NIO Stock Forecast: Nio Inc tumbles to test $22 on recession fears

- NYSE:NIO extends its slump on Tuesday as fears ruled.

- Mizuho analyst Vijay Rakesh provided price downgrades for some EV stocks.

- Nio announced that it has delivered its 200,000th electric vehicle.

Update: NYSE: NIO extended its correction from four-month highs of $24.43 on Tuesday, losing 2.57% of its value to settle at $22.36. The NIO stock price did manage to defend the $22 mark amid the renewed weakness, triggered by the broader meltdown in Wall Street indices. A big drop in the US CB Consumer Confidence heightened worries over a potential recession, as markets returned to ‘sell everything’ mode. The end of the month as well as the end of the quarter flows played it part, as the benchmark S&P 500 remained on track for its biggest first-half percentage drop since 1970. The Chinese EV maker shrugged off the news of China easing its covid restrictions for international travellers, as recession risks overshadowed.

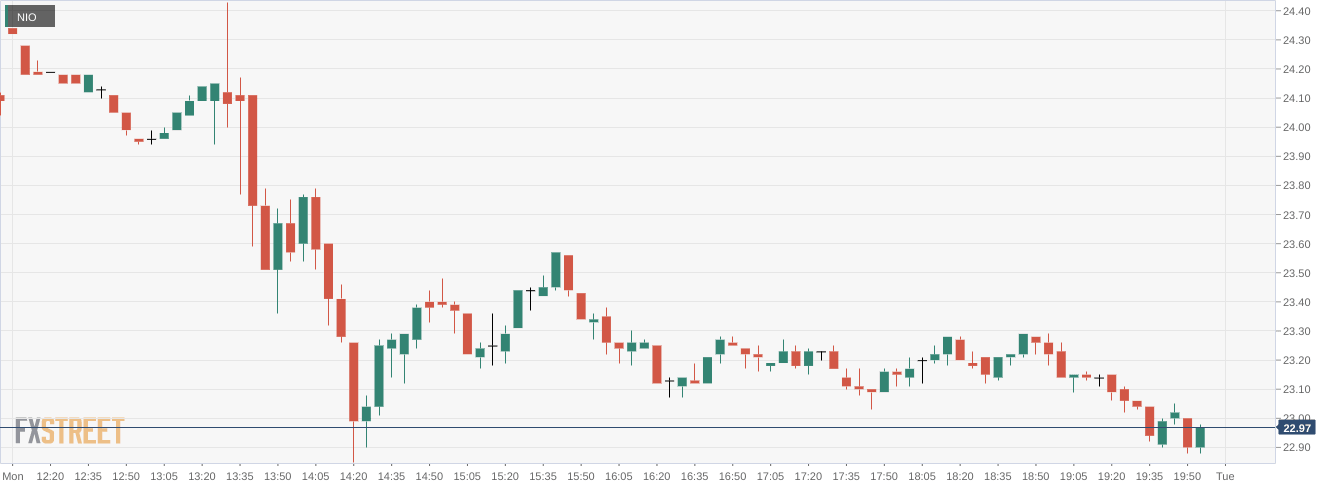

NYSE:NIO dipped lower to start the week as growth stocks and the EV sector cooled off after a bullish close to last week. On Monday, shares of Nio dropped by 4.69% and closed the trading session at $22.95. Following what looks to be a bear market rally that sent the major indices surging last week, the markets opened the last week of June on the back foot. All three major averages closed the day lower. The Dow Jones dropped by 62 basis points, the S&P 500 fell by 0.30%, and the NASDAQ posted a loss of 0.72% during the session.

Stay up to speed with hot stocks' news!

Electric vehicle stocks were in decline on Monday as Mizuho analyst, Vijay Rakesh, issued some price downgrades for some of the sector’s biggest names. Nio (NYSE:NIO), Tesla (NASDAQ:TSLA), and Rivian (NASDAQ:RIVN) all saw their stock price targets get slashed after the COVID-19 lockdowns in Shanghai and ongoing global supply chain issues provide a bleak short-term outlook in Rakesh’s opinion. Investors should note that Rakesh reiterated his Buy rating for all three stocks. Nio’s price target was cut from $55 to $48 per share, while Tesla’s was slashed from $1,300 to $1,150.

NIO stock price

Nio recently announced that it has officially delivered its 200,000th total vehicle since the company began shipping EVs back in 2016 with the high–end luxury sports car, the EP9. Since then Nio has released multiple new vehicle models, with several more on the way this year including the ES8 SUV and the ET5 sedan. Nio is in the midst of a global rollout with a focus on several more European markets later this year.

Previous Updates

Update: NYSE:NIO extended its slide on Tuesday, shedding 2.66% in the day to finish it at $22.36 per share. Wall Street turned south after a positive start to the week amid renewed inflation and growth-related concerns. The Dow Jones Industrial Average ended the day 486 lower, while the S&P 500 lost 1.83%. Finally, the Nasdaq Composite settled at 11,183, down roughly 3%. The market's sentiment soured following the release of the CB Consumer Confidence Index, which plunged to 98.7 in June, its lowest in over a year. The report also showed that consumers expect inflation to continue rising, hinting at a potential recession in the US.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet