NIO Stock Forecast and News: Chinese carmaker defies Biden and surges amid 400% leap in car sales

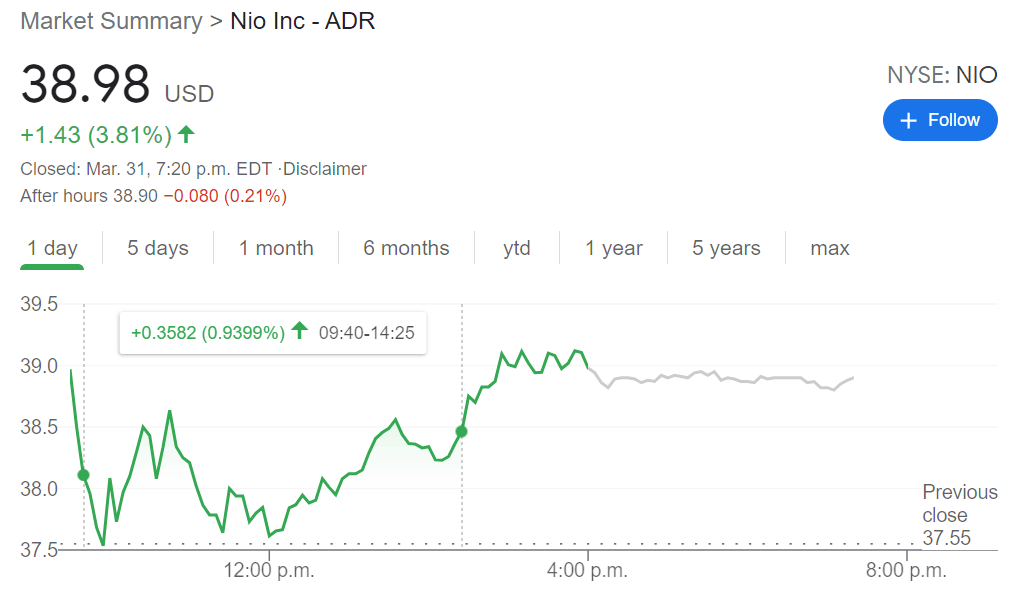

- NYSE:NIO added 3.81% on Wednesday, as the EV sector busted out of its recent slump.

- NIO filed for a new vehicle name trademark for the luxury sports car market.

- NIO is the latest company to cite the global chip shortage as a headwind for the first quarter of 2021.

Update April 1: NIO Adr (NYSE: NIO) is trading above $40.50, boosted by its parabolic 400% growth in sales. The Chinese carmaker is also defying President Joe Biden's desire to make America more competitive against China. His infrastructure plan includes investment in electric vehicle charging stations and vows to focus on US contractors. Will his plans hurt the Beijing-based EV marker? Perhaps in the future. In the meantime, NIO depends on its growing domestic market.

NYSE:NIO and the rest of the global electric vehicle market have been one of the largest losers in the recent tech and growth sector correction that the market has experienced. On Wednesday, NIO reversed that slump and gained 3.81% to close the trading session at $38.98. Shares are still trading well below both its 50-day and 200-day moving averages, which are both strong indicators of the downward trajectory that the stock has seen. NIO is still over 40% off of its all-time highs set in January, so the strong rebound is welcome news to the automaker’s shareholders.

Stay up to speed with hot stocks' news!

On Wednesday, NIO also announced that it had filed for a new trademark in China for a vehicle, codenamed the EF9. The prefix EF has been used by NIO in the past for its high-end supercars so the new vehicle is anticipated to serve the higher end electric vehicle market. With new luxury EVs like Lucid Motors hitting the market later this year, NIO could be preparing to defend against a potential entry into the Chinese EV market.

NIO Price prediction

NIO is also preparing to report its first quarter 2021 deliveries report on Thursday, which could be a catalyst for the stock over the short-term. Shares took a dive after vehicle deliveries fell from January to February, despite still exhibiting a year-over-year growth rate. NIO has already gotten ahead of the news by citing that the global chip shortage is going to be an anticipated headwind for vehicle deliveries in this quarter and the rest of 2021.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet