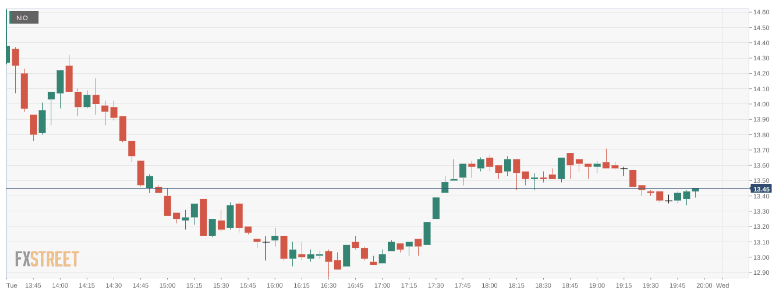

NIO Stock Forecast: Nio Inc closes lower despite an early morning surge

- NYSE: NIO fell by 0.81% during Tuesday’s trading session.

- A report suggested that Nio is getting ready for its mass market line of EVs.

- Nio is still set to begin production at its second facility in the third quarter.

NYSE: NIO appeared to be off to a red-hot start on Tuesday, but continued market uncertainty led the Chinese EV maker to once again close the session in the red. Shares of Nio ended up falling by 0.81% and closed the trading day at $13.44. The stock hit as high as $14.68 during intraday trading before succumbing to the downward pressure of the markets. US indices were mixed on Tuesday as the S&P 500 and NASDAQ snapped their recent slides by gaining 0.25% and 0.98% respectively. The Dow Jones sank for the fourth straight session as the blue-chip index lost a further 84 basis points.

Stay up to speed with hot stocks' news!

The major headline that had Nio investors excited this morning was that CnEVPost reported that the company is set to announce its mass-market line of electric vehicles. The report stated that Nio has signed a deal for an economic development zone inside Hefei, which it will use to build another production facility. CnEVPost also reported that the plant will be completed and commence production as early as 2024. Following comments from CEO William Li at their earnings call, Nio is looking to add models in the price range of $30,000 to $50,000 to compete with Tesla (NASDAQ: TSLA).

NIO stock price

Nio is also believed to be still on track to open its second production facility in the third quarter of this year. The second facility is expected to double Nio’s capacity for its flagship models. Nio has been experiencing major supply chain issues as well as production shutdown from the ongoing lockdowns in China. Still, it’s nice for Nio investors to receive good news from the company considering all of the negative headwinds that have been affecting its stock as of late.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet