COVID-19 restrictions were lifted, production for EV makers should be back to full capacity. It has also helped that Beijing announced cash subsidies for Chinese consumers who want to buy EVs. Shares of Li Auto (NASDAQ:LI) were up by 10.91% while XPeng (NYSE:XPEV) rose by 5.17% on Monday.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet